In January I warned that the Fed’s normalization plan, which will shrink its balance sheet at the rate of $100 billion in 2018 and $200 billion a year thereafter, would cause Treasury yields to rise and the Dollar to weaken.

10-Year Treasury yields are now testing resistance at 3.0 percent. Breakout would signal the end of a decades-long bull market in bonds and start of a bear market as yields rise.

The Dollar Index is in a primary down-trend but the recent rally above the descending trendline suggests that a bottom may be forming.

Commodity prices, which I suggested would climb as the Dollar weakened, are strengthening but remain in an ascending triangle, testing resistance at 90 on the Dow Jones – UBS Commodity Index.

Crude, however, is surging and commodities are likely to follow.

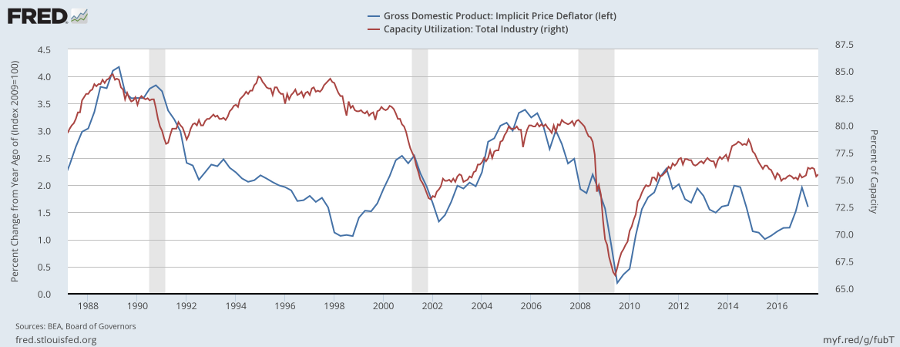

Rising commodity prices — especially crude — would lift inflation, raising the threat of tighter Fed monetary policy.

