I am surprised at John Mauldin’s view in his latest newsletter Playing the Chinese Trump Card:

….This whole myth that China has purposely kept their currency undervalued needs to be completely excised from the economic discussion. First off, the two largest currency-manipulating central banks currently at work in the world are (in order) the Bank of Japan and the European Central Bank. And two to four years ago the hands-down leading manipulator would have been the Federal Reserve of the United States.

John is correct that China has in recent years engaged in less quantitative easing than Japan, Europe and the US. And these activities are likely to weaken the respective currencies. But what he ignores is that these actions are puny compared to the $4.5 Trillion in foreign reserves that China has accumulated over the last decade. That is almost 2 years of goods and services imports — far in excess of the 3 months of imports considered prudent to guard against trade shocks. Arthur Laffer highlights this in his recent paper Currency Manipulation and its Distortion of Free Trade:

Accumulation of excessive foreign reserves is the favored technique employed by China, and Japan before that, to suppress currency appreciation over the last three decades. Dollar outflows through capital account, used to purchase US Treasuries and other quality government and quasi-government debt, are used to offset dollar inflows from exports. This allows the exporting state to maintain a prolonged trade imbalance without substantial appreciation of their currency. And forces the target (US) to sustain a prolonged trade deficit to offset the capital inflows. Laffer sums up currency manipulation as:

….. when a country either purchases or sells foreign currency with the intent to move the domestic currency away from equilibrium or to prevent it from moving towards equilibrium.

Even Paul Krugman (whose views I seldom agree with) has been wise to the problem for at least 5 years:

…..economist Paul Krugman and a group of senators led by New York Democrat Chuck Schumer wanted to impose a 25% tariff on Chinese imports.

Prolonged current account imbalances cause instability in global financial markets. A sustained US current account deficit was one of the primary weaknesses cited by Nouriel Roubini in his forecasts of the 2008 financial crisis (the other side of the equation was a sustained Chinese surplus). But currency manipulation is not only dangerous, it is also short-sighted. International trade is a zero-sum game. For every dollar of goods, services, capital or interest that goes out, a dollar of goods, services, capital or interest must come in. For every country that runs a current account surplus, another must run a deficit. Without international regulation, each country will try to engineer a trade surplus in order to boost their domestic economy at the expense of their trade partners. An endless game of beggar-thy-neighbor.

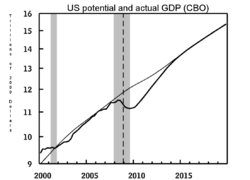

Participants will suffer long-term consequences. The power of financial markets is unstoppable. Central banks attempt to hold back the tide, distorting price signals and shoring up surpluses (or deficits), at their peril. The market will have its way and restore equilibrium in the long term. As Japan in the 1990s and Switzerland recently experienced, the further you move markets away from equilibrium the more powerful the opposing backlash will be. The scale of China’s market manipulation is unprecedented, and caused large-scale distortions in the US. The end result forced the Fed to embark on unprecedented quantitative easing which, in turn, is now impacting back on China.

The impact will not only be felt by China, as John points out:

The low rates and massive amounts of money created by quantitative easing in the US showed up in emerging markets, pushing down their rates and driving up their currencies and markets. Just as [governor of the Central Bank of India, Raghuram Rajan] (and I) predicted, once the quantitative easing was taken away, the tremors in the emerging markets began, and those waves are now breaking on our own shores. The putative culprit is China, but at the root of the problem are serious liquidity problems in emerging markets. China’s actions just heighten those concerns.

Chinese hopes for a soft landing are futile.