Key Points

- Australia has roughly one month of emergency reserves of petrol, diesel, and gasoline.

- Iranian attacks will likely lead to supply shortages and steep price hikes in food, commodities, and air travel.

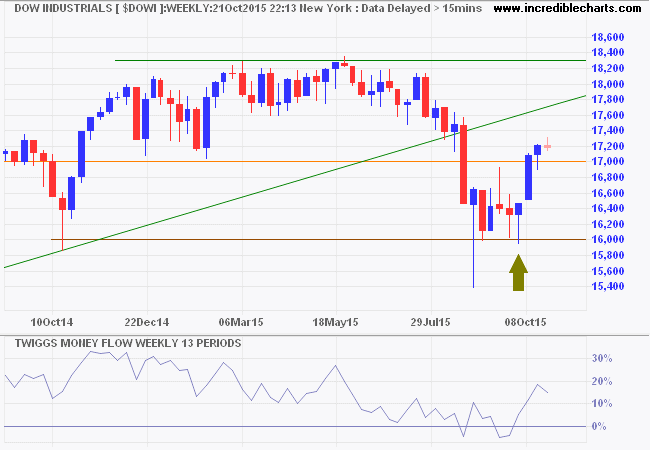

Brent crude futures (May ’26) are testing resistance at $85 per barrel. A breakout will likely offer a short-term target of $90.

March 5 (Reuters) – More tankers came under attack in Gulf waters on Thursday as the U.S.–Iran war escalated, and Iranian drones entered Azerbaijan, threatening to spread the crisis to more oil producers in the region.

A Bahamas-flagged crude oil tanker was targeted by an Iranian remote-controlled boat laden with explosives while anchored near Iraq’s Khor al Zubair port, according to initial assessments. A second tanker at anchor off Kuwait was taking on water and spilling oil after a large explosion on its port side.

Nine vessels have come under attack since the conflict broke out between the U.S., Israel and Iran on Saturday. Iran launched a wave of missiles at Israel early on Thursday and also sent drones into Azerbaijan, injuring four people.

….Around 200 ships, including oil and liquefied natural gas tankers as well as cargo ships, remained at anchor in open waters off the coast of major Gulf producers, according to Reuters estimates based on ship-tracking data from the MarineTraffic platform.

Hundreds of other vessels remained outside the Strait of Hormuz unable to reach ports, shipping data showed.

Australian Energy Minister Chris Bowen said on Tuesday that Australia has 36 days of petrol, 34 days of diesel, and 32 days of jet fuel in reserve. While Bowen stressed this was the highest level in more than a decade, it’s far below the International Energy Agency recommendation of 90 days.

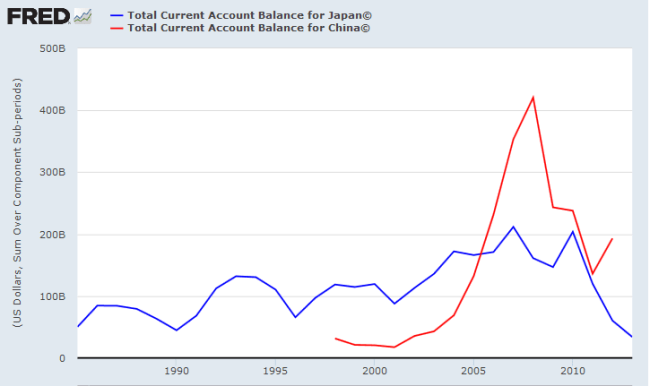

Compare that to Japan, which is similarly reliant on crude oil from the Middle East and holds emergency oil reserves equivalent to 254 days of consumption. (Reuters)

Ongoing shortages caused by even partial closure of the Strait of Hormuz could lead to fuel rationing in Australia.

Major industries that are heavily reliant on diesel fuel include long-haul road transport, agriculture, and mining. Iron ore operations in the Pilbara region, a major earner of export revenue, alone consume hundreds of millions of liters of diesel each year. (Reuters)

The aviation industry is also vulnerable to fuel shortages. Jet fuel prices in Asia’s trading hub Singapore climbed to $225.44 a barrel on Wednesday, a record high.

The spot price of jet kerosene has now gained 140% since the close of $93.45 a barrel on February 27, the day before the United States and Israel launched an aerial bombing campaign against Iran.

The problem is that much of the oil shipped through the Strait of Hormuz is medium-sour crude, a grade prized for its higher yield of middle distillates such as jet kerosene and diesel.

Even if refiners can source alternative crudes from Africa or South America, these grades tend to be lighter and yield more light distillates such as gasoline and naphtha. (Reuters)

The Dow Jones Global Oil & Gas Index has climbed 20% since mid-January.

Conclusion

Japan and China have large emergency stockpiles of crude and LNG and can probably survive several months of supply interruptions.

India, Australia, and Europe do not have that luxury and will likely suffer from a steep spike in prices and possible fuel rationing if the Strait of Hormuz remains closed.

In Australia, we expect food prices to jump if the price of diesel, used in agriculture and long-haul freight, rises. Mining costs will also likely rise due to diesel shortages, driving up the cost of materials.

Global aviation is also vulnerable because of the steep rise in jet fuel prices.

Acknowledgments

- Reuters: Australia tells consumers no need to panic buy petrol over Iran war as stocks high

- Reuters: More tankers come under attack as US-Iran conflict spreads in the region

- Reuters: Japan’s Middle East energy dependency – and how it mitigates shocks

- Reuters: Jet fuel’s huge price surge points to coming pain from Iran war

- CNBC: ICE May ’26 Brent Crude Futures

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.