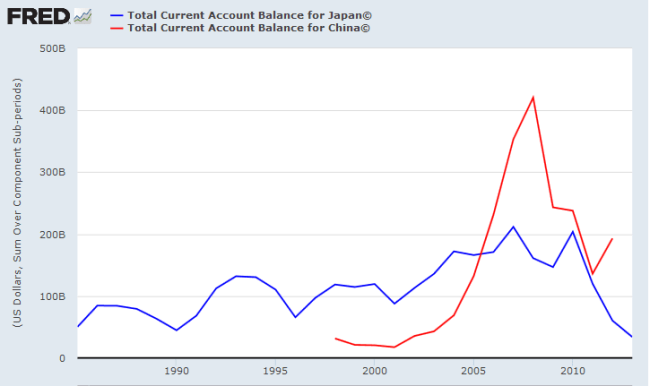

My newsletter on December 10th, warned of The Gathering Storm across global markets. A month later, concern over China is sapping investor confidence. Several exchanges signal a primary down-trend and more are approaching the tipping point.

The Dow Jones Global Index broke primary support at 300, warning of a decline to 260*. Follow-through below 290 confirms the signal — and a primary down-trend. A 6-month Twiggs Momentum peak below zero strengthens the signal.

* Target calculation: 300 – ( 340 – 300 ) = 260

North America

Declining profit margins proved a reliable indicator of recent recessions. The 10% year-on-year decline in Q3 is an early warning. Data for Q4 2015 is not yet available. A year-on-year fall of 20% would suggest that recession is imminent.

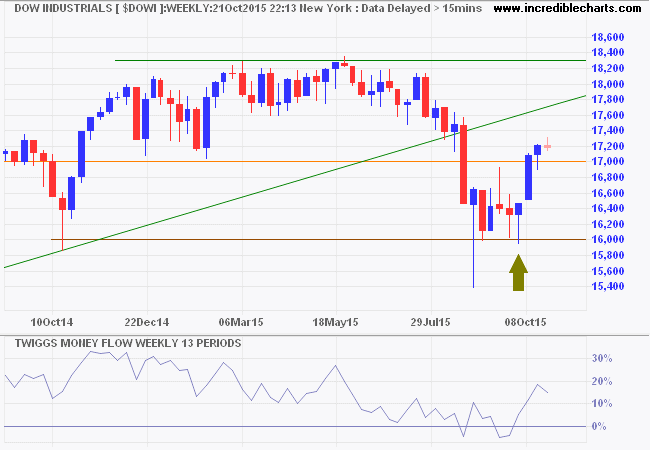

The S&P 500 is headed for a test of primary support at 1870. Declining 21-day Twiggs Money Flow below zero warns of selling pressure. Breach of 1870 would confirm a primary down-trend. Respect of support is unlikely but would suggest another bear rally.

* Target calculation: 1900 – ( 2100 – 1900 ) = 1700

CBOE Volatility Index (VIX) is rising. Breakout above 30 would warn of elevated risk.

Canada’s TSX 60 broke support at 750, confirming a primary down-trend. 13-Week Twiggs Momentum peaks below zero strengthen the bear signal. Target for the decline is 700*.

* Target calculation: 800 – ( 900 – 800 ) = 700

Europe

Germany’s DAX is headed for a test of primary support at 9400. Reversal of 13-week Twiggs Money Flow below zero warns of selling pressure. Breach of support would signal a decline to 7500*.

* Target calculation: 9500 – ( 11500 – 9500 ) = 7500

The Footsie again breached 6000, warning of a primary down-trend. Declining 13-week Twiggs Money Flow below zero strengthens the signal. Follow-through below 5800 would confirm. Target for the decline is 5000*.

* Target calculation: 6000 – ( 7000 – 6000 ) = 5000

Asia

The Shanghai Composite Index crossed below 3000 for the first time since August. Declining 21-day Twiggs Money Flow warns of medium-term selling pressure. Follow-through below 2900 would confirm another (primary) decline, with a target of 2400*.

* Target calculation: 3000 – ( 3600 – 3000 ) = 2400

Japan’s Nikkei 225 is back testing primary support at 17000. The peak at zero on 13-week Twiggs Momentum warns of a primary down-trend. Breach of support would confirm.

* Target calculation: 17500 – ( 20000 – 17500 ) = 15000

India’s Sensex breached primary support at 25000. 13-Week Twiggs Money Flow peaks below zero indicate a primary down-trend. Expect retracement to test the new resistance level at 25000 but respect is likely. Target for the decline is 23000*.

* Target calculation: 26500 – ( 30000 – 26500 ) = 23000

Australia

The ASX 200 breached primary support at 5000, signaling another decline. Follow-through below 4900 would confirm. Declining 13-week Twiggs Money Flow below zero indicates selling pressure. Target for a decline is 4600 (medium-term), or 4000* in the long-term.

* Target calculation: 5000 – ( 6000 – 5000 ) = 4000