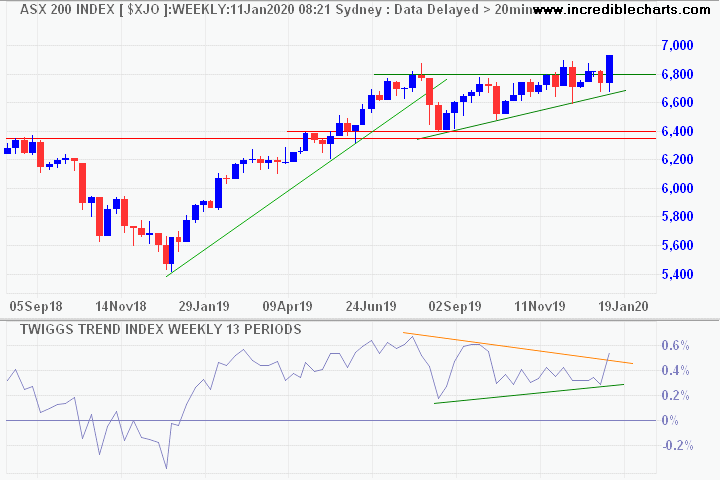

The ASX 200 broke resistance at 6800, signaling a fresh advance. Expect retracement to test the new support level. Respect would strengthen the bull signal, confirming a fresh advance.

At the same time, fundamentals are distinctly bearish, with falling retail sales and dwindling GDP growth. So, what sectors are driving the index?

A comparison of the ASX 200 sector indices shows that the advance is led by Healthcare and Information Technology sectors, while the laggards are Financials, Utilities and Telecommunications.

Top performers in Healthcare (with forward price-earnings ratio where available) are:

- Polynovo (PNV) – negative eps

- Clinuvel (CUV) – 79

- Pro Medicus (PME) – 137

- Nanosonics (NAN) – 158

- Resmed (RMD) – 55

- CSL (CSL) – 49

- Fisher & Paykel Health (FPH) – 55

In Information Technology, top performers are:

- Afterpay (APT) – negative eps (forward pe 476)

- Nearmap (NEA) – negative eps

- Bravura (BVS) – 37

- Appen (APX) – 58

- Xero (XRO) – 5998 (forward pe 270)

- Altium (ALU) – 63

The graph below compares PE Ratios on the y-axis to required Annual Growth in earnings on the x-axis. The curve plots the compound annual growth (CAGR) required for a 20-year income stream to deliver a 12.5% return on investment.

What this illustrates is that PE Ratios above 50 should be treated with caution as they assume the ability to maintain high CAGR in earnings (e.g. above 20%) for long periods. Even when growing off a low base that can be difficult to achieve.

Bottom line: many stocks in these sectors (Healthcare and IT) are highly-priced and vulnerable to strong draw-downs.