Caroline Baum’s opinion on the Fed’s approach to inflation:

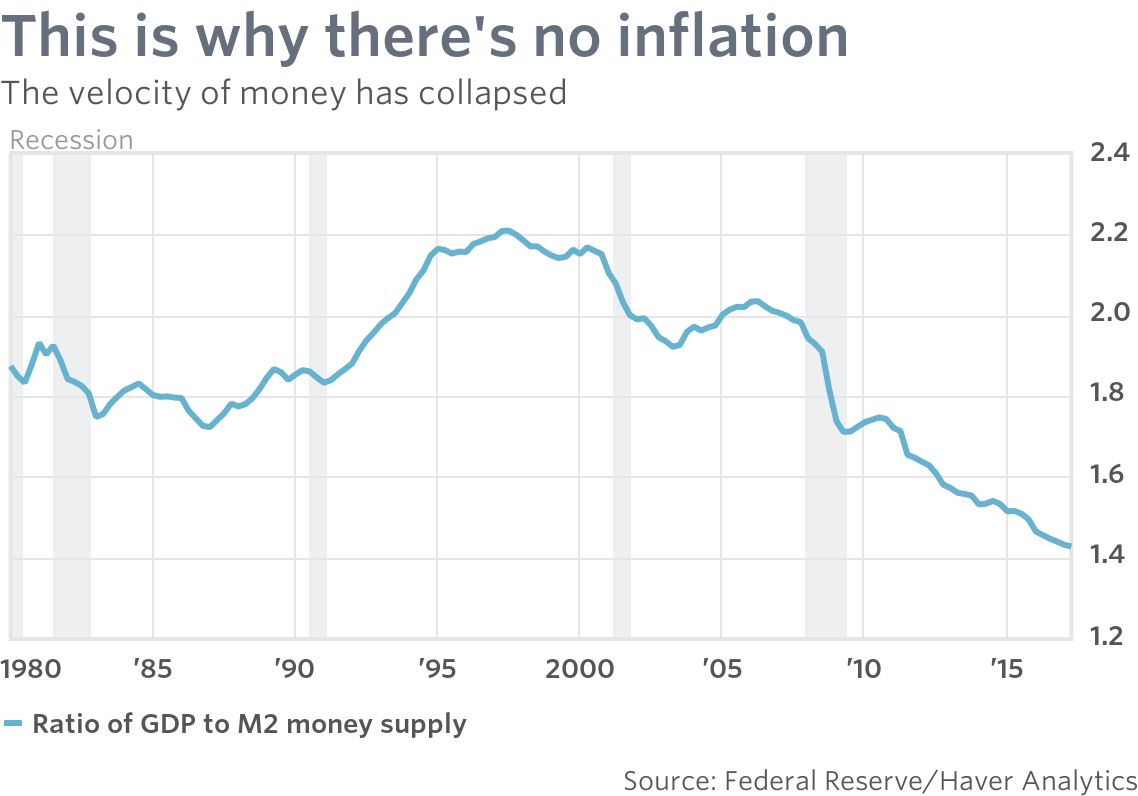

For all the sturm und drang about the Fed debasing the dollar and sowing the seeds of the next great inflation, the public’s demand for money has increased. The increased desire to hold cash and checkable deposits has risen to meet the increased supply. Velocity, or the rate at which money turns over, has plummeted.

The Fed has two choices. It can adopt the Dr. Strangelove approach and learn to stop worrying and live with low inflation and low unemployment. Or it can do something about it, which runs counter to its stated intention to raise the funds rate and reduce the size of its balance sheet.

Option #1 involves learning to live with a low, stable inflation rate about 0.5 percentage point below the Fed’s explicit 2% target.

Not only has the Fed has achieved price stability in objective terms, but it has also fulfilled former Fed Chairman Alan Greenspan’s subjective definition of price stability: a rate of inflation low enough that it is not a factor in business or household decision-making.

Option #2 means taking some additional actions to increase the money supply by lowering interest rates or resuming bond purchases. The Fed is taking the opposite approach. It began its balance sheet normalization this month, allowing $10 billion of securities to mature each month and gradually increasing the amount every quarter. And it has guided markets to expect another 25-basis-point rate increase in December….

