Gold briefly broke support at $3,000 per ounce, threatening a correction to test the support band between $2,800 and $2,850. However, strong buying drove the precious metal above the support level, displaying a long tail on today’s candlestick. A breakout above $3,050 would complete a bear trap reversal, signaling a rally to $3,150.

According to the IMF, gold increased to 21% of official currency reserves. However, gold reserves are far below the 60% to 70% required for a viable gold-backed financial system, as in the 1960s.

China’s and Saudi Arabia’s gold reserves are climbing steeply, while Western central bank holdings remain below 22,000 tonnes.

China’s actual reserves are likely higher than the official IMF figures. Jan Nieuwenhuijs at The Gold Observer estimates that China purchased 570 tonnes of gold through unofficial channels last year, with their total holdings close to 5,000 tonnes compared to the 2,280 tonnes in official figures.

Conclusion

We are long-term bullish on gold while the dollar-based global financial system weakens due to excessive government debt and steep fiscal deficits.

The false break below $3,000 warns of a bear trap. Recovery above $3,050 per ounce would confirm a short-term target of $3,150.

Acknowledgments

- Jan Nieuwenhuijs, The Gold Observer: China’s Gold Reserves Going Through the Roof

- WGC, GoldHub: Central Bank Gold Reserves

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.

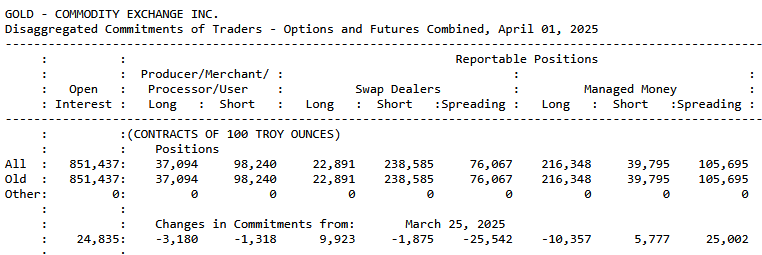

Doesn’t the current Commitment of Traders indicate a bearish outlook for gold by the smart money Commercials?

The long-term uptrend is due to physical outflows of gold from London and Zurich to mainly China, creating a shortage in Western markets.

The COT may influence the short-term, however, most short positions are held by swap dealers who seem to be covering.