Of companies in the S&P 500 index, 90.2% have reported their results for the quarter. According to S&P Dow Jones Indices:

- Sales growth at 11.0% year-on-year (Y/Y) is close to a potential record.

- The earnings beat rate of 78% is also historically high, compared to an average of 67%.

- Operating margins are at a record 11.58%, compared to an average of 8.08% over the last 20 years.

Forward earnings estimates are climbing, driving the forward Price-Earnings ratio to a more comfortable 17.6 compared to its March 2015 high of 23.9.

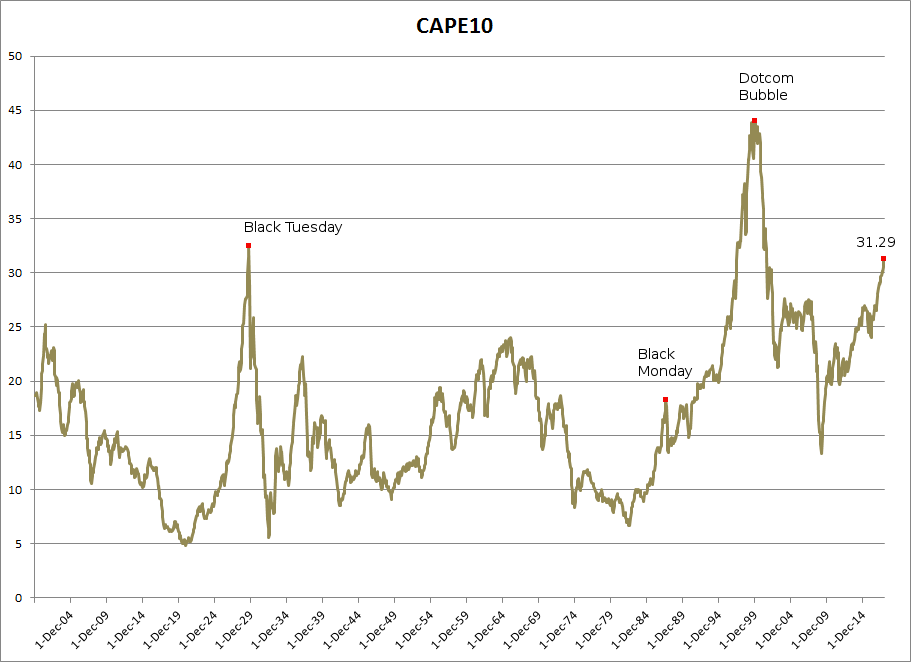

Valuations based on historic earnings remain high, but P/E multiples have fallen to 22.02 from 24.16 in the last quarter. The long-term chart below compares the index price to previous highest annual EPS, to eliminate distortions caused by sudden falls in earnings.

The current earnings multiple is still significantly higher than the 18.86 reached prior to the 1929 Wall Street crash and 18.69 in October 1987. But high valuations don’t cause market crashes. Sudden falls in earnings do. And there is little sign of that at present.

The S&P 500 is retracing for another test of its new support level at 2800. Respect would signal an advance to 3000. Declining Money Flow warns of selling pressure but this appears secondary in nature, with the indicator still well above the zero line.

The Nasdaq 100 also warns of a correction, with bearish divergence on Twiggs Money Flow. Again this appears secondary in nature because of the indicator’s position relative to the zero line. Expect a test of support at 7000.