Michael Every from Rabobank is bearish on Gold in his recent video:

“I can’t see the case for Gold while the Fed is hiking — you don’t get a correlation with the Fed hiking aggressively and Gold going up…..If you want to buy into the Gold argument you are buying into the end of the US system. You are implicitly backing a New World Order and Commodity-backed currencies.”

Several readers have written, asking if this changes our view on Gold.

The short answer is NO, for three reasons:

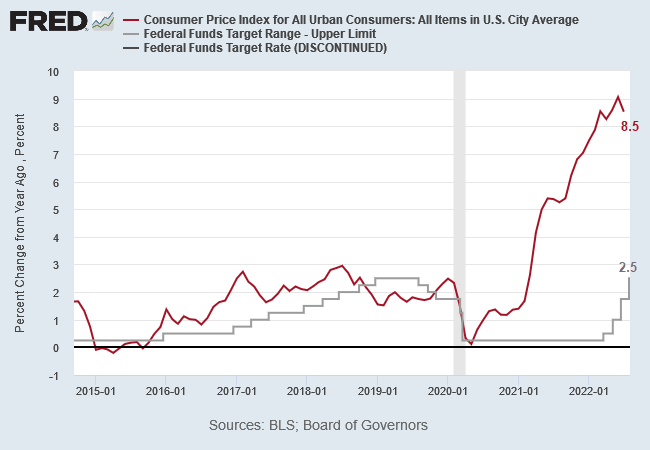

1. The Fed can only hike rates until something breaks

Michael qualifies his view: he is bearish on Gold while the Fed hikes interest rates.

The Fed is expected to tighten — but only until something breaks. Not stocks, which they are unlikely to support, but the bond market. Credit is the lifeblood of the economy. When it stops flowing, the Fed is forced to inject liquidity into financial markets to maintain the flow.

Bank credit still grows at a healthy rate.

The ratio of Copper/Gold (orange below), however, is a good indication of the economic cycle. When the economy is growing — and long-term interest rates (blue) are increasing — industrial metals, like Copper, rise faster than Gold and the ratio rises. When the economy contracts, the ratio falls.

Copper/Gold going sideways at present warns that the global economy is stalling. It is highly unlikely that the Fed would continue to tighten if the economy starts to contract — which would be signaled by a falling Copper/Gold ratio.

Consumer sentiment (blue, inverted scale below) also gives a recession warning, at levels normally associated with high unemployment (red).

Investment grade corporate bond issuance (green below) is still within its normal range, albeit on the low side, but high yield (light blue) has slowed to near its March 2020 low, warning that we are close to an economic contraction.

A fall of investment grade issuance below $50 billion (the Dec 2020 low) would be cause for concern.

2. A strong Dollar is destroying US industry

The US has been running twin deficits for several decades, supporting the US Dollar as global reserve currency and offering US Treasuries as the global reserve asset.

This has allowed the Financial sector to grow to a point where it dominates the US economy.

Wall Street may be reluctant to relinquish their “exorbitant privilege” of cheap debt but it has come at a huge cost to the US economy.

In order to supply international financial markets with sufficient Dollars, the US has to run large trade deficits. But every foreign exchange transaction has to have a buyer and a seller, so the large outflow of Dollars on current account is balanced by an equal and opposite inflow on the capital account.

The resulting trade imbalance boosts the Dollar exchange rate to the point that US manufacturers find it difficult to compete against foreign manufacturers in export markets and against foreign imports in domestic markets.

The strong Dollar decimated the manufacturing sector which has shed almost 7 million jobs over the past four decades.

The inflow of surplus capital also encourages malinvestment in nonproductive areas — dressed up to look attractive through leverage and artificially low interest rates — as in the sub-prime crisis. The ratio of GDP (output) to private non-financial debt has declined by more than 50% since the 1960s.

Cheap debt also enabled the federal government to run large deficits at low cost, spending more than they raised in taxes and softening the impact of the growing trade imbalance.

The largest portion of capital inflows was invested in Treasuries. As the Current account balance plunged, federal debt held by foreign investors ballooned to almost $8 trillion.

3. US debt above 120% of GDP would destroy the bond market

Overall federal debt climbed to more than 120% of GDP, well above the sustainable level of 70% to 80% of GDP posited by Dr Cristina Checherita and Dr Philip Rother in their ECB study of highly indebted economies.

Earlier research by Carmen Reinhart and Ken Rogoff (This Time is Different, 2008) suggested that states where sovereign debt exceeds 100% of GDP almost inevitably default.