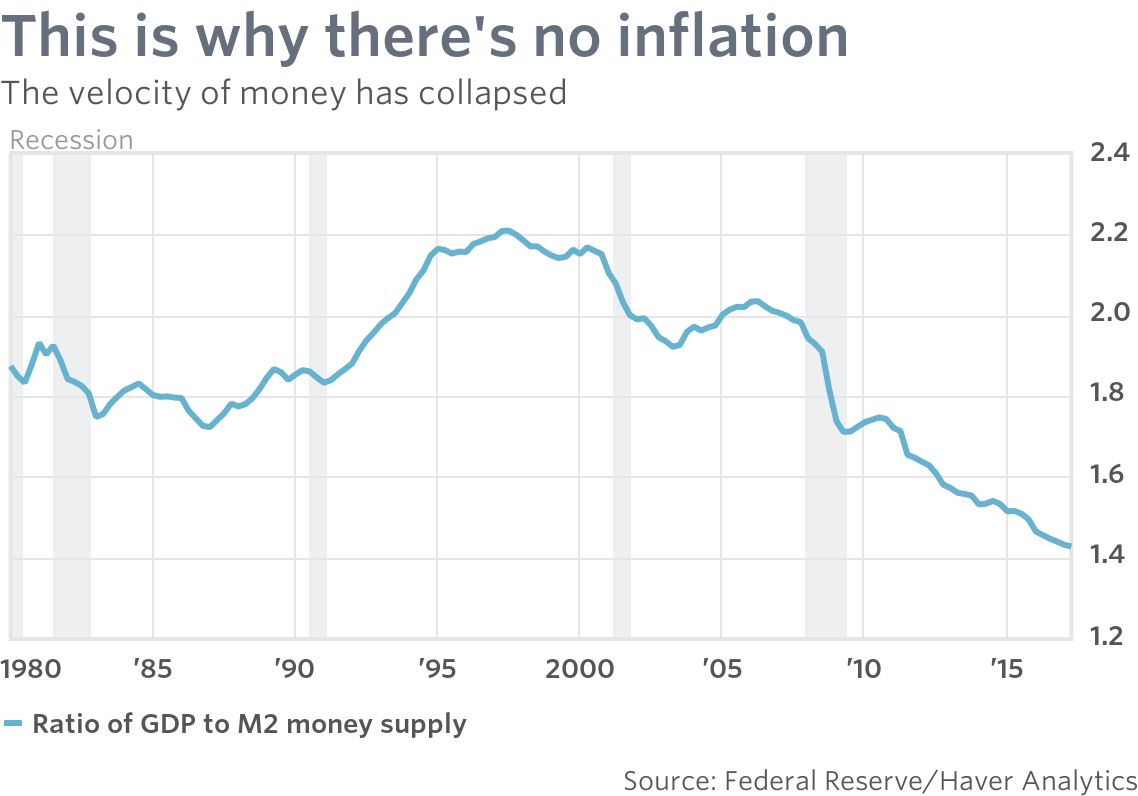

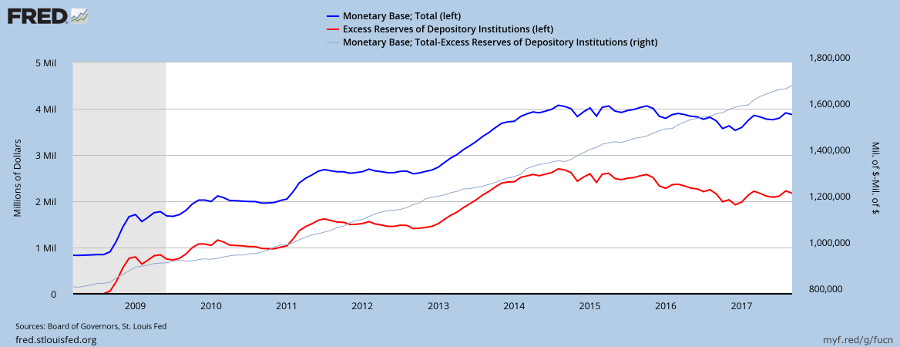

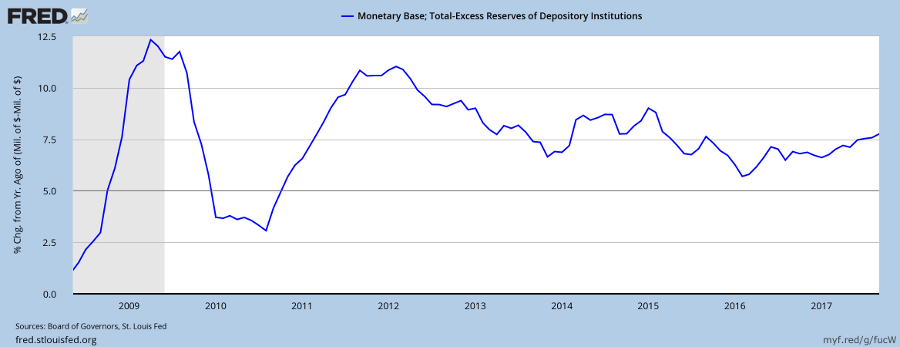

Until now, financial markets have absorbed the Fed shrinking its balance sheet. Primarily because there hasn’t been any contractionary effect at all.

The orange line on the chart below shows Fed assets net of excess reserves of commercial banks on deposit at the Fed. If commercial banks withdraw excess reserves at a faster rate than the Fed shrinks its balance sheet then the net effect is expansionary, with a rising orange line as at present. There are still $2 trillion of excess reserves on deposit at the Fed, so this could go on for years.

The Fed funds rate is climbing, but at a measured pace. I doubt that the market will be too concerned by the FFR at 2.0 percent. The threat is if the Fed accelerates rate hikes in response to rising inflation, as in 2004 to 2006.

Inflationary forces remain subdued, with the average hourly wage rate growing at a modest 2.6 percent a year.

A spike above 3.0 percent would spur the Fed into action but there is no sign, so far, as rising automation and competition from offshore labor markets ease upward pressure despite low unemployment.

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.

You must be logged in to post a comment.