| Stock: |

Apple Inc

|

| Exchange: |

NASDAQ |

Symbol: |

AAPL |

| Date: |

7-May-20 |

Latest price: |

$300.63 |

| Market Cap: |

$1.3 Tn |

Fair Value: |

$181.52 |

| Forward P/E: |

25.06 |

FV Payback (Years): |

11 |

| Forward Dividend Yield: |

1.10% |

Debt/FCF: |

2.1 |

| Financial Y/E: |

28-Sep-20 |

Rating: |

HOLD |

| Sector: |

Technology |

Industry: |

Consumer Electronics |

| Investment Theme: |

LT Growth |

Structural Trends: |

Growth of online services |

Summary

We consider Apple (AAPL) to be priced above fair value, but the technical outlook is bullish.

We rate the stock as a HOLD but have not included it in our model portfolio because of declining long-term revenue growth.

Valuation

We project annual revenue to fall 15% in the next 12 months, recovering to 7% growth in the long-term. Estimated fair value is $181.52 with a payback period of 11 years.

The payback period recognizes AAPL’s strong market position but also its reliance on continuing sales of devices (as opposed to services).

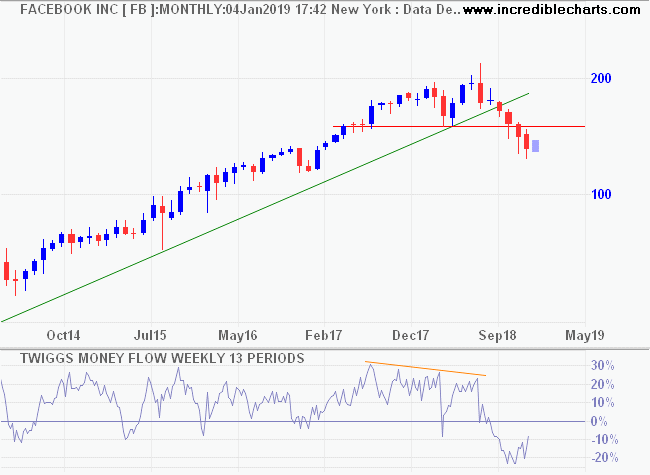

Technical Analysis

AAPL continues in a primary up-trend, but expect strong resistance at its Feb high of 325. A Declining Trend Index warns of secondary selling pressure. Respect of resistance at 325 would suggest another test of primary support at 230.

Company Profile

Apple was a pioneer of the personal computer revolution, introducing the Macintosh in 1984. Today, Apple is a world leader in five areas of consumer electronics:

- iPhone smart phones;

- iPad tablets;

- Mac computers;

- Apple Watch; and

- Apple TV.

Apple devices run internally developed semiconductors and software platforms — iOS, iPadOS, macOS, watchOS, and tvOS — with an enviable reputation for connectivity across all Apple devices.

Products are sold online, through company-owned stores, and through third-party retailers. Apart from device sales, about 20% of revenue is derived from services, including:

- the App Store;

- Apple Music;

- Apple Pay; and

- iCloud.

Apple’s headquarters are in Cupertino, California and the corporation employs more than 100,000 people.

Competitors

Morningstar sums up Apple’s competitive strengths:

We assign a narrow economic moat rating for Apple that stems from the combination of switching costs and intangible assets. We think the firm’s primary moat source is customer switching costs, as Apple bolsters the user experience with a cohort of auxiliary products…….

Regarding intangible assets, Apple’s differentiated user experience via iOS coupled with its expertise in both hardware and software design allows the firm to more seamlessly build integrated products.

….Recent survey data shows that iPhone customers are not even contemplating switching brands today. In a December 2018 survey by Kantar, 90% of U.S.-based iPhone users said they planned to remain loyal to future Apple devices. Also, users of ancillary products (especially the Watch and AirPods) lose significant functionality when paired with a smartphone other than the iPhone. Ultimately, we believe that existing iPhone users are relatively locked in to the iOS ecosystem and interface.

Major competitors include Samsung (Galaxy) which, coupled with Google (Android OS), dominates market share in smartphones. But neither offer an integrated suite of products that can compete with Apple.

Segments

Apple sales are dominated by iPhone but there is little year-on-year growth.

Growth is concentrated in the Services and Wearables segments.

Geographically, sales in the US are growing fastest, while China declined in FY19.

Apple is losing market share in China as local smartphone technology improves. From The Wall Street Journal:

Apple’s share of the Chinese smartphone market has been shrinking, crowded out by tech giants such as China’s Huawei Technologies Co. that market increasingly sophisticated phones at a lower price tag.

Apple’s share of the Chinese smartphone market contracted to 7.8% in the first three quarters of 2018 from a peak in 2015 of 12.5%, according to Canalys, a market research firm.

Performance

Revenue growth and operating cash flows have been disappointing in FY19 and FY20 so far. We expect a 15% fall in the next 12 months due to the impact of the coronavirus outbreak and declining sales in China.

Thereafter we expect annual growth to recover to 7% in the long-term.

Declining operating margins reflect an increasingly competitive environment.

Capital expenditure declined as a percentage of sales, suggesting limited growth opportunities.

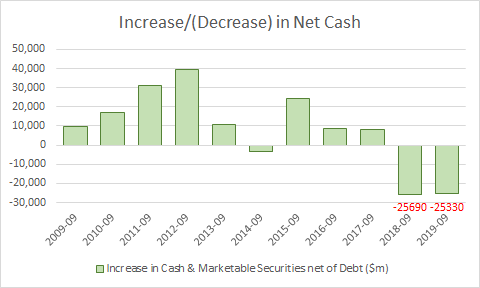

Capital Structure

Stock buybacks reduced shares outstanding by 32% since FY12.

A further $50 billion has been authorized for the year ahead.

Buybacks from FY13 to FY17 were largely funded by debt.

Debt at $99.5 billion (Q2 FY20), or 2.1 times projected free cash flow, however, remains comfortable when compared to cash & marketable investments of $156.8 billion.

Outlook

Apple did not issue guidance for the quarter ending in June, as it usually does, due to uncertainty from the coronavirus outbreak.

Disclosure

Staff of The Patient Investor may directly or indirectly own shares in the above company.