That doesn’t mean that the US is about to default but it does mean that the federal government is precariously close to the point of no return, where it can no longer service the interest on its debt and is forced to capitalize it, compounding the problem.

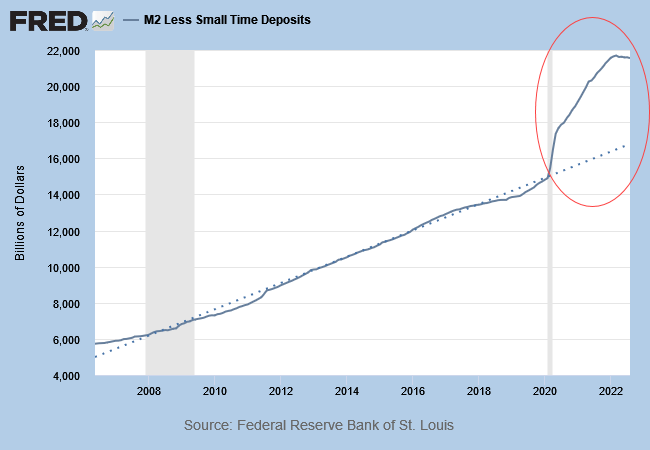

The only viable alternative is inflation. If the borrower suppresses interest rates below the rate of inflation, then GDP is likely to grow faster than the debt. This is already evident on the chart above, where US debt-to-GDP fell in the past 12 months. Federal debt (yellow) increased, but nominal GDP (blue) grew faster because of inflation.

Current turmoil

The global financial system — with a US Dollar reserve currency and US Treasuries as the global reserve asset –appears increasingly fragile as global geopolitical conflict escalates.

China & the Dollar

After China’s admission to the World Trade Organization (WTO), it rapidly accumulated foreign reserves — mostly US Dollars — as it built up its industrial base, reaching $4 trillion by 2014.

China maintained a strict peg against the Dollar until 2014, only allowing it to gradually rise in response to US pressure. But in 2014, a surging Dollar — in response to falling CPI and a shrinking deficit — started to cause problems.

The peg to a strong Dollar started to hurt Chinese exports; so in 2014 the authorities allowed the yuan to weaken, easing capital controls. Capital outflows and a falling Yuan attracted speculators like Hayman Capital who shorted the currency, forcing the PBOC to step in to support the currency in 2017.

In 2018, the Yuan again fell when Donald Trump imposed tariffs on China’s exports to the United States, setting off a trade war.

The third major fall, in 2022, is the result of China’s debt crisis. An over-leveraged economy threatens to contract — triggered by rising US interest rates, a strong Dollar, rising energy prices, and an ongoing pandemic — while regulators attempt to shore up the financial system.

The Belt-and-Road initiative

In 2013 the PBOC were unhappy with the Fed’s program of quantitative easing (QE) which could be seen as currency debasement at the expense of foreign creditors (China).

China’s response was the Belt-and-Road initiative (BRI). This loaned US Dollars to emerging market governments in exchange for lucrative construction contracts, secured against the underlying infrastructure assets. Africa was a prime target.

The capital inflow was diverted from US Treasuries — funding the federal deficit — and into the BRI. By 2022, BRI loans — denominated in Dollars to maintain the Yuan’s trade advantage over the Dollar — amounted to close to $5 trillion.

Funding the federal deficit

China’s BRI left Treasury with a problem with funding the US deficit, So far, the gap has been filled by Fed QE and, to a lesser extent, commercial banks.

But QE is not a long-term solution. The twin deficits supporting the US Dollar status as global reserve currency are now broken. And US Treasuries are no longer attractive to foreign investors as the global reserve asset.

The US is faced with a difficult choice:

- Allow the Fed to continue its easy monetary policy in the hope that inflation will bail Treasury of its serious debt problem, lowering federal debt to between 70% and 80% of GDP. The risk is that foreign investors will increasingly shun Treasuries, threatening its status as the global reserve asset and driving up long-term interest rates in the USA.

- Encourage the Fed to adopt a hawkish stance, shrinking its balance sheet (QT) and raising interest rates. Lower inflation and a stronger Dollar would restore investor confidence in Treasuries. But the risk is that the US plunges into recession which would make the debt problem even worse. Tax revenues would fall during a recession, increasing the fiscal deficit.

It appears that the Fed are attempting to walk a fine line between the two options at present, talking tough but delaying action for as long as possible, but later this year, they will be forced to show their hand.

