Donald Amstad from Aberdeen Standard Investments: “the developed world is verging on catastrophe…. we are facing an unprecedented bust in risk-free (bond) markets.”

Hat tip to Marcus Padley

Donald Amstad from Aberdeen Standard Investments: “the developed world is verging on catastrophe…. we are facing an unprecedented bust in risk-free (bond) markets.”

Hat tip to Marcus Padley

Treasury yields continue to fall, with the 10-Year testing long-term lows at 1.50%. A sign that investors are growing increasingly risk averse.

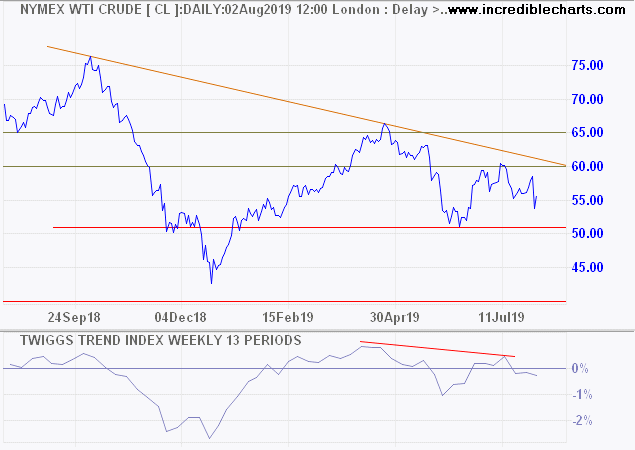

Crude oil prices remain weak; a bearish signal for the global economy. Breach of support at $50/$51 per barrel would warn of a decline to $40.

Volatility (21-Day) above 1.0% on the S&P 500 is flashing an amber warning. Breakout above 2940 is likely and would signal another test of 3000. But expect stubborn resistance at our 3000 target level.

Bearish divergence (13-Trend Index) on the Nasdaq 100 warns of secondary selling pressure. Breach of 7400 would warn of a test of primary support at 7000.

Robert Shiller maintains that Donald Trump is unlikely to survive a recession:

“So far, with his flashy lifestyle, the US president has been a resounding inspiration to many consumers and investors. But his personal narrative is unlikely to survive an economic downturn….the end of confidence in Trump’s narrative is likely to be associated with a recession.

During a recession, people pull back and reassess their views. Consumers spend less, avoiding purchases that can be postponed: a new car, home renovations, and expensive vacations. Businesses spend less on new factories and equipment, and put off hiring. They don’t have to explain their ultimate reasons for doing this. Their gut feelings and emotions can be enough.”

I would go further and argue that Trump’s management style is likely to cause a recession.

Some of the aims the President is attempting, like addressing China’s unfair trade practices, are vitally important to long-term US interests and he should be given credit for tackling them. But his constant hyperbole, erratic behavior, with a constant mix of bouquets and brickbats, and on-again-off-again tactics, has elevated global uncertainty. Consumers are likely to increase savings and cut back on expenditure, while corporations may cut back on hiring and new investment, which could tip the economy into recession.

GDP growth contracted to 2.3% in the second quarter, while growth in hours worked contracted to 0.92% for the year ended July 2019, pointing to further falls in GDP growth for the third quarter.

August employment figures are due for release next week and will either confirm or allay our fears.

We maintain our bearish outlook and have reduced equity exposure for international stocks to 40% of portfolio value.

One of Australia’s largest cement and construction materials producers, Adelaide Brighton Ltd (ABC), announced their half year results today. The media statement contains a decidedly bearish outlook for the housing market.

Operational Review

Demand for construction materials slowed further during the period. Australian residential construction approvals declined more than 25% on seasonally adjusted terms for the six months to June 2019 and residential construction is forecast to continue to decline until 2021, until it returns to growth. However, the Company expects both mining and infrastructure to increase demand for construction materials in the near term. Capacity expansion in iron ore and gold production, along with the reopening of nickel capacity, will increase the demand for both cement and lime in Western Australia and the Northern Territory.

Outlook

For the balance of 2019, Adelaide Brighton expects demand for construction materials to:

- Weaken in east coast markets and South Australia, until the commencement of further planned infrastructure projects;

- Remain stable in the Northern Territory and Western Australia;

- Improve in the lime business as a result of increased gold and nickel production in Western Australia; and

- Increase in concrete and aggregates due to more available work days, seasonality and volumes generated via Scotchy Pocket quarry.

