The S&P 500 climbed to a new high after breaking resistance at its January ’22 high of 4800. Rising Trend Index troughs warn of strong buying pressure. Pricing seems to be losing touch with reality.

The S&P 500 Price-Earnings ratio climbed to 24.2 on December 31st and is forecast to reach 24.9 at the end of the quarter (based on the current index price and forecast Q1 earnings). The chart below shows the pricing history of the index (and its predecessors) over the past 120 years. We use highest trailing earnings to eliminate distortion caused by sharp falls in earnings during past recessions. Prior to the Dotcom bubble, PE had never exceeded 20 times earnings — even during the heady booms preceding the Black Friday crash in 1929 and Black Monday in 1987. The long-term average PE of 16.5 (since 1973) suggests that the index is currently over-priced by close to 50%.

The price-to-sales ratio of 2.57 shows a similar excess compared to the average of 1.70.

The operating margin of 11.0% in the December quarter has declined from its 2021 peak at 13.5% but is still above its 10-year average of 10.2%. We expect margins to revert to the mean over the next year or two.

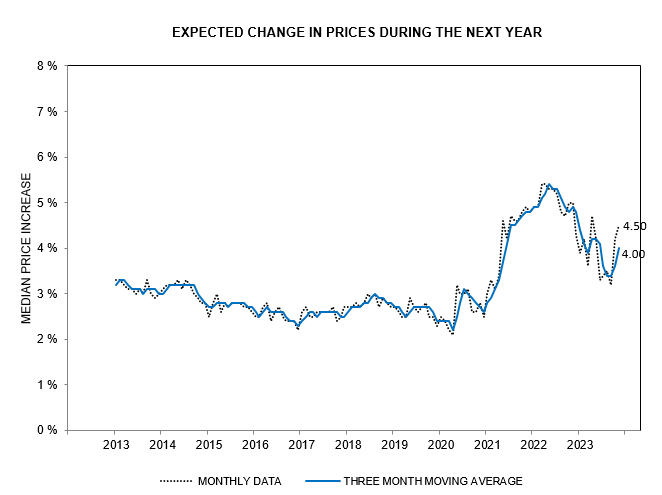

While margins are still reasonably healthy, annual sales growth plunged to 4.0% in the December quarter. Core PCE inflation of 2.9% in 2023 means that real growth in sales was a paltry 1.1% last year.

Conclusion

The S&P 500 is over-priced relative to earnings and sales growth, with long-term intrinsic value estimated at 3200 — roughly two-thirds of the current price. If the Fed continues to inject liquidity to support financial markets ahead of the November elections, we do not expect a major correction in 2024 — bar a major geopolitical event that impacts on energy prices.

The following year is likely to prove more difficult, however, with the Fed draining liquidity to ease underlying inflationary pressure and Treasury increasing issuance of notes and bonds, driving up long-term yields.

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.