Two inter-connected themes likely to dominate the next few decades are War and Energy.

War may take the form of a geopolitical struggle between opposing ideologies, with conventional wars limited to proxies in most cases and nuclear exchanges avoided because the costs are prohibitive. But it is likely to involve fierce competition for energy and resources in an attempt to undermine opposing economies. The impact is likely to be felt throughout the global economy and across all asset classes, including bonds, stocks and precious metals.

War

War can take many forms: conventional war, nuclear war, proxy war, cold war, economic war, or some combination of the above.

Nuclear war can hopefully be avoided, with sane leaders skirting mutually assured destruction (MAD). For that reason, even conventional war between great powers is unlikely — but there is a risk of it being triggered by escalation in a war between proxies.

Cold war, with limited trade between opposing powers — as in the days of Churchill’s Iron Curtain — is also unlikely. Global economic interdependence is far higher than sixty years ago.

Greg Hayes, chief executive of Raytheon, said the company had “several thousand suppliers in China and decoupling . . . is impossible”. “We can de-risk but not decouple,” Hayes told the Financial Times in an interview, adding that he believed this to be the case “for everybody”.

“Think about the $500bn of trade that goes from China to the US every year. More than 95 per cent of rare earth materials or metals come from, or are processed in, China. There is no alternative,” said Hayes. “If we had to pull out of China, it would take us many, many years to re-establish that capability either domestically or in other friendly countries.”

What is likely is a struggle for geopolitical advantage between opposing alliances, with economic war, proxy wars, and attempts to build spheres of influence. This includes enticing (or coercing) non-aligned nations such as India to join one of the sides.

Such a geopolitical arm-wrestle is likely to have ramifications in many different spheres, but most of all energy.

Energy

You can’t fight a war without energy. A key element of the geopolitical tussle will be to secure adequate supplies of energy — and to deprive the opposing side of the same.

The situation is further complicated by the attempted transition from fossil fuels to low-carbon energy sources.

Since the Industrial revolution, development of the global economy has been fueled by energy from fossil fuels, with GDP and fossil fuel consumption growing exponentially. Gradual transition to alternative energy sources would be a big ask. To attempt a rapid transition while in the midst of geopolitical conflict could end in disaster.

The challenge is further complicated by attempts to replace fossil fuels with wind and solar which generate intermittent power. Base-load power — generated from fossil fuels or nuclear — is essential for many industries. Microsoft are investigating the use of nuclear to power data centers. The US Department of Defense (DoD) has commissioned Oklo Inc. to design and build a nuclear micro-reactor to power Eielson Air Force Base in Alaska. Renewables are a poor option for critical applications.

Russia’s 2022 invasion of Ukraine highlighted Germany’s energy vulnerability despite billions of Euros invested in renewables over recent decades. You cannot run a modern industrialized economy without reliable energy sources.

Low investment in fossil fuel resources — which fail to meet ESG standards — has further increased global vulnerability to energy shortages during the transition.

Inflation

War and pandemics cause high inflation. Governments run large deficits during times of crisis, funded by central bank purchases in the absence of other investors. This causes rapid expansion of the money supply, leading to high inflation.

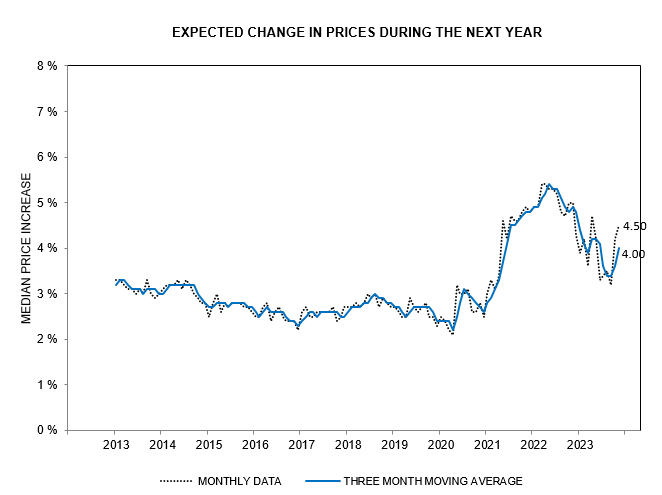

Geopolitical conflict and the attempt to rapidly transition to carbon-free fuels — while neglecting existing resources — are both likely to cause a steep rise in energy costs.

