Tech stocks fell sharply, with the Nasdaq 100 closing below support at 7400, warning of a correction. Twiggs Money Flow (21-day) cross below zero indicates medium-term selling pressure. Follow-through of the index below 7300 would signal a correction to test 7000.

The S&P 500 has so far respected support at 2870. Breach would confirm a broad market correction and test the rising LT trendline at 2800.

Asia

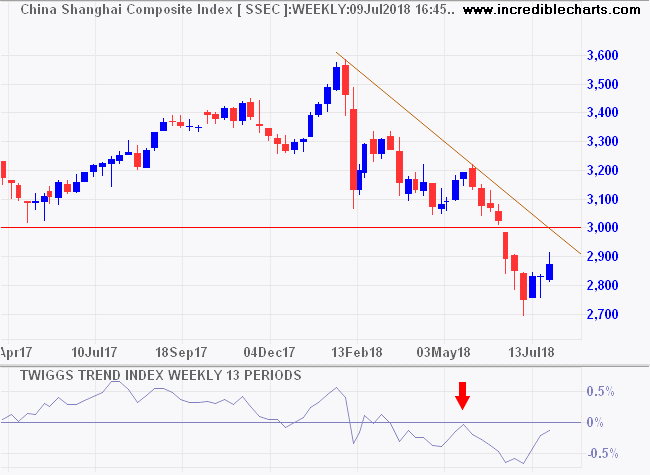

In China, the Shanghai Composite Index is headed for another test of primary support at 2650. Trend Index peaks at/below zero indicate long-term selling pressure. Breach of 2650 would offer a long-term target of 2000, the 2014 low.

India’s Nifty is undergoing a strong correction. Breach of support at 10,000 would warn of a primary down-trend.

Europe

Dow Jones Euro Stoxx 50 is again testing primary support at 3300. A Trend Index peak at zero warns of mounting selling pressure. Breach of 3300 would warn of a primary decline, with a target of 3000.

The Footsie is also testing primary support, at 7250, but a recovering Trend Index indicates buying pressure.

Rising US interest rates are already hurting developing economies like India and China, and a looming US-China trade war would threaten a global contraction.

Only when the tide goes out do you discover who’s been swimming naked.

~ Warren Buffett