Residential mortgage activity is recovering in response to recent rate cuts. Buyers are unable to resist the ultra-low finance costs, while APRA is sitting on its hands regarding macro-prudential measures (e.g. reducing maximum LVRs) to prevent another credit/housing bubble. Again, we see a two-speed economy, with mortgage stress in newer suburbs and inner-city units, where homeowners are unable to take advantage of lower rates, and rising prices in older, more established suburbs with lower mortgage exposure.

ASX 200 Financials index is testing resistance at 6500. Higher troughs on the Trend Index indicate buying pressure. There is no sign of a reversal at present but keep a weather eye on primary support at 6000; breach would warn of a primary decline with a target of 5200.

Banks face headwinds from pressure on interest margins, increased competition from disruptors in the form of neobanks (digital banking service providers), and demands to increase capital buffers which could lead to dividend cuts.

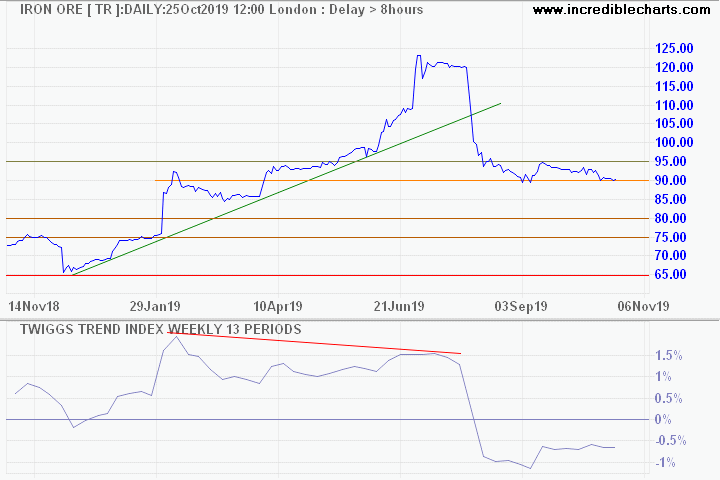

Iron ore is testing support at 90. Breach of support would warn of a decline with a long-term target of 65.

ASX 300 Metals & Mining index is testing support at 4100, the neckline of a large head-and-shoulders reversal pattern. Declining peaks on the Trend Index signal selling pressure. Breach of support would warn of a decline with a target of 3400.

REITs recovered slightly from their recent sell-off but downside risk remains. Breach of support at 1600 would warn of a decline to 1500.

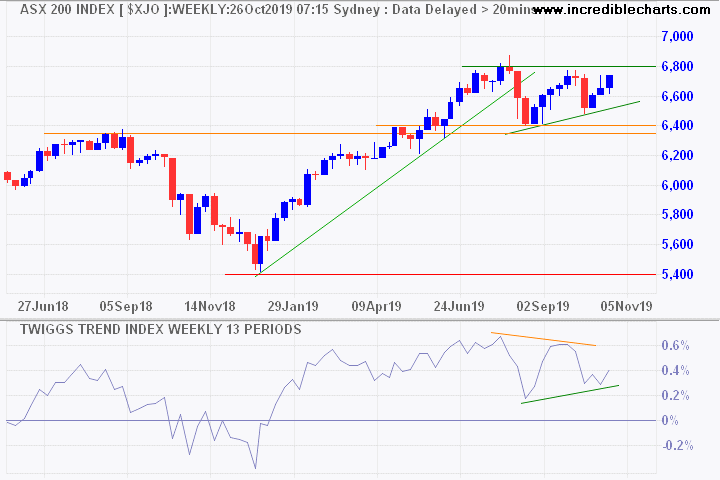

ASX 200

The ASX 200 continues to give mixed signals. An ascending triangle on the index chart is bullish, but the Trend Index also shows declining peaks, warning of selling pressure. Breakout above 6800 would signal another advance, while breach of support at 6400 would warn of a decline with a target of 5400.

We maintain low exposure to Australian equities, with a focus on defensive and contra-cyclical stocks, because of our bearish outlook.