Ten-year Treasury yields continue to respect support at 4.50%. We expect another test of resistance at 5.0%.

Moody’s kept their AAA rating for the US government but changed their outlook from stable to negative. The reasons cited — large deficits and a polarized ineffective Congress — are strong arguments for higher Treasury yields:

Japan has also broken above 150 yen to the Dollar, increasing pressure on the BoJ to relax their cap on long-term JGB yields. Any move to relax yield curve control would be likely to cause an outflow from US Treasuries and the Dollar, driving down prices.

Inflation

Inflation expectations are rising, with University of Michigan 1-year expectations jumping to 4.4% — and the 3-month moving average to 3.9%.

Five-year expectations are also rising, reaching 3.2% in October, with the 3-month moving average at 3.0%.

Higher inflation expectations add to upward pressure on long-term yields.

Financial Conditions

Financial conditions remain loose — despite the strong rise in long-term yields — with the spread between Baa corporate bonds and the equivalent Treasury yield at a low 1.84%.

Economic Outlook

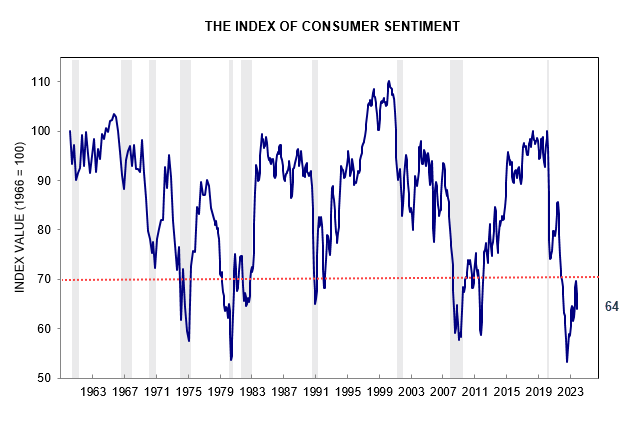

Low consumer sentiment, with the University of Michigan Index at 64, continues to warn of a recession.

Heavy truck sales — a reliable leading indicator — are falling steeply. A fall below 35,000 units would be cause for concern.

Stocks

The S&P 500 ended the week stronger, with a bullish candle testing resistance at 4400.

Small caps continue to warn of weakness, however, with the Russell 2000 iShares ETF (IWM) likely to test primary support at 162. Trend Index peaks below zero warn of strong selling pressure. Small caps tend to outperform large caps by a wide margin in the first phase of a bull market — clearly not the case here.

Global Economy

Copper is retracing for another test of primary support at $7800 per metric ton. Breach would warn of a global recession.

Gold

Gold broke support at $1900 per ounce, indicating a test of $1900. Rising long-term interest rates are undermining investor demand for Gold.

But Gold is supported by strong central bank purchases, led by China.

Australia

The ASX 200 retreated below 7000 on Friday but a bullish close on the S&P 500 should see retracement to test resistance. Declining Trend index peaks, however, warn of rising selling pressure.

Conclusion

We expect upward pressure on long-term Treasury yields to continue, boosted by Moody’s negative outlook for the US, a weakening Japanese Yen and rising inflation expectations.

Declining heavy truck sales and weak consumer sentiment are bearish for the economy. The S&P 500 remains bullish but small caps are more bearish, warning that this is not a broad-based recovery.

Copper breach of $7800 per metric ton would warn of a global recession.

We remain overweight cash, money market funds, short-duration term deposits and financial securities (up to 12 months), defensive stocks, critical materials and gold.

Acknowledgements

- Mohamed El-Erian for discussion of the Moody’s rating.

- Liz Ann Sonders and RJR Markets for Russell 2000 Small Caps commentary.

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.