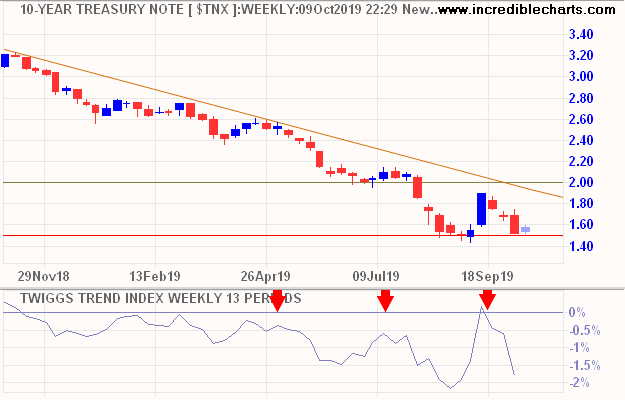

10-Year Treasury yields retraced from resistance at 2.0% this week but rising Trend Index troughs indicate upward pressure on yields. Breakout above 2.0% would strengthen the signal. Higher long-term rates would increase the opportunity cost of holding Gold, reducing demand.

China’s Yuan penetrated its descending trendline against the Dollar. Similarities between the two patterns (above and below) suggest that China is reducing purchases of Treasuries, increasing upward pressure on yields.

Rising yields would normally strengthen demand for the Dollar. Instead, declining Trend Index peaks warn of long-term selling pressure.

Gold found short-term support at $1450/ounce but further rises in Treasury yields would increase the selling pressure highlighted by declining peaks on the Trend Index.

Silver broke support at $17.00/ounce, with an even steeper fall on the Trend Index warning of a further decline on Silver and Gold.

Australia’s All Ordinaries Gold Index continues its downward trend channel, headed for secondary support at 6000. Declining Trend Index peaks again warn of strong selling pressure. Respect of 6000 would signal that the primary up-trend is intact, while breach and a test of primary support at 5400 would again warn of trend weakness.

Patience

Gold is in a long-term up-trend. A correction may offer an attractive entry point but we first need to confirm that the up-trend is intact before increasing exposure to gold stocks.