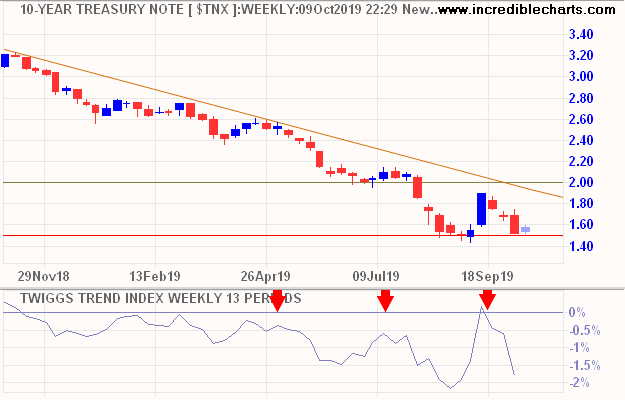

10-Year Treasury yields retreated from resistance at 2.0%, helped by increased Chinese purchases.

Evidenced by the Yuan falling against the US Dollar. Breach of recent support 14.15 would warn of another test of primary support at 14 cents.

Further Yuan weakness and lower Treasury yields are likely after President Trump signed the Hong Kong Human Rights & Democracy Act into law. This puts China in a difficult position. China’s foreign ministry:

“We urge the United States not to continue going down the wrong path, or China will take countermeasures and the U.S. must bear all the consequences.”

Their economy is hemorrhaging and they badly want an interim trade deal but failure to respond to the latest US action would reveal a weak hand. Expect an indirect response as in the popular idiom – kill the chicken to scare the monkey – making an example of someone in the hope that it will deter others.

Gold continues to test support at $1450 but lower Treasury yields (from a weaker Yuan) would strengthen demand as it lowers the opportunity cost of holding Gold. Breach of support is unlikely unless Treasury yields again test resistance at 2.0%.

Silver is similarly testing support at $16.80/ounce but we are unlikely to see a follow-through unless Treasury yields strengthen.

Australia’s All Ordinaries Gold Index continues in a downward trend channel. An up-tick in the Trend index and short-term support at 6500 suggest a rally to test the upper trend channel, around 7000. Breakout from the trend channel, while still unlikely, would warn that a bottom is forming. Breach of support at 6500 is more likely and would offer a short-term target of 6000.

Patience

Gold remains in a long-term up-trend. The current correction may offer an attractive entry point but we first need to confirm that the up-trend is intact.