Copper broke support at $7900/tonne, signaling a primary decline with a target of its 2022 low at $7000. The primary down-trend warns of a global economic contraction.

The bear signal has yet to be confirmed by the broader-based Dow Jones Industrial Metals Index ($BIM) which is testing primary support at 155.

Crude oil

Crude fell sharply this week, after a 3-month rally.

The fall was spurred by an early build of gasoline stocks ahead of winter, raising concerns of declining demand.

Gasoline inventories added a substantial 6.5 million barrels for the week to September 29, compared with a build of 1 million barrels for the previous week. Gasoline inventories are now 1% above the five-year average for this time of year….. production averaged 8.8 million barrels daily last week, which compared with 9.1 million barrels daily for the prior week. (oilprice.com)

Crude inventories have stabilized after a sharp decline during the release of strategic petroleum reserves (SPR).

Releases from the SPR stopped in July — which coincides with the start of the recent crude rally. It will be interesting to see next week if a dip in this week’s SPR contributed to weak crude prices.

Stocks & Bonds

The 10-year Treasury yield recovered to 4.78% on Friday.

Rising yields are driven by:

- a large fiscal deficit of close to $2T;

- commercial banks reducing Treasury holdings; and

- the Bank of Japan allowing a limited rise in bond yields which could cause an outflow from USTs.

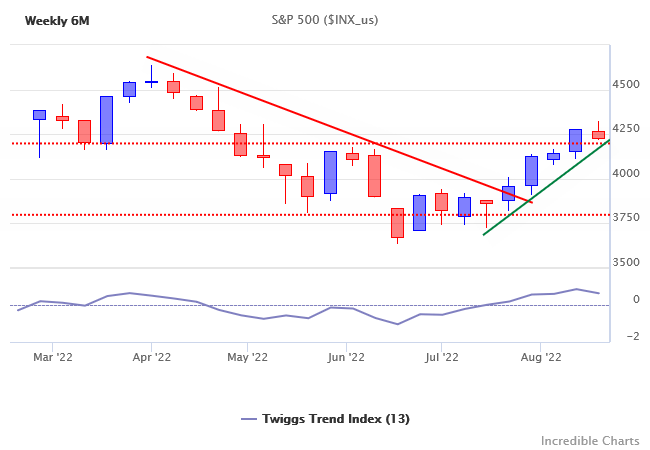

The S&P 500 rallied on the back of a strong labor report.

The S&P 500 Equal-Weighted Index test of primary support at 5600 is, however, likely to continue.

Expect another Russell 2000 small caps ETF (IWM) test of primary support at 170 as well.

Labor Market

The BLS report for September, with job gains of 336K, reflects a robust economy and strong labor market.

Average hourly earnings growth slowed to 0.207% in September, or 2.5% annualized. Manufacturing wages reflect higher growth — 4.0% annualized — but that is a small slice of the economy compared to services.

Average weekly hours worked — a leading indicator — remains stable at 34.4 hours/week.

Unemployment remained steady at 6.36 million, while job openings jumped in August, maintaining a sizable shortage.

Real GDP (blue) is expected to slow in Q3 to 1.5%, matching declining growth in aggregate weekly hours worked (purple).

Dollar & Gold

The Dollar Index retraced to test new support at 106 but is unlikely to reverse course while Treasury yields are rising.

Gold is testing primary support at $1800 per ounce, while Trend Index troughs below zero warn of selling pressure. Rising long-term Treasury yields and a strong Dollar are likely to weaken demand for Gold.

Conclusion

Long-term Treasury yields are expected to rise, fueled by strong supply (fiscal deficits) and weak demand (from foreign investors and commercial banks). The outlook for rate cuts from the Fed is also fading as labor market remains tight.

The sharp drop in crude oil seems an overreaction when the labor market is strong and demand is likely to be robust. Further releases from the strategic petroleum reserve (SPR), a sharp fall in Chinese purchases, or an increase in supply (from Iran or Venezuela) seem unlikely at present.

Falling copper prices warn of a global economic contraction led by China, with Europe likely to follow. Confirmation by Dow Jones Industrial Metals Index ($BIM) breach of primary support at 155 would strengthen the bear signal.

Strong Treasury yields and a strong Dollar are likely to weaken demand for Gold unless there is increased instability, either geopolitical or financial.

Save 50% on an Annual Subscription.