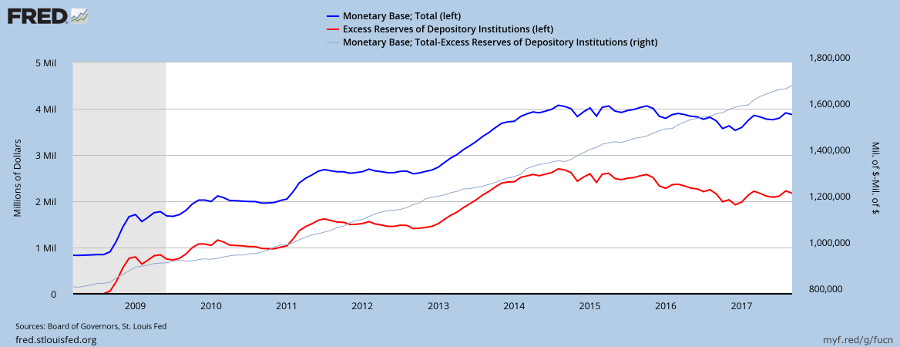

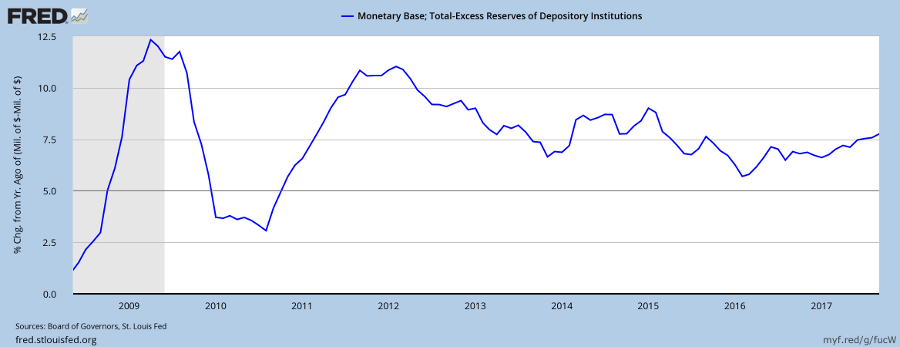

The Federal Reserve last year announced plans to shrink its balance sheet which had grown to $4.5 trillion under the quantitative easing (QE) program.

According to its June 2017 Normalization Plan, the Fed will scale back reinvestment at the rate of $10 billion per month and step this up every 3 months by a further $10 billion per month until it reaches a total of $50 billion per month in 2019. That means that $100 billion will be withheld in the first year and $200 billion each year thereafter.

How will this impact on financial markets? Here are a few clues.

First, from the Nikkei Asian Review on January 11:

The yield on the benchmark 10-year U.S. Treasury note shot to a 10-month high of 2.59% in London, before retreating later in the day and ending roughly unchanged in New York. Yields rise when bonds are sold.

The selling was sparked by reports that China may halt or slow down its purchases of U.S. Treasury holdings. China has the world’s largest foreign exchange reserves — holding $3.1 trillion, about 40% of which is in U.S. government notes, according to Brad Setser, senior fellow at the Council on Foreign Relations.

Chinese officials, as expected, denied the reports. But they would have to be pondering what to do with more than a trillion dollars of US Treasuries during a bond bear market.

Treasury yields are rising, with the 10-year yield breaking through resistance at 2.60%, signaling a primary up-trend.

On the quarterly chart, 10-year yields have broken clear of the long-term trend channel drawn at 2 standard deviations, warning of reversal of the three-decade-long secular trend. But final confirmation will only come from a breakout above 3.0%, completing a large double-bottom.

Withdrawal or a slow-down of US Treasury purchases by foreign buyers (let’s not call them investors – they have other motives) would cause the Dollar to weaken. The Dollar Index recently broke support at 91, signaling another primary decline.

The falling Dollar has created a bull market for gold which is likely to continue while interest rates are low.

US equities are likely to benefit from the falling Dollar. Domestic manufacturers can compete more effectively in both local and export markets, while the weaker Dollar will boost offshore earnings of multinationals.

The S&P 500 is headed for a test of its long-term target at 3000*.

Target: 1500 x 2 = 3000

Emerging market borrowers may also benefit from lower domestic servicing costs on Dollar-denominated loans.

