If we don’t learn from the mistakes of the past we will be destined to repeat them (George Santayana). Looking back over the last three decades gives an inkling as to what went wrong and to the level of economic mismanagement.

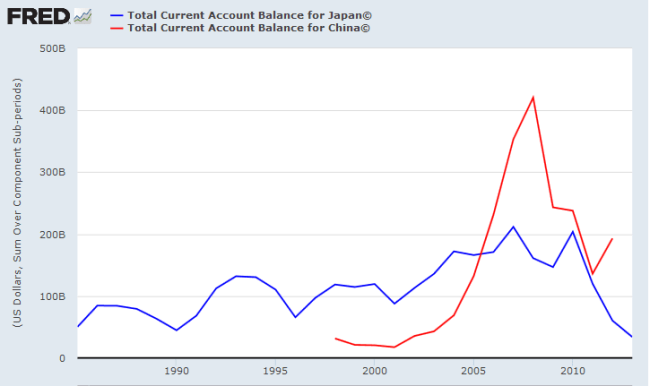

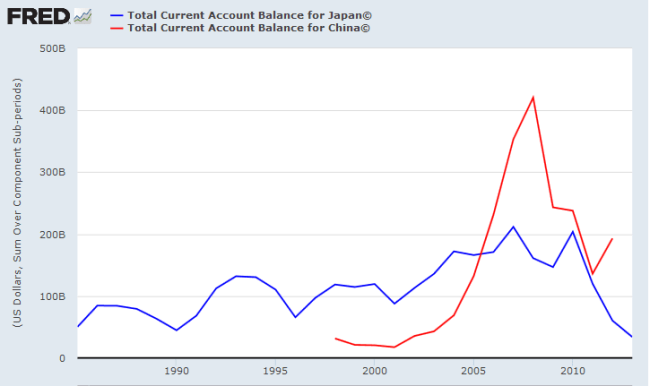

International trade is a zero sum game: what one country exports, another must import. Likewise, current accounts between nations are a zero-sum game: if one country runs a surplus, another will experience a deficit. Fortunately currency exchange rates act as an automatic stabilizer. If one country exports more than another, its currency will strengthen to the point that balance is restored in the level of trade between the two nations.

At least that is how it is supposed to work. Over the last three decades, Japan followed by China, has been rorting the system [translation: engage in a sharp practice (Australian/NZ)]. Accumulation of massive foreign reserves (e.g. by buying US Treasuries) prevented their currencies from appreciating and allowed them to maintain massive current account imbalances.

These beggar-thy-neighbor policies built up massive imbalances within the US economy.

Which led to the global financial crisis, the Great Recession, the sovereign debt crisis in Europe, the subsequent emerging markets crisis and extended slow recovery we are now experiencing.

North America

The S&P 500 continues to test support at 2000. Failure would warn of another test of support at 1870, but respect is more likely and would indicate another test resistance at the high of 2130. Troughs above zero on 13-week Twiggs Money Flow indicate continued buying pressure. The overall trend remains bearish, however, having broken primary support at 2000. Respect of resistance at 2130 would warn of another test of support at 1870.

* Target calculation: 2000 + ( 2000 – 1870 ) = 2130

The CBOE Volatility Index (VIX) has declined to below 20. A peak below this level (20) would confirm that market risk is easing.

NYSE short sales remain subdued.

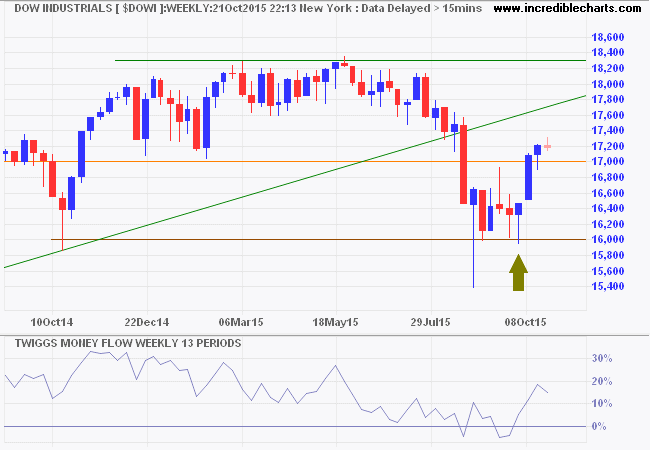

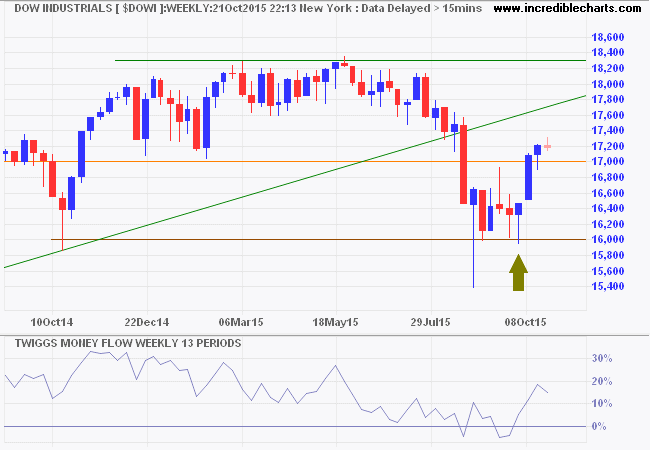

Dow Jones Industrial Average is similarly testing support at 17000, with 13-week Twiggs Money Flow holding above zero.

Canada’s TSX 60 is testing support at 800. Breach would warn of another decline, while follow-through below 775 would confirm. Weak 13-week Twiggs Momentum, below zero, indicates the market remains bearish.

* Target calculation: 775 – ( 825 – 775 ) = 725

Europe

Germany’s DAX respected support at 10000 and 13-week Twiggs Money Flow recovered above zero. Recovery above 10500 is likely and would indicate a bear rally to 11000.

The Footsie continues to test support at 6250. Respect is more likely and recovery above the descending trendline and resistance at 6500 would suggest another test of 7000. 13-Week Twiggs Money Flow holding above zero indicates long-term buying pressure. Reversal below 6000 is unlikely, but would confirm the primary down-trend.

Asia

The Shanghai Composite Index respected resistance at 3500 and is likely to re-test government-backed support at 3000.

Hong Kong’s Hang Seng Index is expected to retrace to test support at 22500 after a similar bear rally. Rising 13-week Twiggs Money Flow indicates medium-term buying pressure. Respect of 22500 would indicate another test of 24000, but breach of support is as likely and would warn of another test of primary support at 21000.

Japan’s Nikkei 225 also signals medium-term buying pressure on 13-week Twiggs Money Flow. Breakout above resistance at 18500 would suggest an advance to 21000; follow-through above 19000 would confirm.

* Target calculation: 19000 + ( 19000 – 17000 ) = 21000

India’s Sensex displays the strongest buying pressure, with rising 13-week Twiggs Money Flow troughs above zero. Respect of support at 26500 indicates continuation of the rally. Penetration of the descending trendline would suggest an advance to 30000; follow-through above 28500 would confirm. Reversal below 26000 remains unlikely, but would confirm a primary down-trend.

Australia

The ASX 200 threatens to break resistance at 5300, with rising 13-week Twiggs Money Flow indicating medium-term buying pressure. Breakout above 5300 would signal a test of the descending trendline. The bear market, however, continues despite recent support and breach of 5000 would confirm a primary down-trend.

* Target calculation: 5000 – ( 5400 – 5000 ) = 4600

The biggest mistake in investing is believing the last three years is representative of what the next three years is going to be like.

~ Ray Dalio, Bridgewater Associates