Commodity prices warn that the global economy is still in a slump.

The Dow Jones – UBS Commodity Index remains at one-third of its 2007 peak, with no sign of recovery.

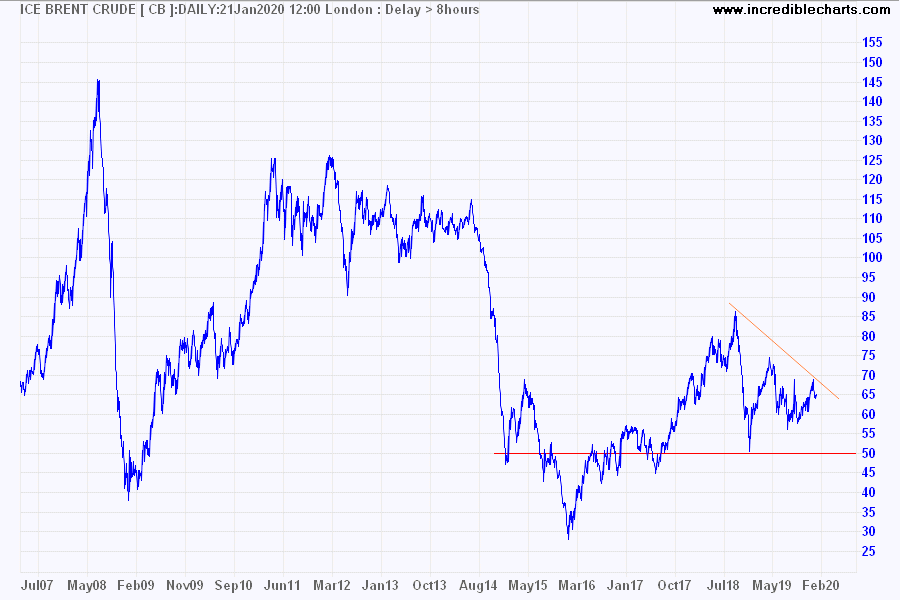

The fall in crude prices hasn’t been as severe, but Brent Crude is again weakening and looks set for another test of $50/barrel.

Shipping rates for dry bulk goods, such as iron ore and coal, have fallen, with the Baltic Dry Index close to long-term support at 500.

Supply interruptions to iron ore production in Brazil have cushioned Australian producers from a sharp down-turn in iron ore prices. But coal exporters are feeling the pinch.

Recovery of Brazilian production over the next two years is expected to add downward pressure to iron ore prices.

The only positive appears to be container shipping rates. The Harpex Index rose steeply in 2019, reflecting increased demand for container shipping of finished goods.

Somewhat surprising, since this coincided with US-China trade tensions and tariff increases. The answer may lie with importers on both sides of the Pacific attempting to front-run the imposition of tariffs and build inventories in case of supply interruptions and to allow time to adapt their supply chain. Expect the index to retreat in the early part of 2020.

It looks like low global growth will continue.