Bond Market

The bond market has the final say. The recent steep rise in long-term Treasury yields is the bond market’s assessment of fiscal management in the US. The deeply divided House of Representatives has effectively been awarded an “F” on its economic report card.

Failure of a divided government to address fiscal debt at precarious levels and rein in ballooning deficits raises a question mark over future stability, with the bond market demanding a premium on long-term issues.

The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions. (Fitch Ratings)

CBO projections show federal debt held by the public rising from 98% of GDP today to 181% in thirty years time.

Rising long-term yields also add to deficits as servicing costs on existing debt increase over time. The actual curve is likely to be even steeper. CBO projections assume an average interest rate of 2.5%, while current rates are close to 5.0%.

Continuing large fiscal deficits in the next few decades appear unavoidable. The result is likely to be massive central bank purchases of fiscal debt — as in previous wars/pandemics — with negative real interest rates (red circles below) driving higher inflation (blue) and rising inequality.

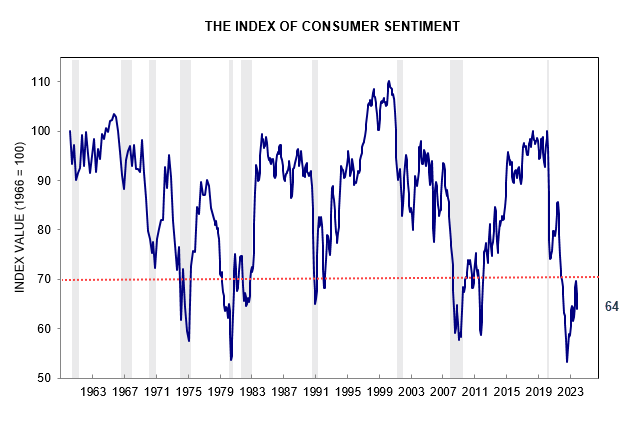

Political instability

Interest rate suppression effectively subsidizes borrowers at the expense of savers. Only the wealthy are able to leverage their large balance sheets, buying real assets while borrowing at negative real interest rates. Those less fortunate have limited access to credit and suffer the worst consequences of inflation, further accentuating the division in society and fostering political instability as populism soars.

Commodities

Resources are likely to be in short supply, from under-investment during the pandemic, geopolitical competition, and the attempted rapid transition to new energy sources. Prices are still likely to fall if global demand shrinks during a recession. But growing demand, shrinking supply (from past under-investment) and inflation pushing up production costs are expected to lead to a long-term secular up-trend.

Gold

High inflation, negative real interest rates and geopolitical competition are likely to weaken the Dollar, strengthening demand for Gold as a safe haven and inflation hedge. Breakout above $2000 per ounce would offer a long-term target of $3000.

Conclusion

We expect large government deficits and shortages of energy and critical materials — such as Lithium and Copper — the result of a geopolitical struggle and attempt to transition to low-carbon energy sources over several decades.

Rising government debt will necessitate central bank purchases as the bond market drives up yields in the absence of foreign buyers. The likely result will be high inflation and interest rate suppression as central banks and government attempt to manage soaring debt levels and servicing costs.

Our strategy is to be overweight commodities, especially critical materials required for the transition to low-carbon fuel sources; short-term bonds and term deposits; and defensive (value) stocks.

We are also overweight energy, including: heavy electrical; nuclear technology; uranium; and oil & gas resources.

Gold is more complicated. Rising long-term interest rates will weaken demand for Gold, while geopolitical turmoil will strengthen demand, causing a see-sawing market with high volatility. If long-term yields fall — due to central bank purchases of US Treasuries — expect high inflation. That would be a signal to load up on Gold.

We are underweight growth stocks and real estate. Rising long-term interest rates are expected to lower earnings multiples, causing falling prices. Collapsing long-term yields due to central bank purchases of USTs, however, would cause negative real interest rates. A signal to overweight real assets such as growth stocks and real estate.

Long-term bonds are plunging in value as long-term yields rise, with iShares 20+ Year Treasury ETF (TLT) having lost almost 50% since early 2020.

The trend is expected to reverse when Treasury yields peak but timing the reversal is going to be difficult.

Acknowledgements

Save 50% on an Annual Subscription.

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.

Treasury debt held by the public is projected to rise to a precarious 160% of GDP by 2050.

Treasury debt held by the public is projected to rise to a precarious 160% of GDP by 2050.