I am fond off quoting Jesse Livermore’s maxim “You don’t argue with the tape” but Livermore was a keen student of market conditions and based his decisions on far more than just price action in the market.

We are witnessing a spectacular stock market rally, driven by retail investors and hedge funds piling into the market while institutional investors are sitting on the sidelines.

The Nasdaq 100 broke through resistance at 10,000, new highs signaling a fresh primary advance. Bearish divergence on Twiggs Money Flow index may warn of selling pressure but it is hard to argue with the tape. Only a fall below 9500 would signal another decline and that seems unlikely at present.

Even retail sales (ex food) have recovered sharply, from -15.3% in April to -1.4% in May (annual % gain).

Light vehicle sales are more sluggish but June sales of 13.05 million are still a sizable bounce.

So why are many old investment hands acting with such caution?

We know that the efforts to contain the COVID19 outbreak are struggling, with over 60,000 new cases per day, but the economy still seems in good shape.

Source JHU CSSE

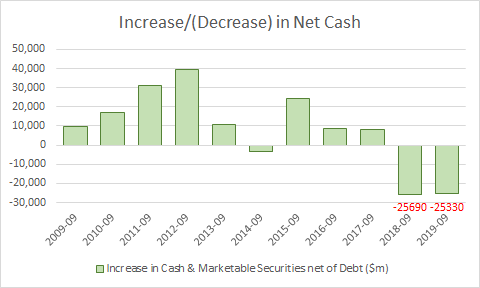

Let’s look at where the money is coming from.

Treasury debt has expanded by more than $3 trillion in the last four months (March 9 – July 9) as the government does everything in its power to cushion the economy from an unprecedented shutdown. Rescuing airlines, bailing out Boeing, emergency business loans, job preservation schemes, and supporting Fed purchases of a wide variety of financial assets to keep the plumbing of financial markets open. Every way they can, government has been flooding the market with money and some of that has found its way to the stock market. Whether through boosting stock purchases, enabling companies to raise debt or boosting consumer spending to buoy up sales, the market is flying on borrowed money.

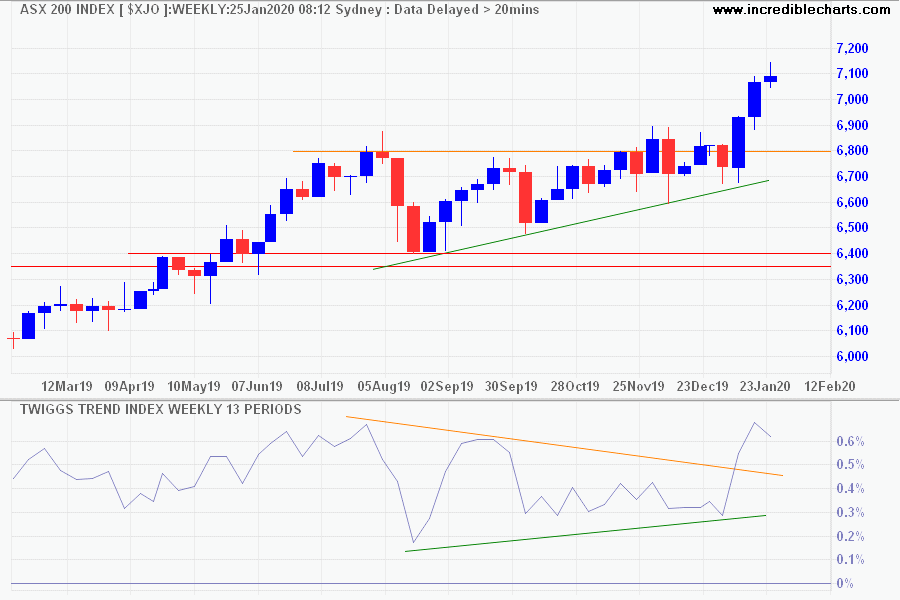

Steep up-trends like this typically end in a blow-off. A trend is self-reinforcing if rising prices attract more investors who in turn bid up prices even further. A steady influx of new investors is required to sustain the trend, else it dies.

Similar self-reinforcing cycles are evident in nature, where they expand violently outward at an exponential rate until they run out of fuel. The fuel driving the event may differ, from dry tinder in a forest fire, warm ocean temperatures in a hurricane, consumable vegetation in a locust plague, …..or exposed population in a virus outbreak. The cycle expands, feeding on itself, until the fuel is exhausted.

A stock market blow-off is no different. The up-trend will continue for as long as rising prices are able to attract new investors. It will stop when the source of new money dries up. In this case, when Treasury tries to slow the unsustainable growth in federal debt. Then it becomes a case of devil-take-the-hindmost as a preponderance of sellers attempt to offload their stocks on a rapidly shrinking pool of buyers.