Corporate profits (before tax) ticked up slightly in the second quarter of 2019 but remain below 2006 levels in real terms. The chart below shows corporate profits adjusted for inflation using the GDP implicit price deflator.

Growth in production of durable consumer goods remains week, reflecting poor consumer confidence.

The chart below shows growth in bank credit and the broad money supply (MZM plus time deposits). Credit growth (blue) remains steady at around 5%, slightly ahead of nominal GDP growth (4.04% for 12 months ending June); a healthy sign. Broad money (green) surged upwards in the first three quarters of this year. Not an encouraging sign when there were similar surges in broad money before the last two recessions.

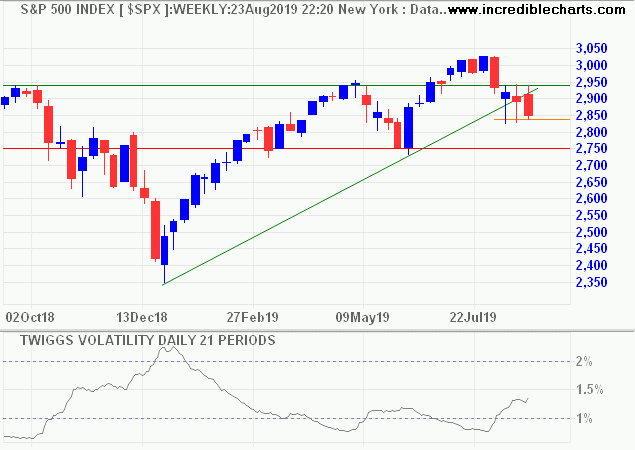

The S&P 500 is testing resistance at 3000. Bearish divergence on Twiggs Money Flow warns of secondary selling pressure. Expect a test of support at 2800. Breach would flag a reversal, with a target of 2400.

The cyclical Retailing Index displays a similar pattern, with resistance between 2450 and 2500.

Our view is that upside is limited, while downside risks are growing.

On the global front, the outlook is still dominated by the prospect of a prolonged US-China trade war. More great insights from Trivium China:

Tariff delays may be aimed at creating warm, fuzzy feelings before the next round of talks in early October, but……These small gestures do nothing to resolve the underlying trade conflict. We’re still pessimistic on prospects for a deal.

Zhou Xiaoming – China’s former top diplomat in Geneva – expressed the same view in a recent interview (Guancha):

“The two sides disagree too much on the objectives of the negotiations……It is almost impossible to reach an agreement in the short term.”Zhou urged Chinese officials to be clear on the US’s objective:

“Economic and technological decoupling is the objective of the entire US government.”Zhou said that officials must prepare for that potentiality, even if it is not their desired outcome.

So should we.

Dow Jones – UBS Commodity Index found support at 76 before rallying to 79. Rising troughs on the Trend Index reflect increased support. Consolidation between 76 and 81 is likely but we maintain our bearish long-term outlook for commodities.

On the global front, weak crude oil prices flag an anticipated slow-down in the global economy. Trend Index peaks below zero indicate selling pressure. Breach of support at $50/$51 per barrel would be a strong bear signal, warning of a decline to $40 per barrel.

We maintain our investment in quality growth stocks but have reduced equity exposure to 40% of (International Growth) portfolio value.