First, let me correct the implication that this is a trade war started by Donald Trump. It is not. His is only the first significant response by the US in a trade war initiated by China more than a decade ago, in the early 2000s.

In 2011 I warned of the danger of a trade war in Five Challenges facing President Obama:

…1. Stop importing capital and exporting jobs.

Japan and China have effectively maintained a trade advantage against the US by investing more than $2.3 trillion in US Treasuries. The inflow of funds on capital account acts to suppress their exchange rate, effectively pegging it against the greenback. Imposition of trade penalties would result in tit-for-tat retaliation that could easily escalate into a trade war….

In Mega-trends and their impact in 2012:

Trade wars

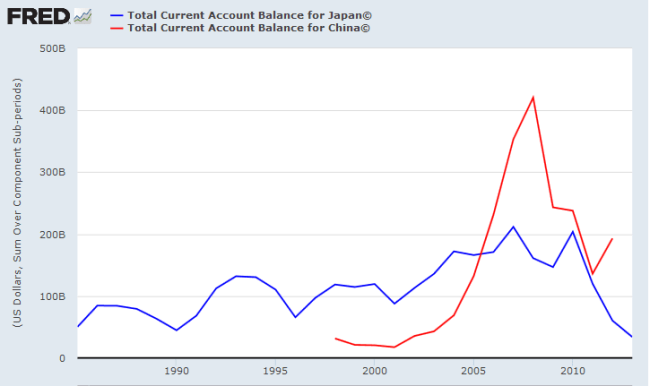

In addition to competition for scarce resources, we are also likely to see increased competition for international trade. Resistance to further currency manipulation — initiated by Japan in the 1980s and perpetuated by China in the last decade — is likely to rise. US Treasury holdings by China and Japan currently sit at more than $2.3 Trillion, the inflows on capital account being used to offset outflows on current account and maintain a competitive trade advantage by suppressing their exchange rate.

In China’s Export Dilemma 2014:

…China has been buying US Treasuries as a form of vendor financing, allowing them to export to the US while preventing the RMB from appreciating to its natural, market-clearing level against the Dollar. The fact that they are attempting to disguise this manipulation, using third parties, means that Congress is unlikely to tolerate further suppression of the RMB against the Dollar and will be forced to take action.

And in 2015, Sectoral Imbalances: Where Have All the Jobs Gone?

A second threat is foreign capital inflows… which commenced in earnest with Japanese purchases of US Treasuries in the 1980s but reached a ‘nuclear’ scale when China joined the party in the early 2000s. While it may appear fairly benign, with foreign investors stepping in to lend Uncle Sam a helping hand, the damage is insidious… these capital inflows were intended to undermine the competitiveness of US manufacturers in both domestic and export markets through currency manipulation.

To understand how currency manipulation works, we need to examine the foreign surplus in more detail. There are two parts to currency flows between nations: the current (income) account and the capital account. The current account comprises the trade surplus or deficit (the net sum of all trade flows between the two nations) and the smaller net income flow from investments.

The capital account reflects all capital flows, whether investment or loans, between the two countries. Again, the sum of the two is always zero. If there is a deficit on the current account (money flowing out), there must be a surplus on the capital account (loans and investments flowing in) to restore the balance. If not, and Japan/China had to increase their exports to the US without a reciprocal flow of capital, the value of the dollar would plummet against the yen/yuan until the trade balance was restored.

Think of it this way. If an importer in the US buys goods from China, they must purchase yuan to pay for the goods. If there are more imports than exports, the demand for yuan will be higher than demand for dollars; so the yuan will rise against the dollar until demand matches supply. But what currency manipulators do is invest money via capital account (mainly in US Treasuries), purchasing dollars to soak up the shortfall so that their currency doesn’t appreciate despite the massive trade surplus with the US.

The impact of this is two-fold. First US manufacturers shed jobs as they lose market share in both domestic and export markets. That cuts into the household surplus as unemployment rises and real wages fall. Second, the US government runs bigger deficits to make up for the demand shortfall in order to buoy economic growth. The end result is that US taxpayers grow poorer — as the size of the public debt millstone increases — while currency manipulators grow richer. The debt binge that led to the GFC was largely fueled by foreign capital inflows. The fact that this imbalance has been allowed to continue is a damning indictment of political leadership in Washington. There is no way that they can be unaware of the damage being caused to US manufacturers, households and to public finances. Change is long overdue.

Why has it taken this long to respond?

The last incumbent in the White House refused to confront the rising menace. A risk-averse culture led to micro-management and Obama’s mantra of “Don’t do stupid sh*t” frequently translated into “Don’t do anything”.

