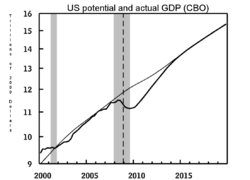

GDP failed to rebound after the 2008 Financial Crisis, sinking into a period of stubborn low growth. Economic commentators have advanced many explanations for the causes, while the consensus seems to be that this is the new normal, with the global economy destined to decades of poor growth.

This is a classic case of recency bias. Where observers attach the most value to recent observations and assume that the current state of affairs will continue for the foreseeable future. The inverse of the Dow 100,000 projections during the Dotcom bubble.

Real GDP for Q1 2018 recorded 2.9% growth over the last 4 quarters. Not exactly shooting the lights out, but is the recent up-trend likely to continue?

Neils Jensen from Absolute Return Partners does a good job of summarizing the arguments for low growth in his latest newsletter:

The bear story

Putting my (very) long-term bearishness on fossil fuels aside for a moment, there is also a bear story with the potential to unfold in the short to medium-term, but that bear story is a very different one. It is a story about GDP growth likely to suffer as a consequence of the oil industry’s insatiable appetite for working capital, which is presumably a function of the low hanging fruit having been picked already.

In the US today, the oil industry ties up 31 times more capital per barrel of oil produced than it did in 1980, when we came out of the second oil crisis. ….Such a hefty capital requirement is a significant tax on economic growth. Think of it the following way. Capital is a major driver of productivity growth, which again is a key driver of economic growth. Capital tied up by the oil industry cannot be used to enhance productivity elsewhere, i.e. overall productivity growth suffers as more and more capital is ‘confiscated’ by the oil industry.

I am tempted to remind you (yet again!) of one of the most important equations in the world of economics:

∆GDP = ∆Workforce + ∆Productivity

We already know that the workforce will decline in many countries in the years to come; hence productivity growth is the only solution to a world drowning in debt, if that debt is to be serviced. Why? Because we need economic growth to be able to service all that debt.

Now, if productivity growth is going to suffer for years to come, all this fancy new stuff that we all count on to save our bacon (advanced robotics, artificial intelligence, etc.) may never be fully taken advantage of, because the money needed to make it happen won’t be there. It is not a given but certainly a risk that shouldn’t be ignored.

….For that reason, we need to retire fossil fuels as quickly as possible. Ageing of society (older workers are less productive than their younger peers) and a global economy drowning in debt (servicing all that debt is immensely expensive, leaving less capital for productivity enhancing purposes) are widely perceived to be the two most important reasons why productivity growth is so pedestrian at present.

I am not about to tell you that those two reasons are not important. They certainly are. However, the adverse impact the oil industry is having on overall productivity should not be underestimated.

I tend to take a simpler view, where I equate changes in GDP to changes in hours worked and in capital investment:

∆GDP = ∆Workforce + ∆Capital

Workers work harder if they are motivated or if there is a more efficient organizational structure, but these are a secondary influence on productivity when compared to capital investment.

The chart below compares net capital formation by the corporate sector (over GDP) to real GDP growth. It is evident that GDP growth rises and falls in line with net capital formation (or investment as it is loosely termed) by corporations.

A quick primer (with help from Wikipedia):

- Capital Formation measures net additions to the capital stock of a country.

- Capital refers to physical (or tangible) assets and includes plant and equipment, computer software, inventories and real estate. Any non-financial asset used in the production of goods or services.

- Capital does not include financial assets such as bonds and stocks.

- Net Capital Formation makes allowance for depreciation of the existing capital stock due to wear and tear, obsolescence, etc.

Net Capital Formation peaked at around 5.0% from the mid-1960s to the mid-1980s, made a brief recovery to 4.0% during the Dotcom bubble and has since struggled to make the bar at 3.0%. Rather like me doing chin-ups.

There are a number of factors contributing to this.

Intangible Assets

Capital formation only measures tangible assets. The last two decades have seen a massive surge in investment in intangible assets. Look no further than the big five on the Nasdaq:

