Real GDP for the September quarter reflects an annual growth rate of 2.9% for the US, well below the Atlanta Fed GDPNow estimate of 5.4%. Growth in weekly hours worked declined to 1.5% for the 12 months ended September, indicating that GDP is likely to slow further in the fourth quarter.

New Orders

Manufacturers’ new orders for durable goods, adjusted for inflation, shows signs of strengthening.

Transport

Transport indicators show a long-term down-trend but truck tonnage has grown since May 2023.

Container (intermodal) rail freight likewise grew for several months but then turned down in August..

Growth in weekly payrolls of transport and warehousing employees slowed to an annual rate of 3.6% in September but remains positive.

Consumer Cyclical

Light vehicle sales continue to trend higher, suggesting consumer confidence.

Housing

New housing starts (purple) have been trending lower since their peak in 2022 but new permits (green) are now strengthening.

New single family houses sold are trending higher.

Despite a steep rise in mortgage rates. In a strange twist, higher rates have reduced the turnover of existing homes on the market, with owners reluctant to give up their low fixed rate mortgages. Low supply of existing homes has boosted sales of new homes, lifting employment in residential construction.

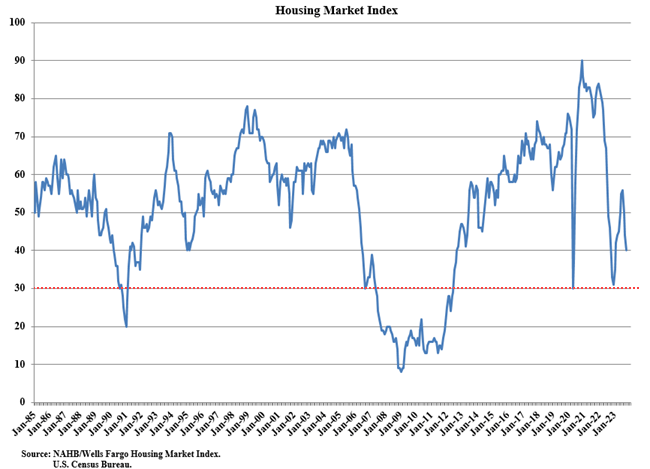

The National Association of Home Builders Housing Market Index (HMI), however, reflects falling sentiment — likely to be followed by declining new home sales and housing starts.

HMI is a weighted average of three separate component indices. A monthly survey of NAHB members asks respondents to rate market conditions for the sale of new homes at the present time; sales in the next six months; and the traffic of prospective buyers. (NAHB)

Financial Markets

The ratio of bank loans and leases to GDP declined to 0.44 in the third quarter but remains elevated compared to levels prior to 2000.

The cause of ballooning debt is not hard to find, with negative real interest rates for large parts of the past two decades.

Now real rates are again positive and money supply is contracting relative to GDP, the days of easy credit are at an end. A significant contraction of credit is likely unless the Fed intervenes, either by cutting rates or expanding its balance sheet to inject more liquidity into the system.

Commercial banks continued to raise lending standards in Q3, making credit less accessible.

Conclusion

This is not a normal market cycle and investors need to be prepared for sudden shifts in financial markets.

The US economy is slowing but cyclical elements like light vehicle sales and new home sales are holding up well.

The rise in long-term Treasury yields, however, is likely to cause a sharp credit contraction if the Fed does not intervene by cutting rates or expanding its balance sheet (QE).

The Fed is reluctant to intervene because this would undermine their efforts to curb inflation. But they may be forced to if there is a credit event that unsettles financial markets.

Fed intervention is unlikely without a steep rise in credit spreads. But would be especially bullish for Gold.