Citigroup (C) was the last of the bank heavyweights to release their first-quarter (Q1) 2016 earnings this week, reporting a sharp 27 percent fall in diluted earnings per share ($1.10) compared to the first quarter of last year ($1.51).

Revenues (net of interest) dropped 11% while non-interest expenses reduced by 3%. There was a modest 7% increase in the provision for credit losses (including benefits and claims). The fall in net revenues was largely attributable to a 27% decline in institutional business from Europe, Middle East & Africa (EMEA) and an 8% decline in North America. Consumer business also dropped in Latin America (13%) and Asia (9%).

Tier 1 Capital (CET1) improved to 12.3% (Q1 2015: 11.1%) of risk-weighted assets, while Leverage (SLR) improved to 7.4% (Q1 2015: 6.4%).

The dividend was held at 5 cents (Q1 2015: 5 cents), increasing the payout ratio to a parsimonious 5%, from 3% in Q1 2015.

C is in a primary down-trend, having broken primary support at $48. Long-term Momentum below zero confirms. Expect a rally to test resistance at $48 but respect is likely and would warn of another test of the band of primary support at $34 to $36. Breach would offer a target of the 2011 low at $24*.

* Target calculation: 36 – ( 48 – 36 ) = 24

We have had four heavyweights, JPM, BAC, WFC and C, all report declining earnings per share. Most had cut non-interest expenses but insufficient to compensate for falling revenues and rising provisions for credit losses.

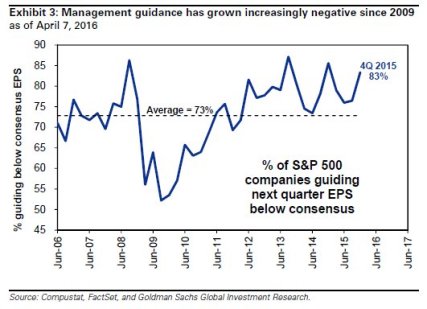

It looks like we are on track for a tough earnings season.