| Stock | Symbol | Price ($) | Book Value ($) | Times Book Value |

|---|---|---|---|---|

| Amazon | AMZN | 1582.26 | 64.85 | 24.40 |

| Microsoft | MSFT | 95.00 | 10.32 | 9.21 |

| FB | 173.86 | 26.83 | 6.48 | |

| Apple | AAPL | 169.10 | 27.60 | 6.12 |

| Alphabet | GOOGL | 1040.75 | 235.46 | 4.42 |

Currency Manipulation

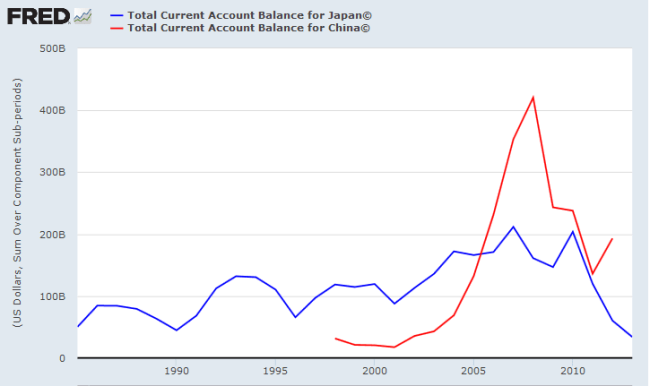

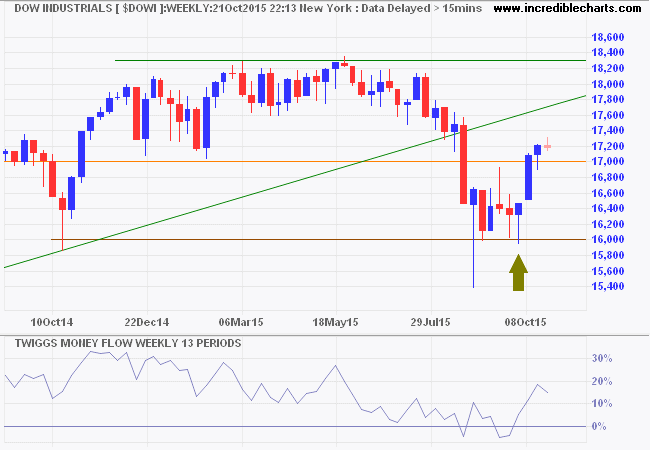

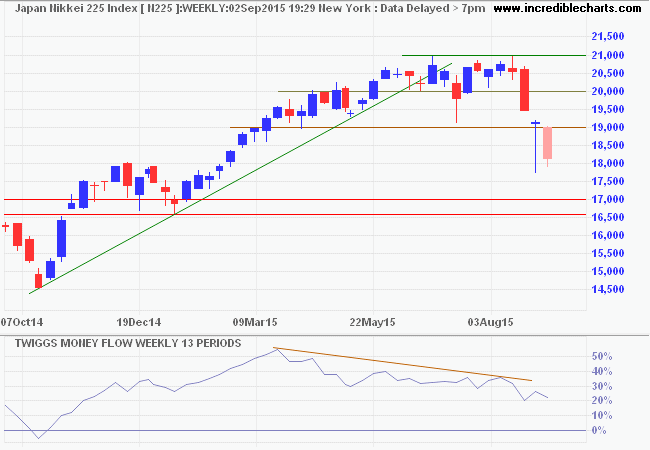

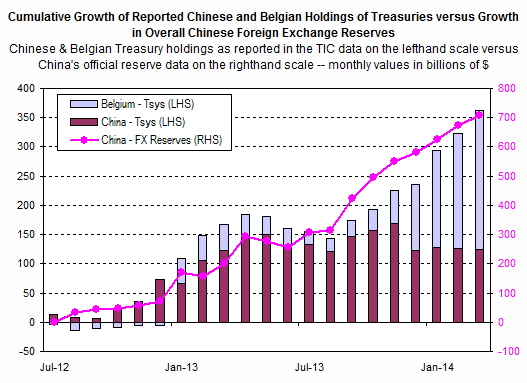

Capital formation first fell off the cliff in the 1980s. This coincides with the growth of currency manipulation by Japan, purchasing excessive US foreign reserves to suppress the Yen and establish a trade advantage over US manufacturers. China joined the party in the late 1990s, exceeding Japan’s current account surplus by 2006. Currency suppression creates another incentive for corporations to offshore or outsource manufacturing to Asia.

Tax on Offshore Profits

Many large corporations took advantage of low tax rates in offshore havens such as Ireland, avoiding US taxes while the funds were held offshore. This created an incentive for large corporations to invest retained earnings offshore rather than in the USA.

The net effect has been that retained earnings are invested elsewhere, while new capital formation in the USA is almost entirely funded by debt.

Donald Trump’s tax deal will make a dent in this but will not undo past damage. The horse has already bolted.

Offshore Manufacturing

Apart from tax incentives, lower labor costs (enhanced by currency manipulation) led large corporations to set up or outsource manufacturing to Asia and other developing countries. In effect, offshoring capital formation and — more importantly — GDP growth to foreign destinations.

Offshoring Jobs

Along with manufacturing plants, blue-collar jobs also moved offshore. While this may improve the company bottom-line for a few years, the long-term, macro effects are devastating.

Think of it this way. If you build a manufacturing plant offshore rather than in the USA you may save millions of dollars a year in labor costs. Great for the bottom line and executive bonuses. But one man’s wage is another man/woman’s income (when he/she spends it). So, from a macro perspective, the US loses GDP equal to the entire factory wages bill plus the wage component of any input costs. A far larger figure than the company’s savings. As more companies offshore jobs, sales growth in the USA is affected. In the end this is likely to more than offset the savings that justified the offshore move in the first place.

Stock Buybacks

Stock buybacks accelerate EPS (earnings per share) growth and are great for boosting stock prices and executive bonuses. But they create the illusion of growth while GDP stands still. There is no new capital formation.

Can GDP Growth Recover?

Yes. Restore capital formation and GDP growth will recover.

How to do this:

Trump has already made an important move, revising tax laws to encourage corporations to repatriate offshore funds.

But more needs to be done to create a level playing field.

Stop currency manipulation and theft of technology by developing countries, especially China. Trump has also signaled his intention to tackle this thorny issue.

Repatriating offshore manufacturing and jobs is a much more difficult task. You can’t just pack a factory in a box and ship it home. There is also the matter of lost skills in the local workforce. But manufacturing jobs are being lost globally at an alarming rate to new technology. In the long-term, offshore manufacturing plants will be made obsolete and replaced by new automated, high-tech manufacturing facilities. Incentives need to be created to encourage new capital formation, especially high-tech manufacturing, at home.

Stock buybacks, I suspect, will always be around. But remove the incentive to boost stock prices by targeting the structure of executive bonuses. It would be difficult to isolate benefits from stock buybacks and tax them directly. But removing tax on dividends — in my opinion far simpler and more effective than the dividend imputation system in Australia — would remove the incentive for stock buybacks and make it difficult for management to justify this action to investors.

We already seem to be moving in the right direction. The last two points are relatively easy when compared to the first two. If Donald Trump manages to pull them (the first two) off, he will already move sharply upward in my estimation.

Judge a tree by the fruit it bears.

~ Matthew 7:15–20

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.