The S&P 500 retreated Friday, the bearish engulfing candle and a lower peak on the Trend Index warn of a test of support at 5050. The longer-term outlook remains bullish, with rising Trend Index troughs above zero signaling unusual buying pressure.

S&P 500 (purple below) outperformed the broader Equal-Weighted S&P 500 (lime green) in February, a bullish sign. Periods when $IQX outperforms the general index ($INX) can highlight when the top stocks are no longer participating in the advance — a strong bear signal.

Labor Market

The economy added 275,000 jobs in February, a strong result.

Of the cyclical sectors that normally lead the economic cycle, manufacturing showed a small loss of 4K jobs but construction and transport & warehousing showed gains of 23K and 20K respectively.

The unemployment rate increased to 3.9% as more people entered the workforce. The 3-month moving average of the unemployment rate has increased 27 basis points (red below) from its preceding low. According to the Sahm Rule — developed by former Fed economist Claudia Sahm — a 50 basis point increase signals the start of a recession, while 35 points provides an early warning.

Average weekly hours worked ticked up to 34.3 hours but the downward trend warns that the economy is slowing.

Another good indicator is the quit rate which soars when the labor market is tight and jobs are readily available. The down-trend since 2022 indicates that the heat is coming out of the job market.

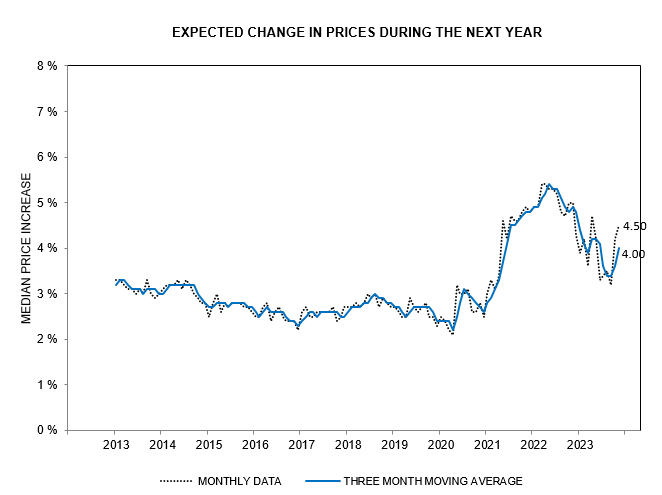

The decline in average hourly earnings annual growth is slowing.

But the February monthly rate fell sharply, after a strong January. The 3-month moving average growth rate of 1.0% — 4.0% annualized — suggests further easing ahead despite a robust economy.

Aggregate weekly hours worked (purple below) are growing at an annual rate of 1.2%. We are unlikely to see productivity benefits from AI this year and real GDP growth (blue) is expected to converge with the slower labor growth rate.

Financial Markets

10-Year Treasury yields found short-term support above 4.0%. Retracement to test the new resistance level at 4.20% is now likely. Respect of resistance would confirm the target of 3.80%.

The Chicago Fed Financial Conditions Index ticked up to -0.47 but continues below zero, signaling easy monetary policy.

Commercial bank cash assets — primarily reserves at the Fed — are leveling off at $3.6 trillion.

Strong growth in bank reserves over the last 6 months is unlikely to be repeated, with a decline expected after the Fed’s reverse repo (RRP) balance is drained. Money market funds are switching to T-Bills. After the RRP is depleted, further Treasury issuance is likely to be taken up by private investors — either through direct purchases or by switching from bank deposits to money market funds.

Bank time deposits are still growing but the rate of growth, especially in retail deposits (blue below), has fallen dramatically over the past 12 months. Negative growth would be a strong recession warning.

Gold & the Dollar

The Dollar Index broke support at 103, warning of a decline to 100. Retracement that respects the new resistance level at 103 would confirm the target.

Gold continues to climb, reaching close to $2200 per ounce on during the day. A weaker close signals some profit taking but is so far insufficient to set off retracement. Follow-through above $2200 would lead us to revise our short-term target to $2250 — calculated as $2050 + ($2050 – 1850).

Our long-term target of $2450 is calculated as $2050 + ($2050 – $1650).

Crude & Commodities

Brent crude continues in a narrow range between $82 and $84 per barrel. Downward breakout would offer short-term relief but supply issues threaten a rally to test resistance at $90 per barrel — warning of higher inflation in the months ahead.

Faster-than-expected land inventory drawdowns due to seaborne trade disruptions from the Red Sea crisis have prompted Goldman Sachs to revise up its forecast for summer peak Brent Crude prices to $87 per barrel, up by $2 from earlier expectations.

“OECD commercial stocks on land have drawn somewhat faster than expected as the redirection of flows away from the Red Sea has increased inventories on water,” analysts at the investment bank wrote in a Sunday note, as carried by Reuters. ~ Oilprice.com

Copper broke through resistance at $8500 per metric ton, signaling an advance to $9000, but expect retracement to test the new support level first.

China’s real estate/financial woes are weighing more heavily on iron ore which continues to test support at $114 per metric ton.

Uranium has fallen about 20% from its peak earlier in the year, with the Sprott Physical Uranium Trust (SRUUF) testing support at 20. Respect of support would suggest another advance with a target of 30.

Please note: This is not a recommendation to buy SRUUF. It is simply being used as an indicator of physical uranium prices.

Growth in electricity demand is likely to have more than doubled in 2023 as data centers, crypto-mining and re-shored manufacturing facilities joined the grid.

Conclusion

Demand for stocks and Gold is booming. Investors seek real assets ahead of anticipated June rate cuts by the Fed and a likely resurgence in inflation.

The labor market remains tight but there are signs that upward pressure on average hourly earnings is easing as growth in aggregate weekly hours worked slows.

Declining reverse repo (RRP) balances at the Fed warn that bank reserves are likely to decline in the not-too-distant future. Liquidity is expected to tighten unless the Fed slows QT after the RRP is drained. The current $95 billion per month reduction in the Fed holdings of securities cannot be sustained without hurting liquidity in financial markets. A liquidity contraction is unlikely before the November elections but would cause a sharp fall in stock prices.

An alternative for the Fed would be to encourage commercial banks to buy Treasuries by excluding USTs from bank SLR leverage calculations. But that seems less likely than tapering QT, especially after the Silicon Valley Bank disaster where SVB took huge losses on their holdings of long-duration Treasuries and mortgage-backed securities.

We are overweight Gold, Critical Materials and Defensive stocks. We feel that Technology stocks and Industrial Real Estate are over-priced and will wait for better opportunities in 2025.

Acknowledgements

- Luke Gromen, FFTT: March 8, 2024

- Eric Basmajian, EPB Research for his notes on the Sahm Rule

- Oilprice.com: Goldman Raises Forecast of Brent Oil Summer Price to $87

- RJ Bono for the Washington Post headline

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.