On Obama’s watch the US abdicated its global leadership, leaving the door open for scoundrels like Vladimir Putin and Xi Jinping to step into the void. His legacy is a series of brewing crises that risk a major global confrontation in the next few decades. Taiwan and the South China Sea, India and Pakistan, North Korea, Iran and Saudi Arabia, Yemen, Syria, Ukraine, the Balkans, and the Baltic States. All of these hotspots have the potential to spark a major conflict. It needs just a single miscalculation from an emboldened aggressor accustomed to being able to bully their neighbors into acquiescence.

All this seems eerily familiar. As Winston Churchill long ago warned:

An appeaser is one who feeds a crocodile, hoping it will eat him last.

But back to Donald Trump.

To his credit Trump correctly identified the need to confront the growing threat.

Unfortunately he is not up to the task.

His confrontational style may have worked well when nailing down contractors on construction contracts, or even negotiating media contracts for his show, but is totally unsuited for the role of a leader of the free world.

Trump’s campaign style has left a fiercely divided political landscape, with little support in the mainstream media and even a large swathe of Republicans shocked and embarrassed by his behavior. He has zero chance of uniting the country behind him in confronting these major challenges. His erratic behavior means the Republican party is likely lose control of the House of Representatives at the upcoming mid-term elections, leaving Trump as a lame duck President.

What he does not seem to realise is that belittling treatment of senior officials in his own administration diminishes him in the eyes of subordinates and demoralises his remaining team. It also makes it exceedingly difficult for him to attract new talent.

Internationally, Trump has managed to offend many of America’s traditional allies and is also unlikely to receive much support or understanding from that quarter.

Fortunately the President has been unable to derail the US economy which I suspect will be able to weather the current storm as it has many others. The political mess will continue while the economy keeps on going.

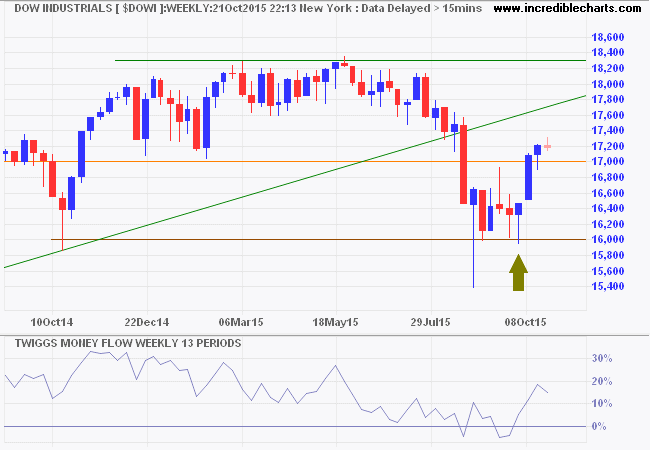

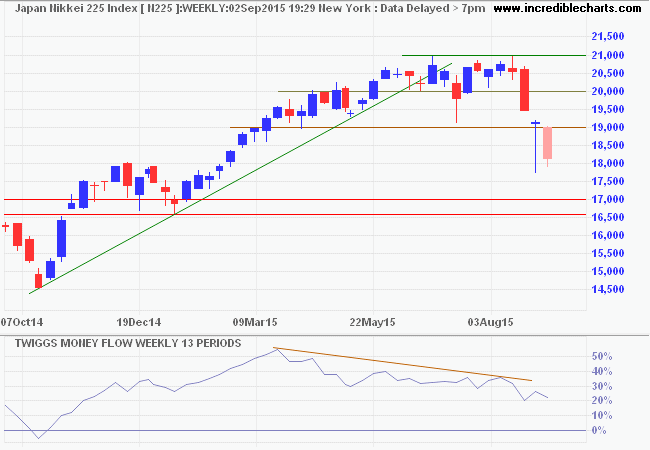

When it comes to stocks, the S&P 500 index is headed for a test of primary support between 2500 and 2550. Breach would signal a primary down-trend but Twiggs Volatility Index is currently in the amber zone, between 1% and 2%, suggesting that the correction is secondary in nature.

From Market Volatility and the S&P 500 in February 2018:

The key is not to wait for Volatility to spike above 2%. By then it is normally too late. An alternative strategy would be to scale back positions when the market remains in an elevated range, between 1% and 2%, over several months. Many traders would argue that this is too early. But the signal does indicate elevated market risk and I am reasonably certain that investors with large positions would prefer to exit too early rather than too late.

My current policy is to maintain 30% cash in our model portfolio (this may not suit investors with different risk profiles) and I am only likely to increase this for US investments if there is a fall below 2500 or Twiggs Volatility remains elevated (above 1%) for at least 3 months. But I am likely to review our cash position for Australian investments in the weeks ahead.

When liberty exceeds intelligence, it begets chaos, which begets dictatorship.

~ Will Durant

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.

You must be logged in to post a comment.