The S&P 500 is testing resistance at the previous high of 2130. Down-turn on 21-day Twiggs Money Flow warns of short-term selling pressure; a fall below zero would indicate strong resistance. Reversal below 2050 is unlikely, but would indicate another test of primary support at 1870.

* Target calculation: 2000 + ( 2000 – 1870 ) = 2130

A declining CBOE Volatility Index (VIX) indicates market risk is easing.

NYSE short sales remain subdued.

Nasdaq 100 broke resistance at 4700 and is approaching its previous (March 2000) high of 4816. 13-Week Twiggs Money Flow is rising steeply but expect resistance at 4800. Breakout would be a positive sign for the large cap S&P 500 and Dow Industrial indices.

Canada’s TSX 60 is far more hesitant, testing stubborn resistance at 825. Breakout would signal a fresh advance, but follow-through below 800 would be bearish and failure of 775 would warn of another decline. Recovery of 13-week Twiggs Momentum above -5% would offer some hope, but the index remains tentative.

* Target calculation: 775 – ( 825 – 775 ) = 725

Europe

Germany’s DAX is consolidating below resistance at 11000; a bullish sign. Recovery of 13-week Twiggs Money Flow above zero indicates medium-term buying pressure. Breakout above 11000 and the descending trendline would suggest another test of the previous high at 12400.

The Footsie is similarly testing resistance at 6500. Breakout would suggest another test of the previous high at 7100. 13-Week Twiggs Money Flow troughs above zero indicate long-term buying pressure. Reversal below 6250 is unlikely, but would warn of another test of primary support at 6000.

Asia

The Shanghai Composite Index is testing resistance at 3500. Rising 13-week Twiggs Money Flow indicates buying pressure. Breakout would signal an advance to 4000, but I remain wary because of government intervention.

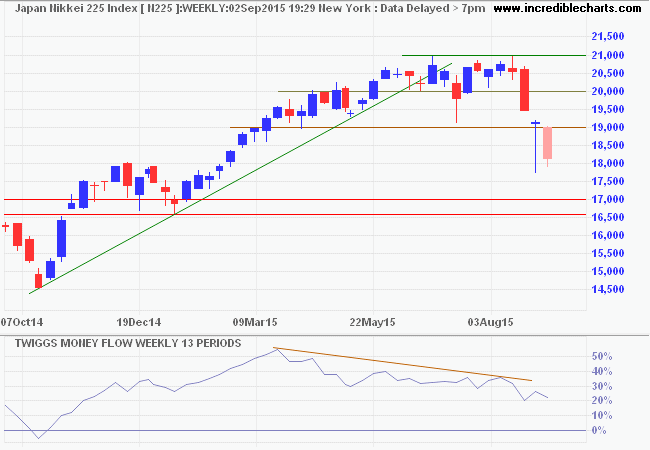

Japan’s Nikkei 225 is testing resistance at 19000. Breakout would signal another test of 21000. Respect is less likely, but reversal below 18500 would warn of another test of primary support at 17000.

* Target calculation: 19000 + ( 19000 – 17000 ) = 21000

India’s Sensex is testing the former primary support level at 26500 after encountering resistance at 27500. Rising 13-week Twiggs Money Flow troughs above zero indicate long-term buying pressure. Respect of 26500 is likely and would indicate continuation of the rally (to 28500). Failure of support would warn of a primary decline.

* Target calculation: 25000 – ( 27500 – 25000 ) = 22500

Australia

The ASX 200 is testing medium-term support at 5150. Reversal of 21-day Twiggs Money Flow below zero indicates medium-term selling pressure. Breach of 5150 is likely and would warn of another test of primary support at 5000. Recovery above 5400 is unlikely at this stage, but would suggest an advance to 6000.

* Target calculation: 5000 – ( 5400 – 5000 ) = 4600

More….

Gold tremors

Arthur C Clarke, satellites and democracy | On Line Opinion

Marc Faber: Don’t believe China’s growth figures

US: Robust underlying GDP growth trend

Iron ore price crashes through $50 | MINING.com

Iron ore headed for the smelter

Do the BRICS still matter?

Cilla Black : You’re My World (1964)

Best Halloween costume ever

We aren’t born with the ability to make good decisions; we learn it.

~ Ray Dalio, Bridgewater Associates