China

Rising US interest rates and the strong Dollar are a major problem for China. Not only is the strong Dollar undermining Chinese businesses who borrowed in USD at cheap rates, but the strong Dollar also threatens to collapse China’s $5 trillion Belt-and-Road initiative which is funded by USD-denominated loans. Despite official statistics, the country is in a heap of pain. The private sector has never fully-recovered from the initial COVID-19 pandemic and is now being dragged down by Xi Jinping’s zero-Covid policy lockdowns. Ports are in gridlock.

Falling natural gas consumption warns of an economic contraction, promising further disruption to commodity producers and supply chains around the world.

Team USA

This may be an over-simplification but “team USA” — to use Michael Every’s expression — is primarily split into two camps:

- Wall Street and the Federal Reserve, who want to maintain the US Dollar position as the global reserve currency; and

- The Department of Defense (DOD) and the manufacturing sector, who recognize the damage done by the Dollar reserve currency, with erosion of the US industrial base and offshoring of critical supply chains.

Weaponizing the Dollar against Russia, by seizing their foreign reserves, was apparently a DOD initiative, with the Fed not even consulted. The outcome is likely to be long-term damage to the Dollar’s reserve currency status, with non-aligned states — including China and India — increasingly reluctant to hold reserve assets in Dollars.

There are no ready alternatives to the Dollar — as Michael Every points out — but other asset classes, including Gold and Commodities, are likely to play an increasingly larger role.

Conclusion

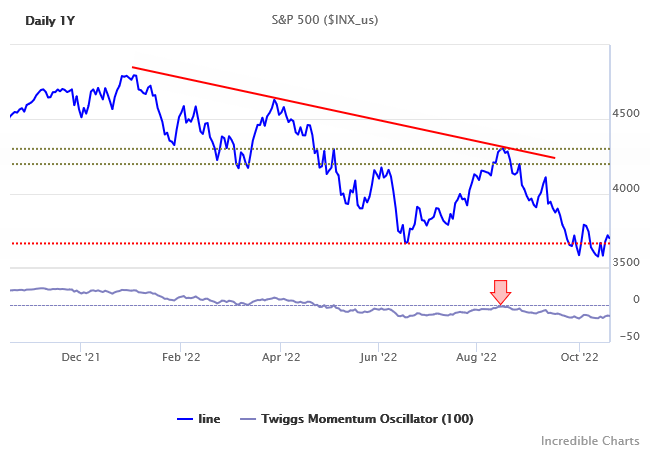

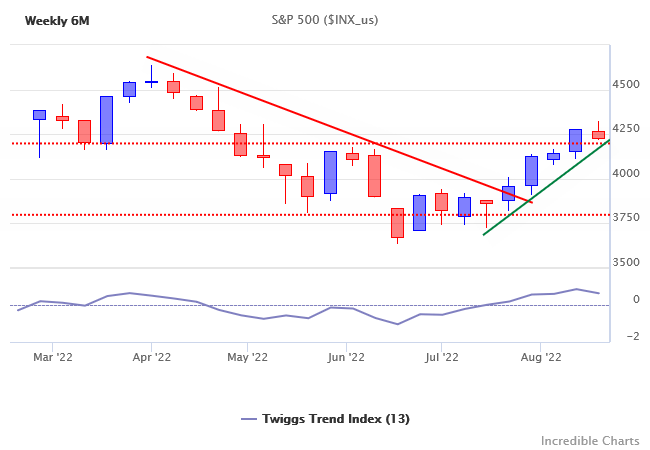

Credit markets are tightening and warn of a recession. The Fed is unlikely to continue its hawkish stance if credit markets dry up or employment falls.

It is not in the US interest to continue running large current account deficits to support the Dollar’s reserve status. The economy has suffered long-term damage from its “exorbitant privilege” with the US Dollar as reserve currency. Support for the Dollar’s reserve status, from Wall Street, faces growing opposition from the DOD and manufacturing sector.

The US faces a tough choice between debt and inflation. A hawkish Fed may lower inflation but is likely to cause a recession, making the debt situation even worse. A dovish Fed, on the other hand, with higher inflation, may alleviate the debt problem but is likely to undermine foreign investor confidence in the Dollar and Treasuries.

The situation is further exacerbated by current market turmoil. The strong Dollar threatens to damage China’s economy and its Belt-and-Road initiative, raising tensions with the US. Weaponization of the Dollar in sanctions against Russia also threatens to undermine the Dollar’s reserve currency status.

Rising interest rates and a strong Dollar are bearish for Gold, but there are a number of developments that suggest the opposite. We remain overweight on Gold.

Acknowledgements