The ASX has undergone a sell-off in the last two days, presumed to be offshore investors withdrawing from Australian investments.

Bell Direct equities analyst Julia Lee (Thursday) said it appeared that overseas investors – or even just one large player – had pulled their money from the Australian market, as losses were concentrated among the ASX’s top 20 companies. (thebull.com.au)

Worst hit were REITs.

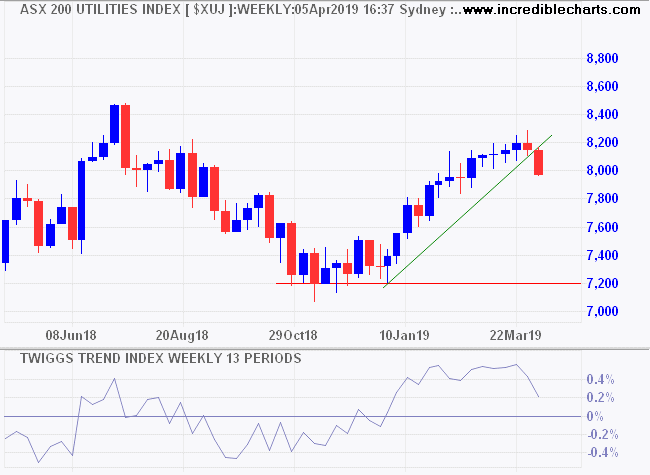

Followed by Utilities.

ASX 200 Financials are testing support at 5800, while the Trend Index warns of a correction. Breach of 5800 would signal another test of primary support at 5300.

Materials continue their advance, benefiting from the iron ore windfall.

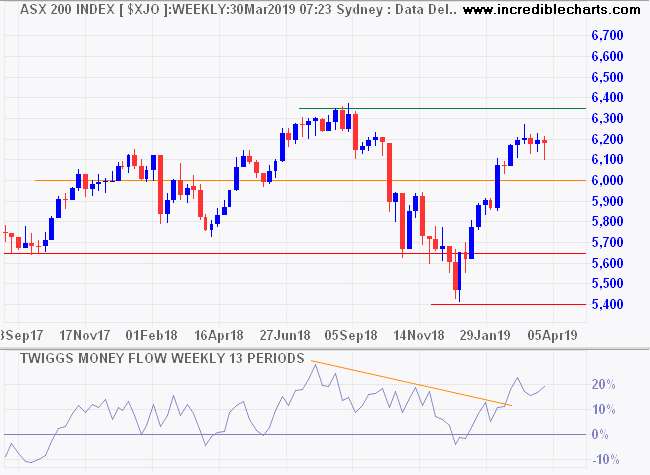

The ASX 200 retreated from resistance at 6350. Declining Trend Index warns of a correction. Breach of 6000 would confirm.

I remain cautious on Australian stocks and hold more than 40% in cash and fixed interest in the Australian Growth portfolio.