Crude Oil (WTI Light Crude) respected support at $45/barrel, with turmoil in Venezuela raising concerns over supply. Breakout above $55 would signal another rally but declining peaks on the Trend Index warn of selling pressure. Expect another test of $45. Breach of support would signal a decline to test the 2016 low at $26/barrel.

The Dollar index is weakening. If China continues to support the Yuan, we may see a correction to test support at 92. A lot will depend on trade talks in the next two weeks but I expect continued Dollar strength and Yuan weakness.

The PBOC increased support for the Yuan over the last month, leading up to the US-China trade talks, causing the Dollar to weaken.

Gold has ranged below resistance at $1350/ounce for the past five years. Expect another test of $1350 if the Dollar weakens. Breakout would signal a primary up-trend but LT Dollar strength is likely ….and a correction to test support at $1200.

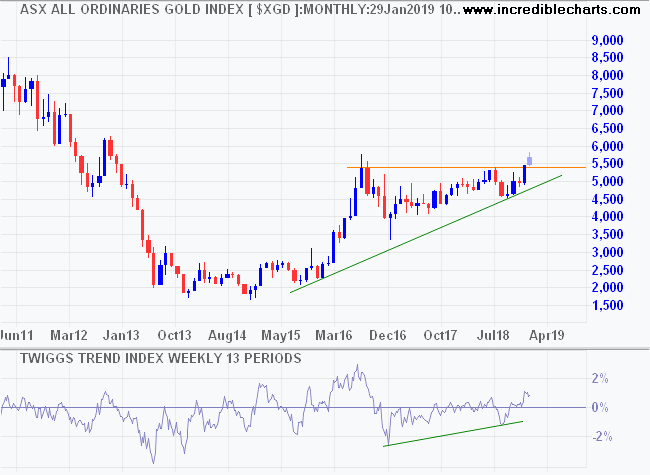

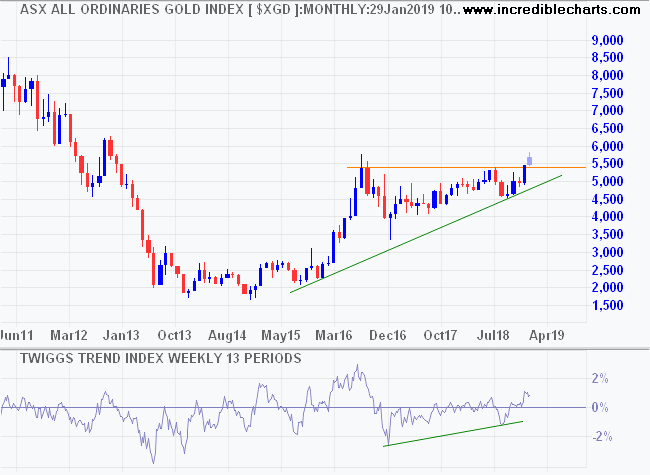

A weakening Australian Dollar has helped Aussie gold stocks. The All Ordinaries Gold Index broke resistance at 5400, signaling a primary advance with a target of 7000. But that depends on further weakness in the Aussie Dollar (< 70 US cents?) and/or a stronger gold price (> $1350?)

Conclusion: We are witnessing a rally in Gold due to global uncertainty but the LT outlook, with declining crude and a stronger Dollar, is bearish.