Markets were spooked by “hawkish” comments in the latest FOMC minutes, where some participants indicated a willingness to tighten policy should such action become appropriate:

Participants discussed maintaining the current restrictive policy stance for longer should inflation not show signs of moving sustainably toward 2 percent or reducing policy restraint in the event of an unexpected weakening in labor market conditions. Various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate. ~ Minutes of the Federal Open Market Committee: April 30–May 1, 2024

This is nothing new: all FOMC members should be prepared to hike rates if inflation spikes to the point where tighter policy is appropriate. What seems to have spooked markets is the fact that it was considered appropriate to discuss this out in the open.

10-year Treasury yields rallied to test 4.5%, ending the series of declining Trend Index peaks. Breakout above 4.5% would signal another test of 4.7% but breach of support remains likely and would signal a decline to test support between 4.0% and 4.1%.

The large engulfing candle on the S&P 500 is a bearish sign. Expect a test of support at 5200 but respect is likely and would confirm our target of 5500.

The S&P 500 Equal-Weighted Index ($IQX) retreated sharply and is likely to test support at 6600.

Financial Markets

Commercial bank reserves at the Fed climbed to $3.39 trillion on May 22, continuing the recovery of financial market liquidity after the sharp fall during April tax payment season.

The inverted Chicago Fed Financial Conditions Index (black below) continues to climb, indicating easier monetary policy. The S&P 500 (blue) is expected to follow the FCI upwards.

Wicksell Analysis

The chart below is based on the theory of interest and money published by Swedish economist Knut Wicksell in 1898. Monetary policy is restrictive when long-term interest rates are higher than nominal GDP growth (the marginal return on new investment) and stimulatory when LT rates are below nominal GDP growth.

We plot nominal GDP (silver) against 10-year Treasury yields (purple) below. Stimulatory monetary policy is evident in the 1960s and ’70s — with GDP growth (silver) above long-term rates (purple) — boosting growth and inflation. This followed by restrictive policies in the 1980s and ’90s before long-term rates were again suppressed to stimulate the economy in the last two decades.

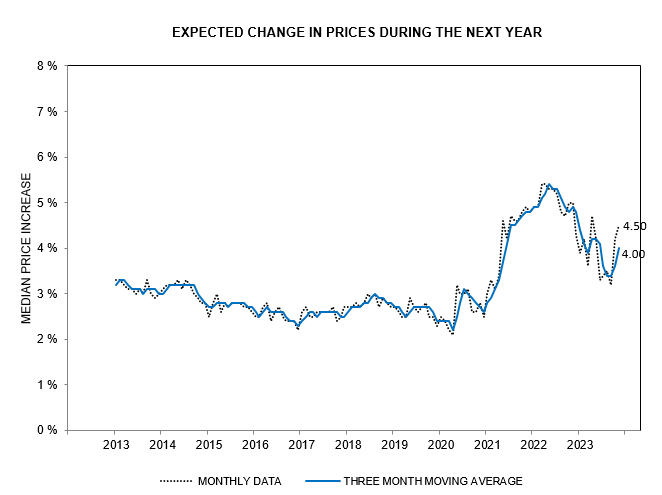

Nominal GDP grew at an annualized rate of 5.5% in Q1 of 2024, while the 10-year yield is below 4.5%, indicating that monetary policy remains stimulatory. Further growth and inflation are likely.

Crude Oil

The counter-argument to the monetarist view is that crude oil prices are falling and likely to ease inflationary pressures in the economy.

Nymex light crude broke support at $78 per barrel, indicating a decline to test long-term support (red) at $68.

Energy prices were the primary cause of the spike in CPI in 2021 and its subsequent fall in 2022-23.

Conclusion

Crude prices are likely to fall, easing inflationary pressures and leading to lower long-term interest rates.

We expect the Fed and US Treasury to maintain easy monetary conditions until after the November elections.

The current bull market in stocks is likely to continue until end of the year.

Ceteris paribus

The Latin phrase ceteris paribus means “all else being equal.”

If Vladimir Putin and Xi Jinping attempt to influence US elections by disrupting the global economy — through cyberattacks, damage to undersea communication cables, infrastructure, or transport bottlenecks — then all bets are off and we could be in for a wild ride.

Acknowledgements

- Federal Reserve Board: Minutes of the Federal Open Market Committee: April 30–May 1, 2024

- Neils Jensen at Absolute Return Partners for his essays on Wicksell Analysis

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.