International Growth portfolio performance since inception on July 1, 2018 is set out below. We expect to hold most growth stocks for 5 to 10 years.

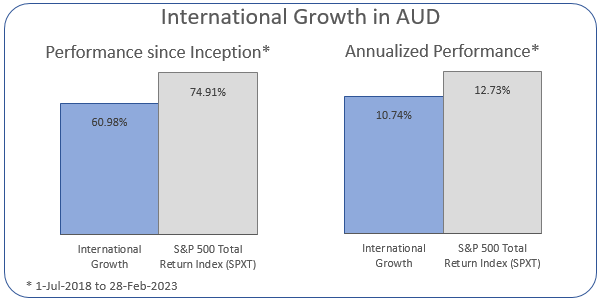

And in Australian Dollars:

Performance of Individual Stocks

[Content protected for Premium, International Growth members only]Past Performance

Hypothetical $1 million invested in the International Growth portfolio on July 1, 2018, calculated in US Dollars:

Converted to Australian Dollars (on a month-end basis):

Performance Notes:

- Performance is calculated in US Dollars except where otherwise stated.

- Annualized performance is calculated using the CAGR formula.

- Returns are calculated after brokerage costs but exclude all other fees and charges.

- Not all stocks have equal weighting nor held for the full period.

- Past performance is not a guarantee of future performance.

Portfolio Allocation

The graph below reflects current portfolio allocation:

For a detailed discussion of target sectors see Changes to International portfolio allocation.

Past Allocations

Allocations have evolved over time to deal with elevated market risk, over-priced sectors, and opportunities in cyclicals:

You must be logged in to post a comment.