Auction clearance rates in Sydney and Melbourne have improved but sales volumes remain low. We have witnessed recent improvement in consumer attitudes towards housing investment but whether this translates into increased activity will depend on:

10-Year Treasury yields plunged below 2.0% on Donald Trump’s announcement of further tariffs (10% on $300bn) on China. The fall reflects rising demand for Treasuries as a safe haven in these turbulent times.

The spread between 10-Year and 3-Month Treasuries recovered above zero. This is a bearish sign: recession normally follows the recovery and not the initial inversion.

The S&P 500 retreated below 3000 on Trump’s announcement, strengthening the bearish divergence signal on Twiggs Money Flow which warns of a correction. A test of support at 2750 is likely.

The Russell 2000 ETF (IWM) is expected to test primary support at 145. Small cap stocks have lagged the S&P 500 this year, highlighting risk aversion.

Dow Jones Euro Stoxx 600, reflecting large cap stocks in the European Union, is similarly headed for a test of primary support at 365. Strong bearish divergence on the Trend Index warns of a reversal.

Falling commodity prices reflect market concerns for the global economy. A Nymex Light Crude breach of $51/barrel would signal a primary down-trend. Declining peaks on the Trend Index warn of selling pressure.

The DJ-UBS Commodity Index is similarly headed for a test of support at 75. Breach would signal a primary down-trend. A peak near zero on the Trend Index warns of strong selling pressure.

Dr Copper, often used as a barometer of the global economy, has breached primary support at 5800, signaling a decline. Again, a Trend Index peak below zero warns of strong selling pressure.

Employment stats for July have improved slightly, with Average Hourly Wages growth easing to 3.3% (Total Private).

And annual payroll growth ticked up to 1.5%

But weekly hours worked are declining, warning that real GDP will decline further, after printing 2.3% for the second quarter.

I have warned my clients to cut exposure to the market. It’s a good time to be cautious.

“Price is what you pay; value is what you get.”

~ Benjamin Graham

The interest rate outlook is softening, with Fed chairman Jerome Powell hinting at rate cuts in his Wednesday testimony to Congress:

“Our baseline outlook is for economic growth to remain solid, labor markets to remain strong and inflation to move back over time.”

but…. “Uncertainties about the outlook have increased in recent months. In particular, economic momentum appears to have slowed in some major foreign economies and that weakness could affect the US economy.”

Stephen Bartholomeusz at The Sydney Morning Herald comments:

“Perhaps the most disturbing aspect of the Fed shifting into an easing cycle before there is strong evidence to warrant it, is economies already stuck in high debt and low growth environments will be forced even deeper into the kind of policies that in Japan have produced more than 30 years of economic winter with no apparent escape route.”

If the Fed moves too early they could further damage global growth, with long-term consequences for US stocks. But markets are salivating at the anticipated sugar hit from lower rates. Stocks surged in response to Powell’s speech, with the S&P 500 breaking resistance at 3000. A rising Trend Index indicates buying pressure.

The argument for higher stock prices is that lower interest rates may stave off a recession. The chart below shows how recessions (gray bars) are normally preceded by rising interest rates (green) followed by sharp cuts when employment growth (blue) starts to fall.

Rate cuts themselves are not a recession warning, unless accompanied by declining employment growth. Otherwise, as in 1998 when there was minimal impact on employment, the economy may recover. Falling employment growth is, I believe, the most reliable recession warning. So far, the decline in growth has been modest but should be monitored closely.

Falling employment is why recessions tend to lag an inverted yield curve (negative 10-year minus 3-month Treasury yield spread) by up to 18 months. The negative yield curve is a reliable warning of recessions only because it reflects the Fed response to rising inflation and then falling employment.

A forward Price-Earnings ratio of 19.08 at the end of June 2019 warned that stocks are highly priced relative to forecast earnings. The forward PE jumped to 19.55 by Friday — an even stronger warning.

June 2019 trailing Price-Earnings ratio at 21.52 warned that stock prices are dangerously high when compared to the 1929 and 1987 peaks preceding major crashes. That has now jumped to 22.04.

The only factor that could support such a high earnings multiple is unusually strong earnings growth.

But real corporate earnings are declining. Corporate profits, before tax and adjusted for inflation, are below 2006 levels and falling. There are still exceptional stocks that show real growth but they are counter-balanced by negative real growth in other stocks.

Impossible, you may argue, given rising earnings for the S&P 500.

