In an appearance before the Joint Economic Committee, Bernanke blamed slow-growing consumer spending, which accounts for 70 percent of economic activity, on persistently high unemployment and the gnawing fear among a growing number of Americans that their jobs may be at risk. After noting that the decline in home values and financial assets also contributed to decreasing confidence, he said “probably the most significant factor depressing consumer confidence, however, has been the poor performance of the job market.”

Dollar surges as Fed nixes QE3

The US Dollar Index surged after the latest FOMC statement avoided any mention of additional purchases of Treasuries or mortgage-backed securities (MBS). Though they did leave the door ajar with their concluding paragraph:

………The Committee discussed the range of policy tools available to promote a stronger economic recovery in a context of price stability. It will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools as appropriate.

The index respected the new support level at 76.00, confirming a primary advance to 79* — the start of a primary up-trend. 63-Day Twiggs Momentum crossed to above zero, further strengthening the primary trend signal; a large trough that respects the zero line would provide final confirmation.

* Target calculation: 76 + ( 76 – 73 ) = 79

Disappointment With The Fed | ZeroHedge

Ben just disappointed the market for the first time. Whether he knew it or not he failed to beat expectations. He has been so good at managing expectations and using that as a policy tool he lost sight of how far ahead of itself the market had gotten.

……He downgraded the economy but didn’t use that as an excuse to do more. There was no new, ingenious idea. If anything they tried to clarify the commitment to hold rates low til 2013 is dependent on economic conditions remaining weak. Yet there were still 3 dissenters.

…..By disappointing some people I expect his ability to keep the market up by talking will be reduced as Investors will need to see action rather than being told vaguely that there could be action. That will take time to play out and even I have to admit he gave us something today, just not enough.

The Next Selling Wave Is About to Begin | Toby Connor | Safehaven.com

As the stock market moves down into the next daily cycle low and the selling pressure intensifies, this should drive the dollar index much higher. It remains to be seen if gold can reverse this pattern of weakness in the face of dollar strength, especially since the dollar will almost certainly be rallying violently during the intense selling pressure that is coming in the stock market.

via The Next Selling Wave Is About to Begin | Toby Connor | Safehaven.com.

When the dollar strengthens, gold normally falls. Except in times of high uncertainty (like the present), when demand for gold as a safe haven overcomes downward pressure from a stronger dollar. Buying gold at current prices is a bet that either Greece will default — a pretty safe bet — or that the Fed is again forced to use its printing press (not quite as certain).

FRB: Press Release–Federal Reserve issues FOMC statement–September 21, 2011

The Committee continues to expect some pickup in the pace of recovery over coming quarters but anticipates that the unemployment rate will decline only gradually toward levels that the Committee judges to be consistent with its dual mandate. Moreover, there are significant downside risks to the economic outlook, including strains in global financial markets.

………The Committee discussed the range of policy tools available to promote a stronger economic recovery in a context of price stability. It will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools as appropriate.

via FRB: Press Release–Federal Reserve issues FOMC statement–September 21, 2011.

Dollar rallies

The Dollar Index rallied strongly but expect stubborn resistance between 76.00 and 76.50. Consolidation between 73.00 and 76.50 has continued for more than four months, but we are in a bear trend and downward breakout remains likely. Failure of support at 73.00 would offer a target of 70.00*. Any hint of quantitative easing in the next FOMC announcement, on September 21st, would accelerate the sell-off.

* Target calculation: 73 – ( 76 – 73 ) = 70

Jobs Paralysis Raises Odds of Fed Action – Real Time Economics – WSJ

Job market paralysis in August increases the chance the Federal Reserve will do something new to help the economy……. The current environment is pushing the Fed towards action. A week ago, Chairman Ben Bernanke told a gathering of the world’s top economic officials he was expanding the length of the upcoming September Federal Open Market Committee to give policy makers additional time to talk about what the Fed can do, which by itself increased the odds something was going to happen.

via Jobs Paralysis Raises Odds of Fed Action – Real Time Economics – WSJ.

Gold miners threaten breakout

The Gold Bugs Index, representing unhedged gold miners, threatens to break through resistance at 600 which would signal an advance to 700*. Upward breakout would negate the earlier bear signal from penetration of the rising trendline — as well as strengthening prospects of a further advance in the spot price.

* Target calculation: 600 + ( 600 – 500 ) = 700

Spot gold has so far respected the secondary trendline and support at $1750. Short retracement from resistance at $1850 would be a bullish sign, suggesting an upward breakout. Recovery above $1900 would test $2000, though the calculated target is even higher*.

* Target calculation: 1900 + ( 1900 – 1750 ) = 2050

Upside potential for gold remains strong. Treasury and the Fed are running out of options to revive the economy and further quantitative easing grows ever more inviting despite the inflationary outcome. With presidential elections looming in 2012, the White House will also be doing their best to influence the Fed decision.

No respite in bear trend against the Yen

A long-term chart shows the dramatic fall of the greenback against the yen over the last three decades. The bear trend continues with breakout below ¥80 signaling further decline to around ¥60* over the next few years. Quantitative easing by the Fed would accelerate the process.

* Target calculation: 80 – ( 100 – 80 ) = 60

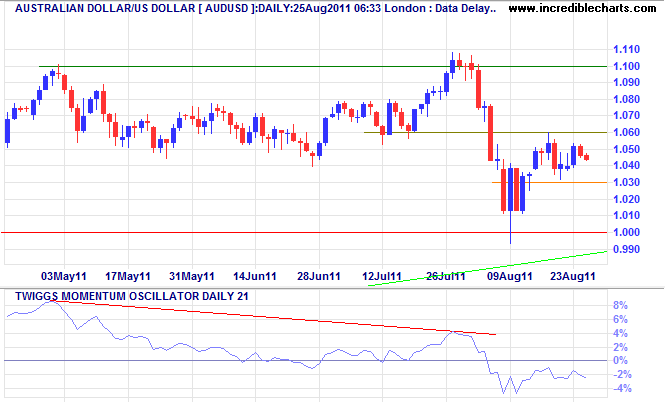

Aussie weaker

The Aussie Dollar continues to consolidate between $1.03 and $1.06 against the greenback. Failure of support at $1.03 would test parity, while breakout above $1.06 would target resistance at $1.10. In the long term, declining commodity prices are likely to drag the Aussie lower — unless the Fed starts printing money again.

* Target calculation: 1.03 – ( 1.06 – 1.03 ) = 1.00

The Aussie Dollar is testing the upper border of the declining trend channel against its Kiwi counterpart. Reversal below short-term support at $1.255 would indicate respect of the upper channel and a down-swing to around $1.20*. Breakout above $1.28 is unlikely but would warn that the down-trend is weakening.

* Target calculation: 1.24 – ( 1.28 – 1.24 ) = 1.20