Gold is in a medium- to long-term up-trend. Apart from record central bank purchases of bullion and a weakening Chinese Yuan, real long-term interest rates are declining.

The chart below highlights the inverse relationship between gold and real long-term interest rates (10-year Treasury yield minus CPI YoY%). When LT interest rates fall, gold prices surge.

Treasury yields are falling because the Fed is cutting short-term interest rates but, more importantly, because QE has resumed. With the ECB driving bond yields into the negative, demand for Treasuries is surging.

The Fed has also reversed course, expanding their balance sheet after the recent liquidity squeeze forced them to resume overnight repos.

Our target for Gold is the 2012 high of $1800/ounce.

A weak rally strengthens the bearish argument for China’s Yuan, suggesting continuation of the primary down-trend.

The Yuan is in a long-term down-trend against the Dollar that shows no signs of easing. Resolution of trade tensions is unlikely. Trade is merely the tip of the iceberg in a far wider clash between two global powers with conflicting ideologies which is likely to continue for decades.

Gold is testing support at $1495/ounce. Breach would warn of a correction.

Silver is similarly testing support. Breach of $17.50/ounce is likely and would warn of a correction, with Gold expected to follow.

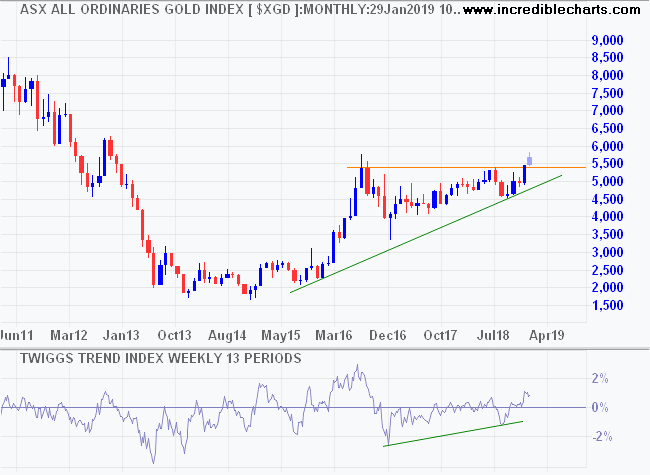

The All Ordinaries Gold Index is trending lower. Breach of 7200 would warn of another decline, with a short-term target of 6500.

Patience is required. Gold remains in a long-term up-trend and a correction may offer a sound entry point.