There are three key differences that contribute to earnings per share growth for the S&P 500:

Inflation is fairly steady at 2.0%.

Quarterly tax rates declined from 25% in Q3 2017 to 13.22% in Q4 2018 (source: S&P Dow Jones Indices).

Stock buybacks are climbing. The buyback yield for the S&P 500 rose to 3.83% in Q4 2018 (source: S&P Dow Jones Indices).

The 2017 Tax Cuts and Jobs Act caused a surge in repatriation of offshore cash holdings — estimated at almost $3 trillion — by multinationals. And a corresponding increase in stock buybacks.

In summary, the 2018 surge in S&P 500 earnings is largely attributable to tax cuts and Q1 2019 is boosted by a surge in stock buybacks in the preceding quarter.

Buybacks plus dividends exceed current earnings and are unsustainable in the long run. When the buyback rate falls, and without further tax cuts, earnings growth is going to be hard to find. Like the emperor’s new clothes.

It’s a good time to be cautious.

“Only when the tide goes out do you discover who’s been swimming naked”.

~ Warren Buffett

Inflationary pressures are easing, with average hourly earnings growth declining to 3.35% in June, for Production and Non-Supervisory Employees, and 3.14% for Total Private sector.

But this warns that economic growth is slowing. Annual growth in hours worked has slowed to 1.25%, suggesting a similar decline in GDP growth for the second quarter.

Jobs growth held steady at 1.5% for the 12 months ended June 2019, after a decline from 2.0% in January.

Further decline in jobs growth is likely in the months ahead and a fall below 1.0% would warn that recession is imminent.

The Case Shiller index warns that growth in housing prices is slowing.

Growth in construction expenditure (adjusted for inflation) has stalled.

Retail sales growth is faltering.

Units of light vehicle sales has stalled.

And capital goods orders (adjusted for inflation) are faltering.

One of the few bright spots is corporate bond spreads — the difference between lowest investment grade (Baa) and equivalent Treasury yields — still low at 2.3%, indicating that credit risk is benign.

The S&P 500 broke through 2950 and is testing 3000. The 3000 level is an important watershed, double the 2000 and 2007 highs at 1500 (1552 and 1576 to be exact), and I expect strong resistance.

A rising Trend Index indicates buying pressure but this seems to be mainly stock repurchases and institutional buying. Retail money, as indicated by investment flows into ETFs, favors fixed income over equities despite the low yields.

It’s still a good time to be cautious.

The prevailing wisdom is that markets are always right. I take the opposite position. I assume that markets are always wrong……I watch out for telltale signs that a trend may be exhausted. Then I disengage from the herd and look for a different investment thesis. Or, if I think the trend has been carried to excess, I may probe going against it. Most of the time we are punished if we go against the trend. Only at an inflection point are we rewarded.

~ George Soros

Ross Gittins, Economics Editor at The Sydney Morning Herald, sums up Australia’s predicament:

“The problem is, the economy seems to be running out of puff because it’s caught in a vicious circle: private consumption and business investment can’t grow strongly because there’s no growth in real wages, but real wages will stay weak until stronger growth in consumption and investment gets them moving.

Policy has to break this cycle. But, as [RBA governor] Lowe now warns in every speech he gives, monetary policy (lower interest rates) isn’t still powerful enough to break it unaided. Rates are too close to zero, households are too heavily indebted, and it’s already clear that the cost of borrowing can’t be the reason business investment is a lot weaker than it should be.

That leaves the budget as the only other instrument available. The first stage of the tax cuts will help, but won’t be nearly enough…..”

Cutting already-low interest rates is unlikely to cure faltering consumption and business investment. Low wage growth and a deteriorating jobs market are root causes of the downward spiral and not much will change until these are addressed.

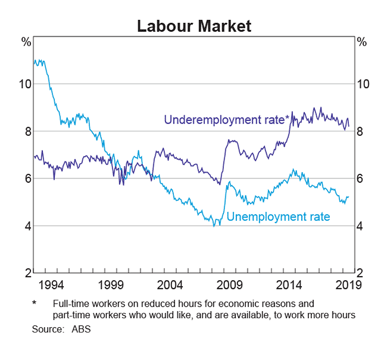

Low unemployment is misleading. Underemployment is growing. Trained barristers working as baristas may be an urban legend but there is an element of truth. The chart below shows underemployment in Australia as a percentage of total employment.

