Ten-year Treasury yields tested support at 4.25% yesterday before rallying to 4.35%. Breakout above 4.35% would suggest a stronger move to test 4.50%.

The Dollar index surged in response and is likely to test resistance at 103.

Gold weakened slightly, to $2040 per ounce.

Long-term View

Jim Bianco thinks we are headed for 5.5% yield on 10-Year Treasuries by mid-2024. He says that the 10-year yield should match nominal GDP growth:

- No recession next year

- Inflation bottoms around 3%

- Real growth of 2% to 3%

- That gives nominal growth of 5.0% to 6.0%.

Growth

Nominal GDP growth ticked up to 6.3% for the 12 months to September, but the long-term trend is downward.

Growth in Aggregate weekly hours worked declined to 1.1% for the 12 months to October — a good indicator of real growth.

Continued unemployment claims are climbing, suggesting that (real) growth will slow further in the months ahead.

Inflation

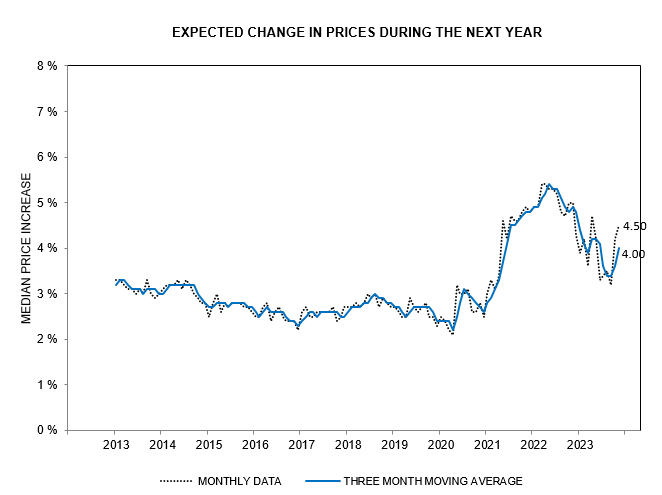

The other component of nominal GDP growth is inflation, where five-year consumer expectations (from the University of Michigan survey) have climbed to above 3.0%.

However, core PCE inflation (orange) and trimmed mean PCE (red) are both trending lower.

Services PCE inflation (brown below) is also trending lower but likely to prove more difficult to subdue.

Real Interest Rate

Jim Bianco suggests that nominal GDP growth will fall to between 5.0% and 6.0% in 2024 — a good approximate of return on new investment — while the 10-year yield will rise to a similar level. This represents a neutral rate of interest that is unlikely to fuel further inflation.

Inflation builds when the 10-year yield exceeds GDP growth by a wide margin. The long-term chart below shows how PCE inflation (red) climbs when 10-year Treasury yields minus GDP growth (purple) fall near -5.0%. Inflation also falls sharply when the purple line rises above 5.0%, normally during a recession when GDP growth is negative.

Conclusion

Jim Bianco’s premise of 10-year yields at 5.5% is based on the expectation that the Fed will maintain neutral real interest rates in order to tame inflation. Whether the Fed will be able to achieve this is questionable.

Japan and China have stopped investing in Treasuries, commercial banks are net sellers, and the private sector does not have the capacity to absorb growing Treasury issuance to fund federal deficits. That leaves the Fed as buyer of last resort.

The Fed may be forced to intervene in the Treasury market, keeping a lid on long-term yields while expanding the money supply. The likely result will be higher inflation and a weaker Dollar, both of which are bullish for Gold.

Acknowledgements

- CNBC/Jim Bianco: 10-Year Treasury yield to rebound to 5.5%

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.