The ASX 200 advance is tentative, with a short doji candle signaling hesitancy, and we expect retracement to test support at 7000. The Trend Index trough above zero indicates longer-term buying pressure. Respect of support is likely and would signal a fresh advance.

Financial Markets

Bond ETFs broke through resistance, signaling falling long-term interest rates.

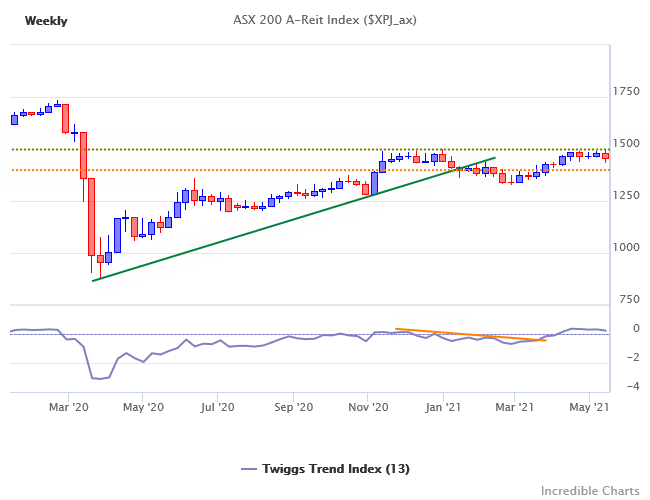

A-REITs advanced on the prospect of lower long-term interest rates.

Bank net interest margins, however, are squeezed when interest rates fall.

ASX 200 Financials retreated to test support at 6500. The trend is unaffected and Trend Index troughs above zero indicate long-term buying pressure.

Mining

Mining continues to benefit from the infrastructure boom, with iron ore respecting support at $200/ton1. Troughs above zero, flag buying pressure, and respect of support both signal another advance.

The ASX 300 Metals & Mining index is again testing resistance at 6000. Breakout would signal another advance, with a target of 65002.

Health Care & Technology

Health Care respected its new support level and is advancing strongly. Expect resistance between 45000 and 46000.

Information Technology recovered above former resistance at 2000, warning of a bear trap. Expect resistance at 2250; breakout would signal a new advance.

Gold

The All Ordinaries Gold Index (XGD) is testing resistance at 7500. Breakout would signal a fresh advance, with a target of 9000.

The Gold price is retracing to test the new support level at A$2400 per ounce. Respect of support is likely and breakout above A$2500 would be a strong bull signal for Aussie gold miners.

Conclusion

We expect A-REITs and Bond ETFs to advance on the back of lower long-term interest rates.

Financials are expected to undergo a correction as interest margins are squeezed.

Metals & Mining are in a strong up-trend because of record iron ore prices.

Health Care is recovering well and expected to test resistance.

Technology had a strong week but the outlook is still uncertain.

We expect the ASX 200 to retrace to test support at 7000 as its largest sector (Financials) undergoes a correction.

Notes

- Tons are metric tons unless otherwise stated.

- Target for Metals & Mining is calculated as support at 5000 extended above resistance at 5750.