Tax cuts are an expensive sugar hit. The benefit does not last and may be frittered away in paying down personal debt or purchasing imported items like flat-screen TVs and smart phones. Tax cuts are also expensive because government is left with debt on its balance sheet and no assets to show for it.

Infrastructure spending can also be wasteful — like school halls and bridges to nowhere — but if chosen wisely can create productive assets that boost employment and build a healthy portfolio of income-producing assets to offset the debt incurred.

The RBA has already done as much as it can — and more than it should. Further rate cuts, or God forbid, quantitative easing, are not going to get us out of the present hole. What they will do is further distort price signals, leading to even greater malinvestment and damage to the long-term economy.

What the country needs is a long-term infrastructure plan with bipartisan support. Infrastructure should be a national priority. There is too much at stake for leadership to take a short-term focus, with an eye on the next election, rather than consensus-building around a long-term strategy with buy-in from both sides of the house.

Annual employment growth is falling while average hourly earnings growth remains high. This is typical. Ahead of the last two recessions (gray bars below), average hourly earnings growth (green) held steady while employment growth (blue) declined.

If annual employment growth (blue line on the above chart) falls below 1.0% then a Fed rate cut is almost guaranteed. Not something to celebrate though, as the gray bars and further job losses illustrate.

Declining growth in hours worked points to lower GDP growth in the second quarter.

From Bob Doll at Nuveen:

“China is taking a tough stance toward the U.S. on trade. Chinese officials appear open to ongoing negotiations, but a recently released statement denies the country’s role in intellectual property theft, blames the U.S. for negotiation breakdowns and calls out the damage done to the American economy as a result of the dispute. All of this suggests that trade issues will persist for some time.”

The CCP is upset that they are now being called out for bad behavior when this should have been addressed years ago. Conflict can no longer be avoided and is likely to last for a generation or more.

“On Monday, US President Trump told reporters that he would impose tariffs on an additional USD 300 billion of Chinese goods if Xi Jinping doesn’t meet with him in Japan.” ~ Trivium China, June 12, 2019

Trump is doing his best to kill any chance of a trade deal. He is making it impossible for Xi to turn up for a G20 meeting. Kow-towing to Trump would totally undermine Xi’s standing in China.

Xi wants a trade deal that is a handful of empty promises, so the CCP can continue on their present course. The US wants an enforceable undertaking, so that the CPP is forced to change course. Chances of both achieving what they want are negligible.

Both sides need to guard against economic war (time to call it what it is) slipping into a full-scale conflict. All it takes is a spark that sets off tit-for-tat escalation where neither side will back down.

Proxies such as North Korea, Syria and Pakistan are especially dangerous as they are capable of dragging great powers into direct confrontation (think Serbia before WWI, Korea after WWII).

Wannabe great powers like Russia will also do their best to foment conflict between their larger rivals. Stalin achieved this with the Korean War in the 1950s and Vladimir Putin is more than capable of attempting the same. The world is a dangerous place.

Upside potential for stocks is declining while downside risks are growing. Investors are flowing out of equities and into Treasuries despite minimal yield (10-year yield is negative after inflation and tax).

Stocks are being supported by buybacks but that can only continue for as long as cash flows (from earnings) hold up. Buybacks plus dividends for the S&P 500 exceeded reported earnings by more than $100 billion in Q4 2018.

That is unsustainable. If earnings undershoot, stocks will fall.

The market is excited at the prospect of Fed rate cuts (in response to the US-CCP trade war), with the S&P 500 headed for another test of its earlier high at 2950. A Trend Index trough above zero indicates short-term buying pressure.

Falling bond yields, however, warn of a flight to safety. 10-Year Treasury yields have fallen close to 120 basis points (bps) since late 2018, as investors shift from equities to bonds. Prices are being supported by stock buybacks rather than investor inflows.

The Yield Differential between 10-year (purple) and 3-month (lime) Treasury yields is now negative, a reliable early warning of recession.

Corporate bond spreads, the difference between lowest investment grade (Baa) and Treasury yields, are rising. An indicator of credit risk, a spread above 2.5% (amber) is an early warning of trouble ahead, while 3.0% (red) signals that risk is elevated.

Falling employment growth is another important warning. Annual employment growth below 1.0% (amber) would normally cause the Fed to cut interest rates. In the current scenario, that is almost certain.

What is holding the Fed back is average hourly wages. Annual growth above 3.0% is indicative of a tight labor market and warns against cutting rates too hastily.

