First of the financial heavyweights to report first-quarter (Q1) earnings this week, JP Morgan (JPM) reported a 7 percent fall in earnings per share ($1.36) compared to the first quarter of last year ($1.46). The fall was largely attributable to a 90 percent increase in provision for credit losses for the quarter, to $1.8 billion, primarily from a sharp increase in net charge-offs in the Consumer division but also exposure to Oil & Gas and Metals & Mining in Investment Banking.

Tier 1 Capital (CET1) improved to 11.8% (Q1 2015: 10.7%) of risk-weighted assets, while Leverage (SLR) improved to 6.6% (Q1 2015: 5.7%).

The dividend was held at 44 cents (Q1 2015: 40 cents), increasing the payout ratio to a modest 32% from 27% in Q1 2015.

The monthly chart shows long-term Momentum is slowing, with JPM forming a broad top above $54. Declining peaks since August 2015 warn of a primary down-trend and breach of $54 would confirm, offering a target of $40*.

* Target calculation: 55 – ( 70 – 55 ) = 40

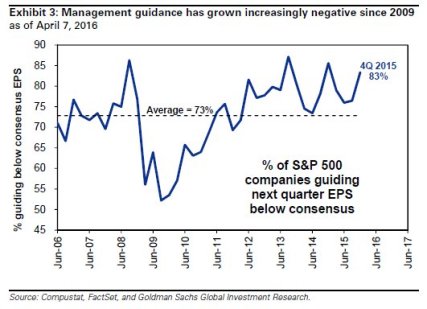

The market responded well to ‘positive’ news that JPM beat its earnings estimate, boosting the stock by 4.6%. This is a game we will see a lot more of this year: give really low guidance if you expect a bad quarter. When the result comes out, the gullible will focus on the fact that you beat your estimate rather than that your earnings are falling. This chart from Zero Hedge shows the rising percentage of companies guiding next quarter earnings below consensus:

Don’t be mis-led by the latest ‘froth’. The reality for the banking sector is net interest margins are near record lows and credit losses are rising.

Bullish in 2015:

– Rising earnings

– Falling oil

– Rate hikesBullish in 2016:

– Falling earnings

– Rising oil

– No rate hikes— Northy (@NorthmanTrader) April 11, 2016