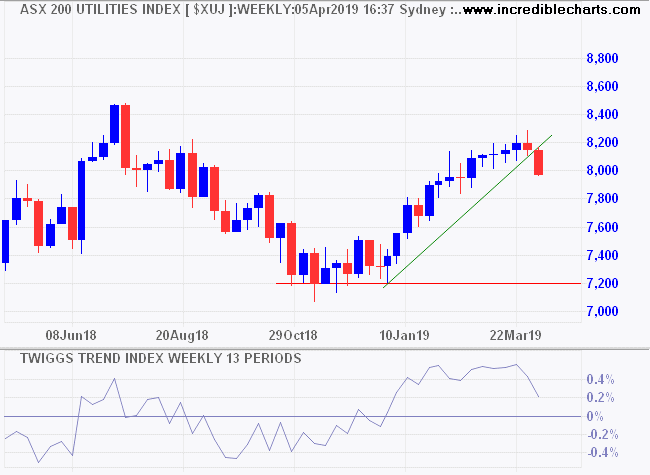

REITs and Utilities found support, partially recovering from their sell-off last week.

Financials continue to test support at 5800; breach would signal another test of primary support at 5300.

The RBA sums up the outlook for banks in its April 2019 Financial Stability Review:

“Analysts expect minimal growth in bank profits over the year ahead. Net interest income growth is expected to be below average as credit growth slows further and NIMs [net interest margins] remain under pressure. Bad and doubtful debt charges are also expected to pick up a little from their current very low level. The final cost of remediation for misconduct identified over recent years is uncertain, and could exceed existing provisions, while spending on compliance and IT may remain elevated in order to address some of the recommendations of the Royal Commission. Overall, there appears to be greater-than-usual uncertainty about the future profit outlook for banks because of the increased scrutiny on banks and the weaker outlook for property prices and housing credit growth.”

Materials encountered resistance at 13500, with a lower peak on the Trend Index warning of selling pressure. Another test of support at 12500 is likely.

The ASX 200 is heading for another test of resistance at 6350 but divergence with a declining Trend Index continues to warn of a correction. Expect stubborn resistance at 6350, followed by another test of 6000. Breach of 6000 would signal another correction to test primary support at 5400/5500.

I remain cautious on Australian stocks, especially banks, and hold more than 40% in cash and fixed interest in the Australian Growth portfolio.