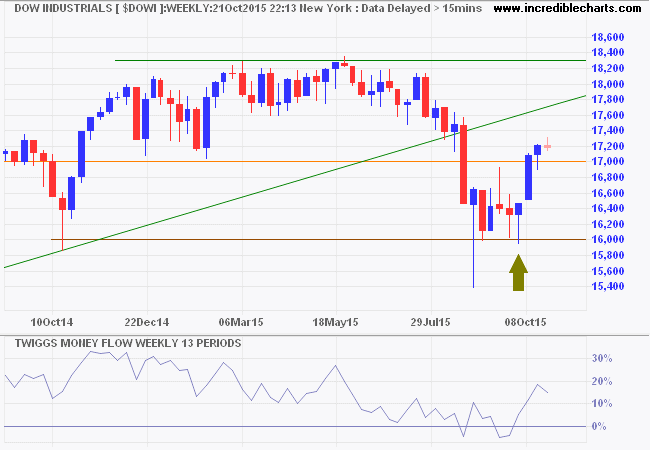

The S&P 500 found resistance at 2100, indicating a continued lack of enthusiasm. Declining 13-week Twiggs Money Flow flags medium-term selling pressure. Reversal below 2000 would warn of another test of primary support at 1870. Upward breakout now appears less likely, but would signal a fresh advance to 2400*.

* Target calculation: 2130 + ( 2130 – 1870 ) = 2390

Declining CBOE Volatility Index (VIX) below 20 indicates market risk is returning to normal. Some macro indicators remain elevated, however, which is why we maintain reduced exposure.

The Nasdaq 100 is testing the previous (2000) high of 4800. Breakout would be a bullish sign for the broader market but bearish divergence on 13-week Twiggs Money Flow continues to warn of stubborn resistance.

Canada’s TSX 60 is struggling to break resistance at 800. 13-Week Twiggs Momentum peaks below zero continue to warn of a strong primary down-trend. Recovery above 825 is unlikely, while failure of support at 765 would confirm another decline.

* Target calculation: 775 – ( 825 – 775 ) = 725

Europe

Germany’s DAX is retracing to test its new support level at 11000. Respect is likely and would confirm another test of 12400. Rising 13-week Twiggs Money Flow indicates medium-term buying pressure. Reversal below 11000 is unlikely, but would warn of another test of 10000.

The Footsie is strengthening, with rising 13-week Twiggs Momentum. Breakout above 6500 would indicate another test of 7000/7100. Reversal below 6000 is unlikely but would signal a primary down-trend.

Asia

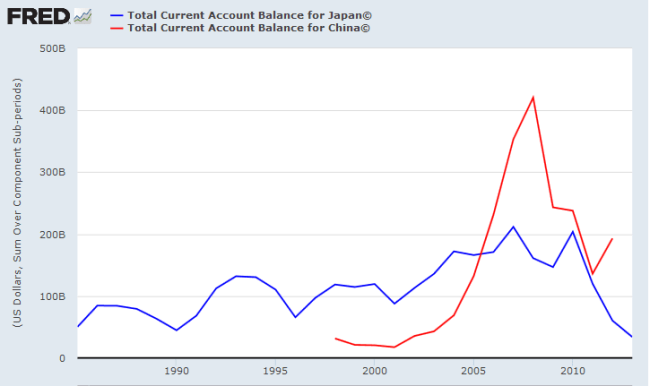

The Shanghai Composite Index recovered above support at 3500. I remain wary of China because of the high Debt to GDP ratio, the need to wean itself off investment stimulus, and impending rate rises in the US which could encourage further capital outflows.

Chart/Quote (CS): China's heavy dependence on investment – pic.twitter.com/op5a3XOtkZ

— SoberLook.com (@SoberLook) December 3, 2015

//platform.twitter.com/widgets.js

Japan’s Nikkei 225 is testing short-term resistance at 20000. This is unlikely to impede an advance to 21000. Rising 13-week Twiggs Money Flow indicates buying pressure.

* Target calculation: 19000 + ( 19000 – 17000 ) = 21000

India’s Sensex is retracing to test the former band of primary support at 26000/26500. Respect would confirm a primary down-trend. Reversal of 13-week Twiggs Money Flow below zero would strengthen the signal. Follow-through below 25000 would offer a target of 22500*. Recovery above the upper trend channel at 27000 is unlikely, but would suggest a rally to 30000.

* Target calculation: 25000 – ( 27500 – 25000 ) = 22500

Australia

The ASX 200 encountered short-term resistance at 5300. Declining 13-week Twiggs Money Flow indicates (medium-term) selling pressure; reversal below zero would strengthen the signal. Breach of 5150 would warn of another test of primary support at 5000. Failure of support would signal a primary down-trend.

* Target calculation: 5000 – ( 6000 – 5000 ) = 4000