Bridgewater CEO Ray Dalio at Davos:

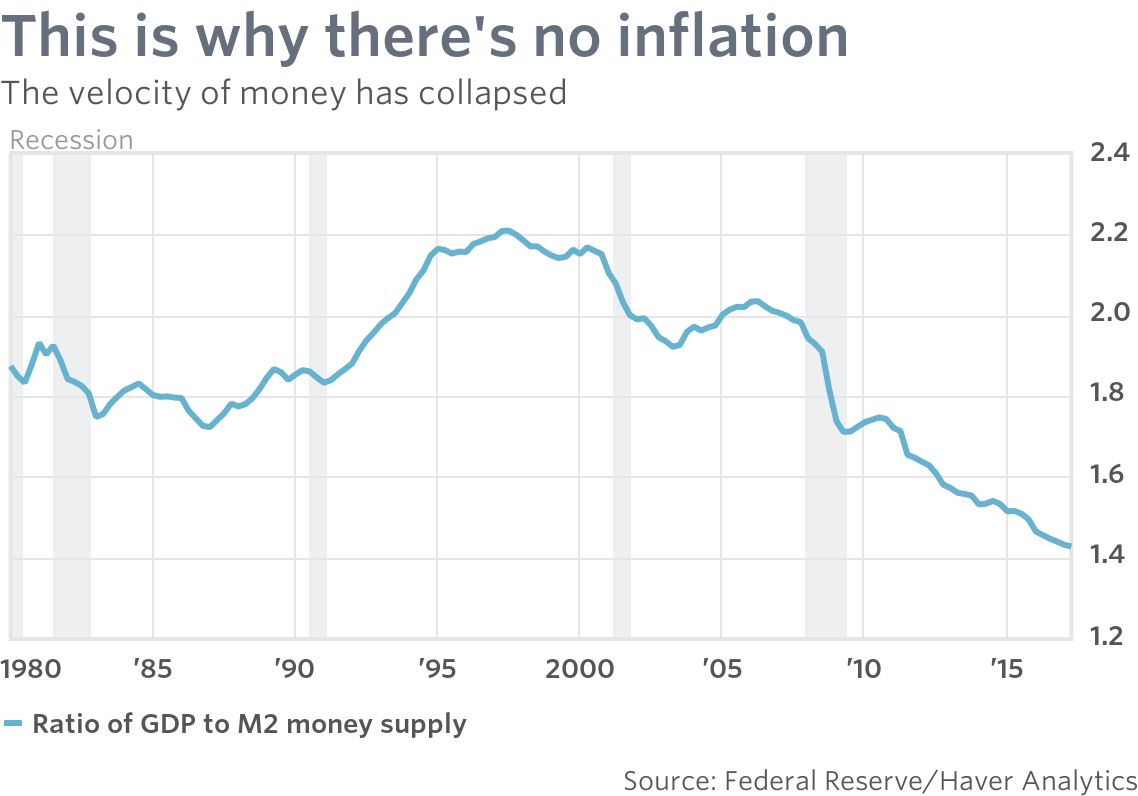

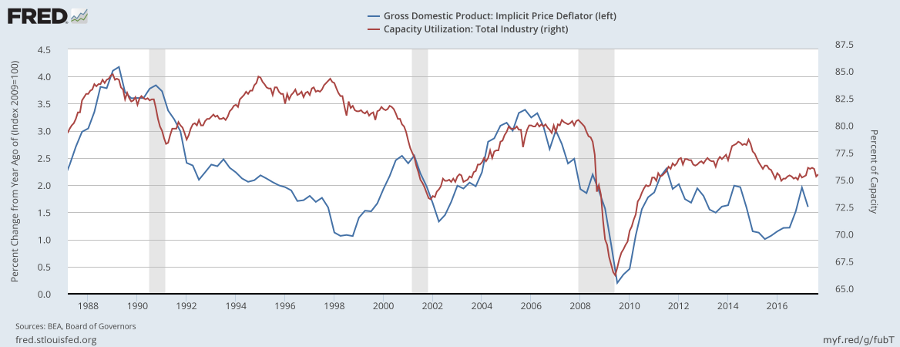

We are in this Goldilocks period right now. Inflation isn’t a problem. Growth is good, everything is pretty good with a big jolt of stimulation coming from changes in tax laws…

If there is a downside, it is likely to be higher US inflation as employment surges and commodity prices rise. Which would force the Fed to raise interest rates faster than the market expects.

Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.

You must be logged in to post a comment.