Despite recent strong performance, investor enthusiasm may be cooling, with the Australian economy facing three headwinds.

Declining Household Spending

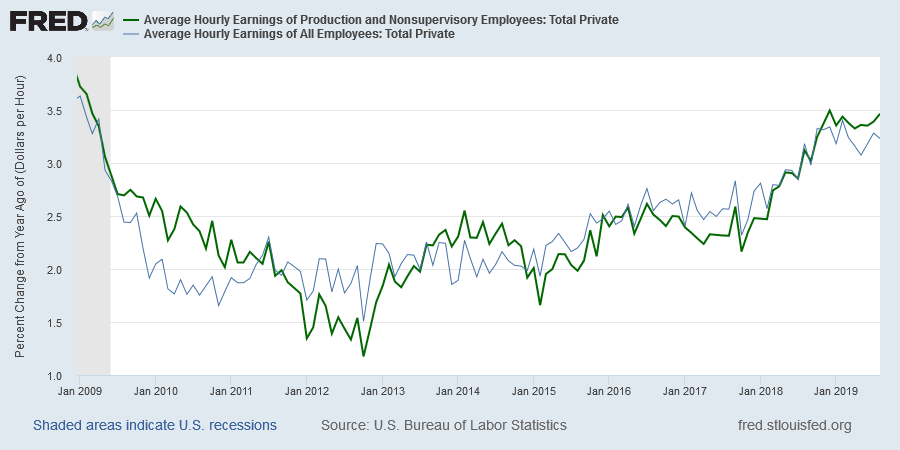

Household income growth is faltering and weighing down consumption. Household spending would have fallen even further, dragging the economy into recession, if households were not digging into savings to maintain their living standards.

But households are only likely to draw down on savings when housing prices are high. Commonly known as the “wealth effect” there is a clear relationship between household wealth and consumption. If housing prices were to continue falling then households are likely to cut back on spending and boost savings (including higher mortgage repayments).

Consumption is one of the few remaining contributors to GDP growth. If that falls, the economy is likely to go into recession.

Housing Construction

The RBA is desperately trying to prevent a further fall in house prices because of the negative effect this will have on household spending (consumption). But rate cuts are not being passed on to borrowers, and households are maintaining their existing mortgage repayments (increasing savings) if they do benefit, rather than increasing spending.

House prices ticked up after the recent fall, in response to RBA interest rate cuts. But Martin North reports that the recovery is only evident in more affluent suburbs with lower mortgage exposure (e.g. Eastern suburbs in Sydney) and that newer suburbs and inner city high-density units are experiencing record levels of mortgage stress.

Building approvals reflect this, with a down-turn in detached housing and a sharp plunge in high density unit construction.

Dwelling investment is likely to remain a drag on GDP growth over the next year.

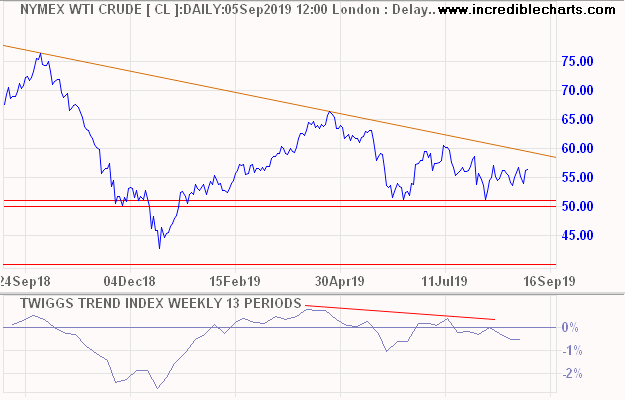

Falling Commodity Prices

Iron ore and coal, Australia’s two largest commodity exports, are falling in price as the global economic growth slows. Dalian Commodity Exchange’s most-traded iron ore contract , with January 2020 expiry, closed at 616 yuan ($86.99) per tonne, close to a seven-month low. Falling prices are likely to inhibit further mining investment.

Metals & Mining

The ASX 300 Metals & Mining index is testing long-term support at 4100. Breach would complete a head and shoulders reversal, with a target of 3400.

Financials

The Financial sector recovered this year, trending upwards since January, but faces a number of issues in the year ahead:

- customer remediation flowing from issues exposed by the Royal Commission;

- net interest margins squeezed as the RBA lowers interest rates;

- continued pressure to increase capital ratios are also likely to impact on dividend payout ratios;

- low housing (construction and sales) activity rates impact on fee income; and

- high levels of mortgage stress impact on borrower default rates.

ASX 200 Financials index faces strong resistance at 6500. There is no sign of a reversal at present but keep a weather eye on primary support at 6000. We remain bearish in our outlook for the sector and breach of 6000 would warn of a primary decline with a target of 5200.

REITs are experiencing selling pressure despite an investment market desperate for yield. Dexus (DXS) may be partly responsible after the office and industrial fund reported a 26% profit fall in the first half of 2019.

ASX 200

The ASX 200 is showing signs of (secondary) selling pressure, with a tall shadow on this week’s candle and a lower peak on the Trend index. Expect a test of support at 6400; breach would offer a target of 5400.

We maintain exposure to Australian equities at 22% of portfolio value, with a focus on defensive and contra-cyclical stocks, because of our bearish outlook.