The S&P 500 continued its cautious advance in a shortened week due to Thanksgiving. Expect retracement to test the new support level at 3000.

I believe that the latest surge has little do with an improved earnings outlook and is simply a straight bet that Fed balance sheet expansion (QE) will goose stock prices in the short- to medium-term. The chart below highlights the timing of the increase in Fed assets and its effect on the S&P 500 index.

There is plenty of research on the web pointing to a strong correlation between QE and equity prices. Here are two of the better ones:

Economic Activity

If we look at fundamentals, many of them are headed in the opposite direction.

Bellwether transport stock Fedex (FDX) is testing primary support at 150. Breach would warn of a slow-down in economic activity.

Monthly container traffic at the Port of Los Angeles shows a marked year-on-year fall in imports and, to a lesser extent, exports.

Rather than boosting local manufacturers, industrial production is falling.

Production of durable consumer goods is falling even faster, though the October figure may be distorted by the GM strike.

What is clear is that slowing growth in the global economy is unlikely to reverse any time soon.

Market Cap v. Corporate Profits

Yet market capitalization for non-financial stocks is at a precarious 24.7 times profits before tax, second only to the Dotcom bubble. The surge since 2010 coincides with Fed injection of a net $2.0 trillion into financial markets ($4.5T – $2.5T in excess reserves).

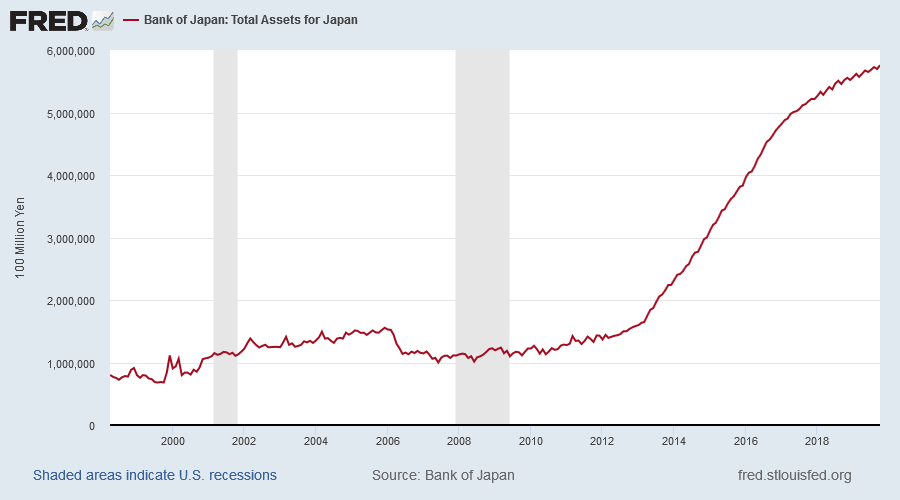

The problem, as the Fed unwind showed, is that once central banks embark on this path, it is difficult for them to stop. The Bank of Japan started in the late 1980s — and is still at it.

Margin Debt

This chart from Advisor Perspectives compares the S&P 500 to margin debt. The decline since late 2018 appears ominous but November margin debt levels may reflect an up-turn. We will have to keep a weather eye on this.

Patience

Patience is required. First, wait for S&P 500 retracement to confirm the breakout. Second, look for an up-turn in November economic indicators, especially employment, to support the bull signal. Failure of economic indicators to confirm the breakout will flag that market risk is elevated and investors should exercise caution.

“If the mind is to emerge unscathed from this relentless struggle with the unforeseen, two qualities are indispensable: first, an intellect that, even in the darkest hour, retains some glimmerings of the inner light which leads to truth; and second, the courage to follow this faint light wherever it may lead.”

~ Carl Von Clausewitz, Vom Kriege (On War) (1780-1831)