North America

Construction activity continues to advance. The graph below shows Total US Construction Spending adjusted for inflation (Core CPI). Spending is substantially below the 2004 to 2007 property bubble but equates to the earlier Dotcom era. The steep rise suggests that rate increases will be necessary to prevent another bubble.

The S&P 500 is testing resistance at 2000. Bullish divergence on 21-day Twiggs Money Flow indicates (medium-term) buying pressure. Recovery above 2000 would signal a relieving rally, with a target (from the double-bottom pattern) of 2130*. The market remains bearish and respect of 2130 would warn of another test of primary support at 1870.

* Target calculation: 2000 + ( 2000 – 1870 ) = 2130

The CBOE Volatility Index (VIX) below 20 indicates market risk is easing. We need to remain vigilant for the next few weeks as VIX can be prone to false breaks.

NYSE short sales are subdued.

Dow Jones Industrial Average is similarly testing resistance at 17000 on the weekly chart. Breakout would offer a similar target of 18300. Recovery of 13-week Twiggs Money Flow above zero indicates buying pressure. Reversal below 16000 is unlikely, but would confirm a primary down-trend.

Canada’s TSX 60 recovered above the former primary support level at 800. Follow-through above 820 would signal a relieving rally. Weak 13-week Twiggs Momentum, below zero, warns the market is still bearish.

* Target calculation: 820 + ( 820 – 750 ) = 890

Europe

Germany’s DAX remains weak, with 13-week Twiggs Money Flow below zero. Recovery above 10500 would indicate a bear rally. Only follow-through above 11000 would signal that the down-trend is over.

The Footsie proved more resilient, respecting support at 6000 with 13-week Twiggs Money Flow holding above zero. Breakout above 6300 indicates a relieving rally, while follow-through above the descending trendline would suggest that the correction is over. Reversal below 6000 is unlikely, but would confirm the primary down-trend.

Asia

The Shanghai Composite Index continues to test government-enforced support at 3000. Recovery above 3500 is most unlikely.

Hong Kong’s Hang Seng Index rallied to test resistance at 22500, while 13-week Twiggs Money Flow recovered above zero. Follow-through above 22500 would indicate another test of 24000. But this remains a bear market and reversal below 22500 would warn of another decline.

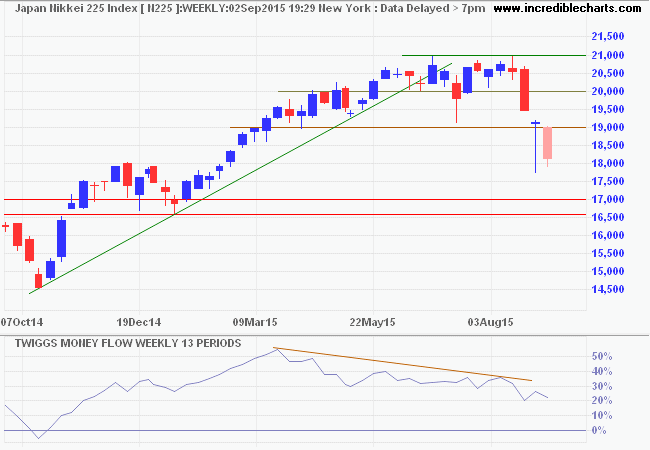

Japan’s Nikkei 225 respected primary support at 17000. Gradual decline on 13-week Twiggs Money Flow suggests a secondary correction. Recovery above 19000 would indicate another test of 21000.

* Target calculation: 19000 + ( 19000 – 17000 ) = 21000

India’s Sensex followed through above resistance at 26500, indicating a bear rally. Strong buying pressure, signaled by a 13-week Twiggs Money Flow trough above zero, suggests a reversal. Breakout above 28500 would confirm. Reversal below 25000 is unlikely, but would confirm a primary down-trend.

Australia

A monthly chart of the ASX 200 shows the significance of the 5000 support level.

Rising 21-Day Twiggs Money Flow on the daily chart indicates medium-term buying pressure. Breakout above 5300 would offer a target of 5700. But expect stiff resistance between 5200 and 5300 — already flagged by a tall shadow on today’s candlestick. Breach of 5000 is unlikely at present, but would confirm a primary down-trend.

* Target calculation: 5000 – ( 5400 – 5000 ) = 4600

More….

Crude: Another bear rally

Gold down-trend continues

Sen. John McCain on Russia’s airstrikes in Syria

Paddleboarding with whales

Deleveragings go on for about 15 years. The process of raising debt relative to incomes goes on for 30 or 40 years, typically. There’s a last big surge, which we had in the two years from 2005 to 2007 and from 1927 to 1929, and in Japan from 1988 to 1990, when the pace becomes manic. That’s the classic bubble. And then it takes about 15 years to adjust.

~ Ray Dalio, Bridgewater Associates