Summary

- A stronger-than-expected BLS labor report buoyed stocks

- The stronger jobs figures reduce the chance of further Fed rate cuts

- Speculators are covering positions in long-term bonds, causing yields to rise

- Higher long-term yields are, in turn, bearish for stocks

The S&P 500 was buoyed by a stronger-than-expected labor report, with little sign of the economy slowing from President Trump’s flip-flop on tariffs. A breakout above strong resistance between 6000 and 6100 would signal a fresh advance, but we advise caution as it could be a bull trap.

Financial Markets

Financial market liquidity has improved, with the Chicago Fed National Financial Conditions Index declining to a revised -0.476 on May 30.

A sharp fall in the Treasury General Account (TGA) at the Fed injected more than $200 billion into financial markets in recent weeks, but that is not sustainable for long.

A declining spread on Moody’s Baa corporate bonds shows the beneficial effect on credit markets.

Treasury Markets

Speculators anticipating a series of Fed rate cuts are covering positions in long-term Treasuries, lifting the yield to 4.5%. Follow-through above 4.5% would offer a short-term target of 4.8%, prompting further action by Treasury Secretary Bessent to keep a lid on long-term rates. However, he can only do so much without the Fed’s help.

Economy

Employment in cyclical sectors—manufacturing, construction, and transport and warehousing—remains strong at 27.8 million, with no sign of the typical contraction that precedes a recession.

Unit sales of heavy-weight trucks are declining gradually rather than the steep fall that typically precedes a recession.

However, declining real manufacturers’ new orders for capital goods (excluding defense and aircraft) for April, adjusted by the producer price index (for capital goods), warn of a sharp fall in new capital investment.

Labor Market

Jobs grew by a better-than-expected 139 thousand in May. However, the figure is seasonally adjusted and likely subject to revision.

Continued claims increased to 1.9 million by May 24, but the unemployment rate remained 4.2% in May, well below our 5.0% warning level.

Growth in aggregate hours worked slowed to an annualized rate of 1.0%, warning of a similar decline in GDP growth in the second quarter.

Temporary jobs have contracted to 2.5 million, reinforcing the bearish sign from declining growth in hours worked.

The gap between job openings and unemployment has narrowed, indicating that the labor market is now in balance.

However, average hourly earnings continue to grow at close to 4.0%, signaling underlying inflationary pressures in the economy.

Dollar & Gold

The US Dollar Index continues to test long-term support at 100. Follow-through below 98 would offer a target of 90, warning of capital outflows and a strong bear signal for the bond market.

Gold is patiently testing resistance at $3,400 per ounce, waiting for a bear signal from the Dollar Index. A breakout would strengthen our target of $4,000 by the end of the year.

Silver made a sharp breakout above resistance at $34 per ounce. We expect retracement to test the new support level. Respect will likely confirm the breakout, but, having been burned before, we remain wary of a bull trap.

Conclusion

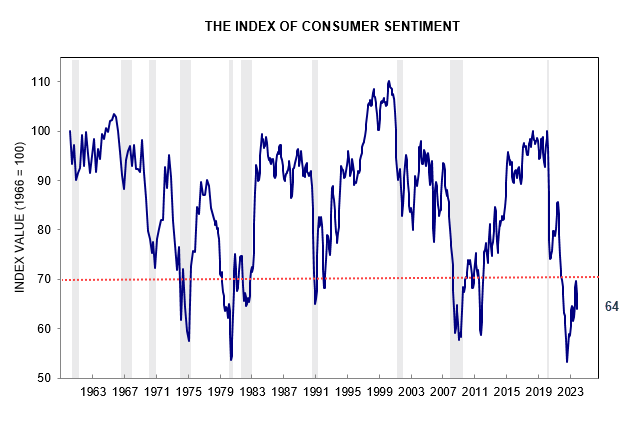

The rise in stocks is likely short-lived as rising long-term interest rates will likely spoil the party. The Fed is unlikely to heed President Trump’s call for a 100 basis-point cut:

“Go for a full point, Rocket Fuel,” Trump said in a post on Truth Social, adding that the Fed could increase rates again if inflation reignited. (Reuters)

The labor market remains in balance, and signs that the economy is slowing more likely reflect the impact of poor trade policy rather than too-high interest rates.

All eyes should be on the dollar. A Dollar Index fall below 98 would warn of capital outflows—a bear signal for bonds and stocks and a bull signal for gold.

Acknowledgments

- Reuters: Fed likely to leave rates unchanged as US job market cools but doesn’t crumble

- Federal Reserve of St Louis: FRED Data

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.