Stats for Q1 2019 warn that compensation is rising as a percentage of net value added, while profits are falling. As can be seen from the previous two recessions (gray bars), rising compensation (as % of NVA) normally leads to falling profits and a recession. Cutting interest rates would accelerate this.

Annual GDP growth came in at 3.2% (after inflation) for the first quarter, but growth in hours worked is slowing. GDP growth is likely to follow.

Personal consumption expenditure for Q1 was largely positive, with an uptick in services and non-durable goods. But consumption of durable goods fell sharply, warning that consumer confidence in the medium-to-long-term is declining.

On the global stage, commodity prices are falling, indicating an anticipated drop in demand, especially from China.

Nymex crude is following, and expected to test support between $40 and $45 per barrel.

Short-term prospects may appear reasonable, but the long-term outlook is decidedly negative.

In the short run, the market is a voting machine but in the long run, it is a weighing machine.

~ Benjamin Graham

We are now headed for a full-blown trade war. Donald Trump may have highlighted the issue but this is not a conflict between him and Xi — it should have been addressed years ago — nor even between China and the West. Accusations of racism are misguided. This is a conflict between totalitarianism and the rule of law. Between the CCP (with Putin, Erdogan, and the Ayatollahs in their corner) and Western democracy.

Australia will be forced to take sides. China may be Australia’s largest trading partner but the US & UK are it’s ideological partners. I cannot see the remotest possibility of Australia selling out its principles for profits, no matter how tempting the short-term rewards (or threatened hardships). We have a proud history of standing up against oppression and exploitation.

Disruptions to supply chains and supply contracts in the US (and China) are going to be significant and are likely to impact on earnings. The S&P 500 reaction is so far muted, with retracement testing medium-term support at 2800. There is also no indication of selling pressure on the Trend Index. Nevertheless, a breach of 2800 is likely and would warn of a test of primary support at 2400.

Falling Treasury yields highlight the outflow from equities and into bonds. Stock buybacks are becoming the primary inflow into stocks.

However, corporate bond spreads — lowest investment grade (Baa) yields minus the equivalent Treasury yield — are still well below the 3.0% level associated with elevated risk.

Profits may fall due to supply disruption (similar to 2015 on the chart below) but the Fed is unlikely to cut interest rates unless employment follows (as in 2007). Inflation is likely to rise as supply chains are disrupted but chances of a rate rise are negligible. Fed Chairman Jay Powell’s eyes are going to be firmly fixed on Total Non-farm Payrolls. If annual growth falls below 1.0% (RHS), expect a rate cut.

This excerpt from a newsletter I wrote in April 2018 (Playing hardball with China) is illuminating: “In 2010, Paul Krugman wrote:

Some still argue that we must reason gently with China, not confront it. But we’ve been reasoning with China for years, as its surplus ballooned, and gotten nowhere: on Sunday Wen Jiabao, the Chinese prime minister, declared — absurdly — that his nation’s currency is not undervalued. (The Peterson Institute for International Economics estimates that the renminbi is undervalued by between 20 and 40 percent.) And Mr. Wen accused other nations of doing what China actually does, seeking to weaken their currencies “just for the purposes of increasing their own exports.”

But if sweet reason won’t work, what’s the alternative? In 1971 the United States dealt with a similar but much less severe problem of foreign undervaluation by imposing a temporary 10 percent surcharge on imports, which was removed a few months later after Germany, Japan and other nations raised the dollar value of their currencies. At this point, it’s hard to see China changing its policies unless faced with the threat of similar action — except that this time the surcharge would have to be much larger, say 25 percent.

I don’t propose this turn to policy hardball lightly. But Chinese currency policy is adding materially to the world’s economic problems at a time when those problems are already very severe. It’s time to take a stand.

Krugman (no surprise) now seems more opposed to trade tariffs but observes:

….I think it’s worth noting that even if we are headed for a full-scale trade war, conventional estimates of the costs of such a war don’t come anywhere near to 10 percent of GDP, or even 6 percent. In fact, it’s one of the dirty little secrets of international economics that standard estimates of the cost of protectionism, while not trivial, aren’t usually earthshaking either.”

Trump has to show that he is prepared to endure the hardships of a trade war and not kowtow to Beijing. But the chances of a reasonable response are unlikely.

Men naturally despise those who court them, but respect those who do not give way to them.

~ Thucydides (circa 400 BC)