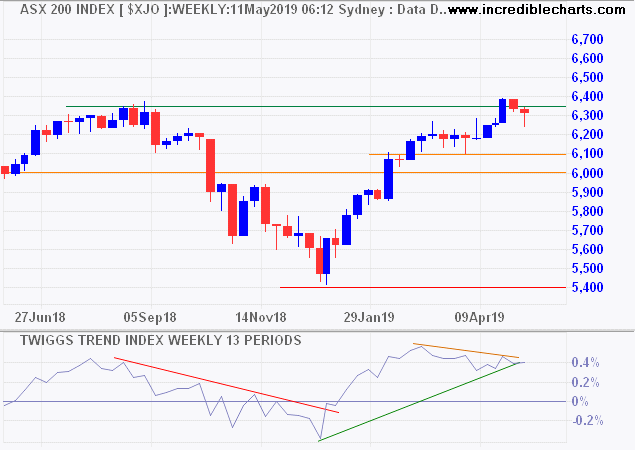

Last week I wrote that I had zero confidence in the ASX 200 breakout but you can’t argue with the tape. The ASX 200 retracement respected its new support level at 6350 and commenced a fresh advance. Money Flow completed a trough high above zero, signaling strong buying pressure.

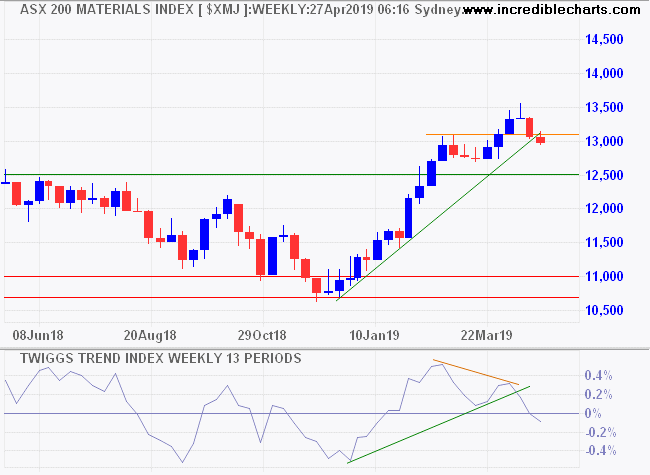

Iron ore is a big contributor, rocketing to $106/tonne.

Materials followed suit, breaking resistance at 13,500 suggesting a fresh advance.

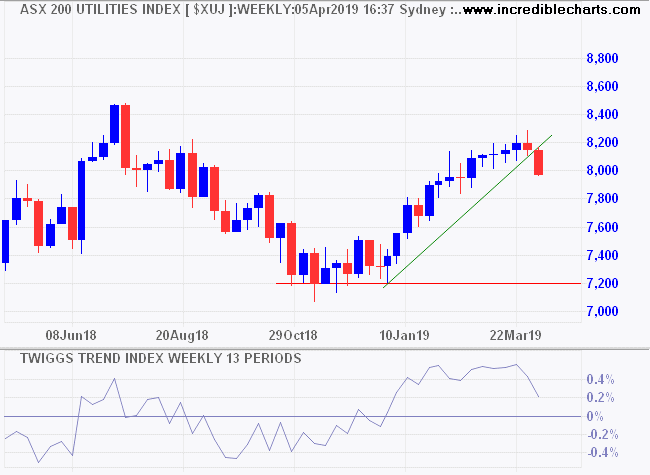

The housing rally in response to the recent RBA rate cut has fizzled out, with CoreLogic reporting lower auction clearance rates last weekend:

The combined capital city final auction clearance rate came in at 48.3 per cent last week, which was lower than the 58 per cent the previous week. The lower clearance rate was across a lower volume of auctions over what was the Queen’s birthday long weekend, which saw 805 homes taken to auction, down on the 1,661 auctions the prior week.

The Financials advance has also lost impetus, with lower peaks on the Money Flow Index warning of increased selling pressure. Reversal below 6000 would warn of another correction.

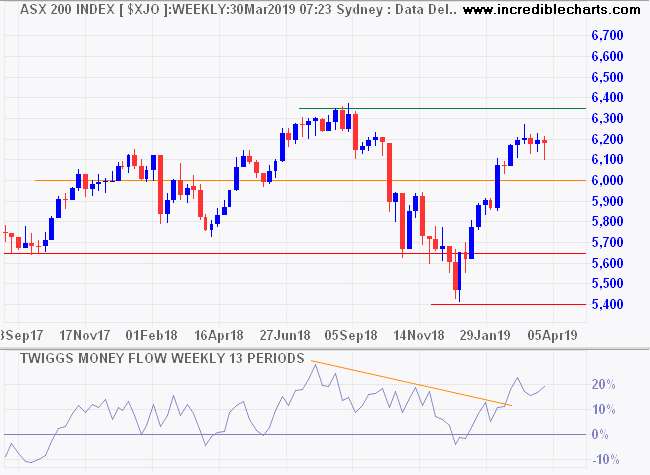

The market is discounting the potential impact of a US-China trade war on Australia, relying on a large Chinese injection of fiscal stimulus to steady the ship. They may be right but Chinese officials have been talking this down for the past few months.

We hold 46% of our Australian Growth portfolio in cash and fixed income securities because of high uncertainty from (1) the US-China trade war; and (2) declining house prices and their potential impact on under-capitalised banks — leveraged at nearly 20 times common equity (CET1).