The interest rate outlook is softening, with Fed chairman Jerome Powell hinting at rate cuts in his Wednesday testimony to Congress:

“Our baseline outlook is for economic growth to remain solid, labor markets to remain strong and inflation to move back over time.”

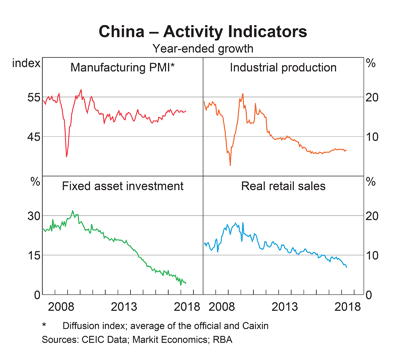

but…. “Uncertainties about the outlook have increased in recent months. In particular, economic momentum appears to have slowed in some major foreign economies and that weakness could affect the US economy.”

Stephen Bartholomeusz at The Sydney Morning Herald comments:

“Perhaps the most disturbing aspect of the Fed shifting into an easing cycle before there is strong evidence to warrant it, is economies already stuck in high debt and low growth environments will be forced even deeper into the kind of policies that in Japan have produced more than 30 years of economic winter with no apparent escape route.”

If the Fed moves too early they could further damage global growth, with long-term consequences for US stocks. But markets are salivating at the anticipated sugar hit from lower rates. Stocks surged in response to Powell’s speech, with the S&P 500 breaking resistance at 3000. A rising Trend Index indicates buying pressure.

The argument for higher stock prices is that lower interest rates may stave off a recession. The chart below shows how recessions (gray bars) are normally preceded by rising interest rates (green) followed by sharp cuts when employment growth (blue) starts to fall.

Rate cuts themselves are not a recession warning, unless accompanied by declining employment growth. Otherwise, as in 1998 when there was minimal impact on employment, the economy may recover. Falling employment growth is, I believe, the most reliable recession warning. So far, the decline in growth has been modest but should be monitored closely.

Falling employment is why recessions tend to lag an inverted yield curve (negative 10-year minus 3-month Treasury yield spread) by up to 18 months. The negative yield curve is a reliable warning of recessions only because it reflects the Fed response to rising inflation and then falling employment.

Valuations

A forward Price-Earnings ratio of 19.08 at the end of June 2019 warned that stocks are highly priced relative to forecast earnings. The forward PE jumped to 19.55 by Friday — an even stronger warning.

June 2019 trailing Price-Earnings ratio at 21.52 warned that stock prices are dangerously high when compared to the 1929 and 1987 peaks preceding major crashes. That has now jumped to 22.04.

The only factor that could support such a high earnings multiple is unusually strong earnings growth.

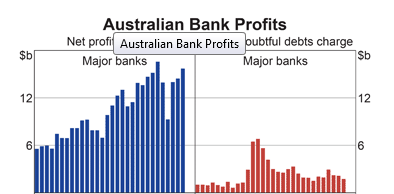

But real corporate earnings are declining. Corporate profits, before tax and adjusted for inflation, are below 2006 levels and falling. There are still exceptional stocks that show real growth but they are counter-balanced by negative real growth in other stocks.

Impossible, you may argue, given rising earnings for the S&P 500.

There are three key differences that contribute to earnings per share growth for the S&P 500:

- Inflation;

- Taxes; and

- Stock Buybacks.

Inflation is fairly steady at 2.0%.

Quarterly tax rates declined from 25% in Q3 2017 to 13.22% in Q4 2018 (source: S&P Dow Jones Indices).

Stock buybacks are climbing. The buyback yield for the S&P 500 rose to 3.83% in Q4 2018 (source: S&P Dow Jones Indices).

The 2017 Tax Cuts and Jobs Act caused a surge in repatriation of offshore cash holdings — estimated at almost $3 trillion — by multinationals. And a corresponding increase in stock buybacks.

In summary, the 2018 surge in S&P 500 earnings is largely attributable to tax cuts and Q1 2019 is boosted by a surge in stock buybacks in the preceding quarter.

Buybacks plus dividends exceed current earnings and are unsustainable in the long run. When the buyback rate falls, and without further tax cuts, earnings growth is going to be hard to find. Like the emperor’s new clothes.

It’s a good time to be cautious.

“Only when the tide goes out do you discover who’s been swimming naked”.

~ Warren Buffett