The market eagerly awaits the decision of the Fed Open Market Committee (FOMC) on whether to lift the target interest rate (FFR) from its 0.00 – 0.25 percent range maintained since the dark days of 2008.

Core CPI remains subdued at 1.83 percent for the 12 months to August — close to its 2 percent target — so there is no urgency to increase rates despite a strengthening job market.

The act of revising the target rate is largely symbolic. There is no doubt that the economy can withstand an increase in the Fed Funds Rate to 0.5%. But commencement of a tightening cycle may scare an already jittery market. There is a fairly equal split amongst economists as to whether the Fed should proceed with the rate rise or not. My guess is that the Fed will opt for a bet each way, with a wider target range (say 0.00 to 0.50 percent) or a reduced increment (say 0.10 to 0.30 percent). The effective FFR is currently sitting at 0.14 percent and I am sure the Fed’s plan is to continue with a gradual increase over time and no sudden movements.

The S&P 500 is testing resistance at 2000 after a higher trough and rising 21-day Twiggs Money Flow indicate buying pressure. Recovery above 2000 would signal a relieving rally, while respect of resistance would suggest another test of support at 1900.

* Target calculation: 1900 – ( 2000 – 1900 ) = 1800

The CBOE Volatility Index (VIX) indicates market risk is declining.

NYSE short sales are also declining.

Dow Jones Industrial Average closed above resistance at 16700. Follow-through after the FOMC decision would confirm a relieving rally. Reversal below 16600 would warn of another test of 16000. Failure of support at 16000 is unlikely, but would signal a primary down-trend. Recovery of 21-day Twiggs Money Flow above zero indicates medium-term buying pressure.

Canada’s TSX 60 recovered above 800, indicating solid support between 790 and 800. Recovery above 820 and the descending channel would signal that the correction has ended. Rising 13-week Twiggs Momentum would strengthen the signal, while recovery above zero would confirm.

* Target calculation: 800 – ( 900 – 800 ) = 700

Europe

Germany’s DAX found support at 10000. Recovery above 10500 would suggest a relieving rally, but only follow-through above the descending trendline and resistance at 11000 would confirm. Respect of the zero line by 13-week Twiggs Money Flow is a bullish sign; completion of a trough above zero would confirm long-term buying pressure.

The Footsie similarly found support at 6000. Recovery above 6300 would indicate a relieving rally. Penetration of the descending trendline would confirm.

Asia

The Shanghai Composite Index continues to test (enforced) support at 3000. Recovery above 3500 is unlikely, but would indicate that the crisis has passed.

Hong Kong’s Hang Seng Index found support at 21000 and is likely to test the former primary support level at 23000. 13-Week Twiggs Money Flow below zero indicates long-term selling pressure, but recovery above zero would suggest a false signal. Breakout above 23000 and the descending trendline is unlikely, but would signal that the down-trend is over.

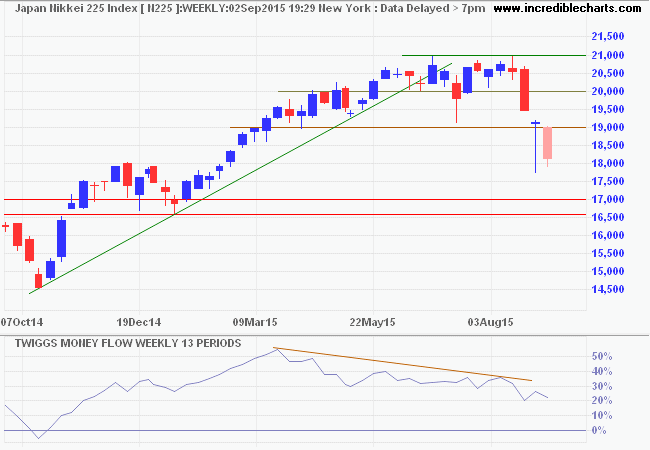

Japan’s Nikkei 225 found support at 17500. Recovery above 19000 would signal a rally to test resistance at 21000. The gradual decline on 13-week Twiggs Money Flow suggests medium-term selling pressure rather than a primary (long-term) shift.

* Target calculation: 19000 + ( 19000 – 17500 ) = 20500

India’s Sensex is headed for a test of the new resistance level at 26500. The primary trend is downward. Respect of the zero line by 13-week Twiggs Money Flow indicates medium-term buying pressure. Recovery above 26500 is unlikely, but would warn of a bear trap. Respect of resistance remains more likely and would suggest another decline.

* Target calculation: 25000 – ( 26500 – 25000 ) = 23500

Australia

The ASX 200 continues to test primary support at 5000. 21-Day Twiggs Money Flow oscillating around zero indicates uncertainty. Breach of 5000 would confirm a primary down-trend. Recovery above 5300 is less likely, but would indicate a bear rally.

* Target calculation: 5000 – ( 5400 – 5000 ) = 4600

Just a word of caution. Relieving rallies can (and often do) fail. Probability of a continued primary up-trend will only improve once support levels have been tested. Early movers always face greater uncertainty. Which is why our long-term portfolios continue to hold high levels of cash.

More….

Why Europe Failed

Not much wrong with the US economy

NYSE short sales easing

Marcus Miller & Eric Clapton [music]

You really wonder why leaders want these jobs when they really do not want to lead. And what is their risk? That Barack Obama will not get a second term? Or that Angela Merkel’s coalition might finally end up on the rocks? If they actually made the leap they might astound themselves. Because, in the end, everyone in political life gets carried out — the only relevant question is whether the pallbearers will be crying.

~ Paul Keating, 24th Prime Minister of Australia (2011)