From PIMCO:

Given the size of its economy – and the high stock of debt for a country at its stage of development – China’s leverage will be a global issue in the future, not just a China issue.

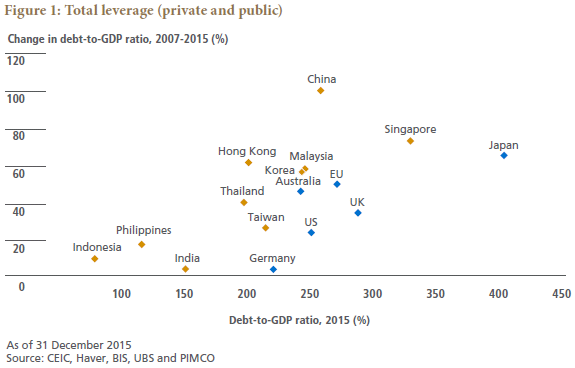

Total debt to GDP in China was around 250% at the end of 2015, the highest among emerging economies…. Over the medium term, we expect more debt creation in China: Leverage is unavoidable for China to achieve its growth targets.

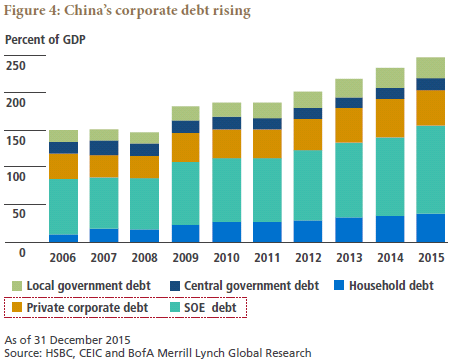

Corporate debt – at more than 120% of GDP – remains the key cause for concern in China….

What will China do in dealing with its mounting leverage? Policymakers appear to have two options.

Option 1: China moves more aggressively to remove the moral hazard in its financial system. That would be the prudent thing to do but would release pent-up perils; defaults would climb, and banks would rack up losses.

Option 2: China postpones reform and instead tries to patch the current system (“kick the can down the road”). That would be safer in the short term, but the inexorable accumulation of debt would slow the economy over the secular horizon and raise the odds of a hard landing in the future.

In our base case, China will take Option 2 and move only temporarily to Option 1 in good, calm times, resulting in a slow-moving process that shifts between the two approaches……

China faces similar challenges today as Japan did in the past:

- The need to rebalance from investment to consumption (which Japan experienced in the 1970s)

- Credit- and asset-bubble risk (Japan in the 1980s)

- A rapidly aging population (Japan since the mid-1990s)

In dealing with their debt problems, China and Japan share an important advantage – they are external creditors. They also have important differences, however, which should make China’s deleveraging process (when it finally happens) more complicated for the rest of the world: China’s global spillover effect should be larger than Japan’s due to China’s size, its commodity and emerging market linkages and its still-evolving exchange rate regime. China has an uncertain and complex political trajectory. The rest of the world, particularly developed countries, still faces the challenge of stimulating growth following the global financial crisis. China today is facing all three of these challenges simultaneously, while Japan had the opportunity to deal with each one of them sequentially.

China seems likely to continue kicking the can down the road, digging itself into an even bigger hole.

Source: Rising Leverage in Emerging Asia Where Is It Headed | PIMCO