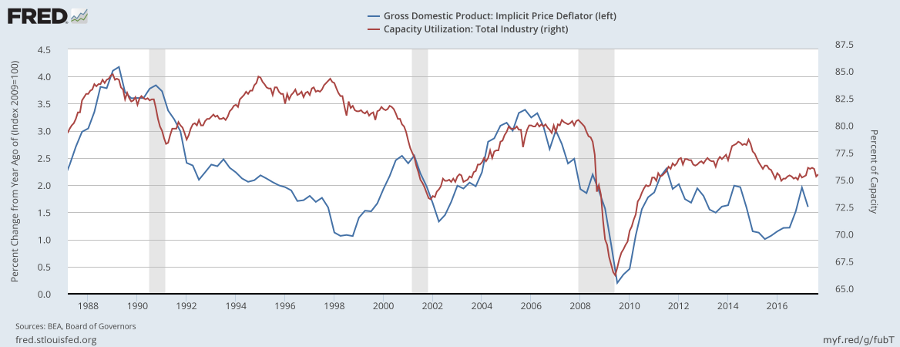

The Fed faces a delicate balancing act. Unemployment is low but capacity utilization is also low, indicating an absence of inflationary pressure.

Janet Yellen understandably wants to normalize interest rates ahead of the next recession but she can afford to take her time. The economy is unlikely to tip into recession unless the Fed hikes rates too quickly, causing a monetary contraction.

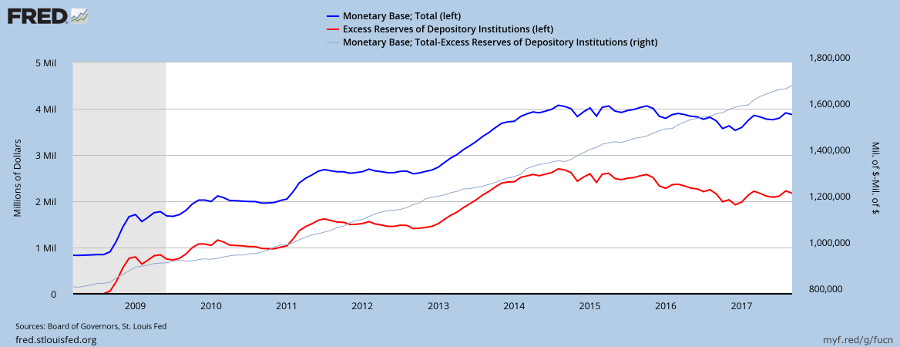

I believe the Fed chair is relying on the outflow from more than $2 trillion of excess reserves held by banks on deposit with the Fed to offset the contractionary effect of any rate hikes.

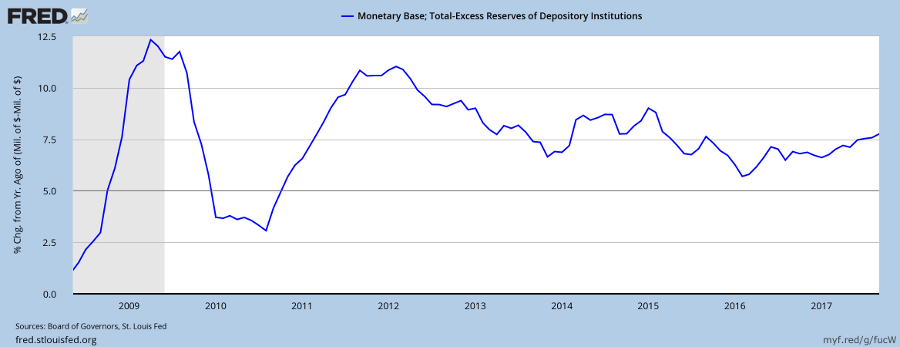

If pushed, the Fed could lower the interest rate paid on excess reserves in order to encourage banks to withdraw excess deposits. But so far this hasn’t been necessary. The attraction of higher interest rates in financial markets has been sufficient to encourage a steady outflow from excess reserves, keeping the monetary base (net of reserves) growing at a steady clip of close to 7.5% p.a. despite rate hikes so far.

Makes you wonder why Donald Trump would even consider replacing the Fed chair when she is doing a great job of managing the recovery.

Source: Fed flunks econ 101: understanding inflation – MarketWatch

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.