China’s PBOC stepped in with belated support for the Yuan, holding the line at 14.5 US cents.

The Dollar retreated, with the Dollar Index testing support at 95. Respect of support would confirm another advance, with a long-term target of 103 — if central banks like the Fed and PBOC don’t intervene.

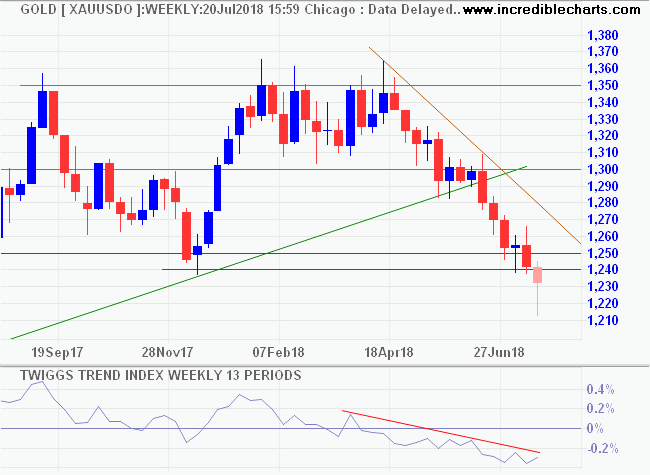

Gold rallied as the Dollar weakened, testing resistance at $1200/ounce. Respect of the descending trendline would warn of another decline with a long-term target of the 2015 low at $1050/ounce.

The Australian Dollar also rallied, reducing the benefit to local gold miners.

The All Ordinaries Gold Index (XGD) continues its downward path, with a long-term target of 4000/4100.

China is conserving its capital account as best it can, after losing $1 trillion in foreign reserves supporting the Yuan in 2015 – 2016.

But failure to support its currency is sure to antagonize the Trump administration and elicit further trade tariffs.

….Trade is drying up and China is stuck with debt it can’t repay or rollover easily. This marks the end of China’s Cinderella growth story, and the beginning of a period of economic slowdown and potential social unrest.

~ Jim Rickards at Daily Reckoning

If that’s the case, expect the Dollar to strengthen and further gold weakness.